Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Applewood Company is a service based company. They are putting together their budgeted income statement for next year. They project their next year's budget

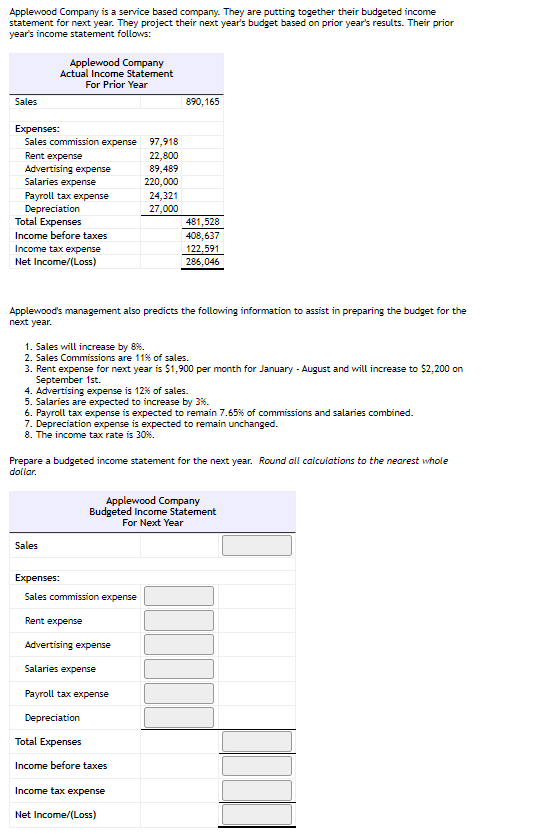

Applewood Company is a service based company. They are putting together their budgeted income statement for next year. They project their next year's budget based on prior year's results. Their prior year's income statement follows: Applewood Company Actual Income Statement For Prior Year Sales 890,165 Expenses: Sales commission expense 97,918 Rent expense 22,800 Advertising expense 89,489 Salaries expense 220,000 Payroll tax expense 24,321 Depreciation 27,000 Total Expenses 481,528 Income before taxes 408,637 Income tax expense 122,591 Net Income/(Loss) 286,046 Applewood's management also predicts the following information to assist in preparing the budget for the next year. 1. Sales will increase by 8%. 2. Sales Commissions are 11% of sales. 3. Rent expense for next year is $1,900 per month for January - August and will increase to $2,200 on September 1st. 4. Advertising expense is 12% of sales. 5. Salaries are expected to increase by 3%. 6. Payroll tax expense is expected to remain 7.65% of commissions and salaries combined. 7. Depreciation expense is expected to remain unchanged. 8. The income tax rate is 30%. Prepare a budgeted income statement for the next year. Round all calculations to the nearest whole dollar. Applewood Company Budgeted Income Statement For Next Year Sales Expenses: Sales commission expense Rent expense Advertising expense Salaries expense Payroll tax expense Depreciation Total Expenses Income before taxes Income tax expense Net Income/(Loss)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To prepare the budgeted income statement for the next year we can use the provided informatio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started