Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Apple wishes to estimate its cost of capital in order to evaluate a new iphone project. The volatility of Apple stock is 0.45. The

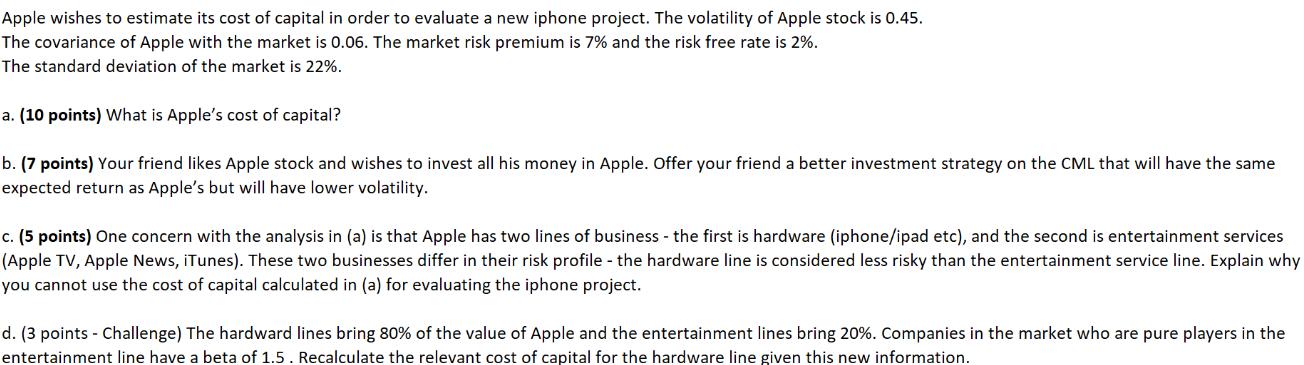

Apple wishes to estimate its cost of capital in order to evaluate a new iphone project. The volatility of Apple stock is 0.45. The covariance of Apple with the market is 0.06. The market risk premium is 7% and the risk free rate is 2%. The standard deviation of the market is 22%. a. (10 points) What is Apple's cost of capital? b. (7 points) Your friend likes Apple stock and wishes to invest all his money in Apple. Offer your friend a better investment strategy on the CML that will have the same expected return as Apple's but will have lower volatility. c. (5 points) One concern with the analysis in (a) is that Apple has two lines of business - the first is hardware (iphone/ipad etc), and the second is entertainment services (Apple TV, Apple News, iTunes). These two businesses differ in their risk profile - the hardware line is considered less risky than the entertainment service line. Explain why you cannot use the cost of capital calculated in (a) for evaluating the iphone project. d. (3 points - Challenge) The hardward lines bring 80% of the value of Apple and the entertainment lines bring 20%. Companies in the market who are pure players in the entertainment line have a beta of 1.5. Recalculate the relevant cost of capital for the hardware line given this new information.

Step by Step Solution

★★★★★

3.52 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate Apples cost of capital we can use the capital asset pricing model CAPM formula Cost of Capital RiskFree Rate Beta Market Risk Premium G...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started