Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Applicable Tax Law for United States the tax law are for united states Part #1: Compensation Report for the Year 2020 1. HR Manager Salary:

Applicable Tax Law for United States

the tax law are for united states

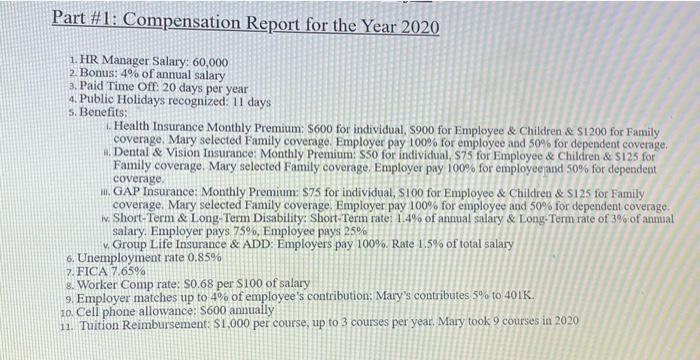

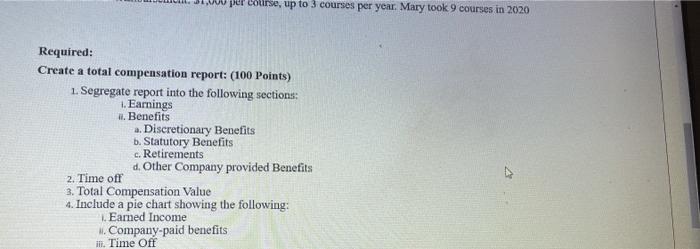

Part #1: Compensation Report for the Year 2020 1. HR Manager Salary: 60,000 2. Bonus: 4% of annual salary 3. Paid Time Off: 20 days per year 4. Public Holidays recognized: 11 days 5. Benefits: 1. Health Insurance Monthly Premium: S600 for individual, 5900 for Employee & Children & S1200 for Family coverage, Mary selected Family coverage. Employer pay 100% for employee and 50% for dependent coverage, Dental & Vision Insurance: Monthly Premium: ss0 for individual, $75 for Employee & Children & $125 for Family coverage. Mary selected Family coverage. Employer pay 100% for employee and 50% for dependent coverage GAP Insurance: Monthly Premium: S75 for individual, S100 for Employee & Children & S125 for Family coverage. Mary selected Family coverage. Employer pay 100% for employee and 50% for dependent coverage. w Short-Term & Long-Term Disability: Short-Term rate: 1.4% of annual salary & Long-Term rate of 3% of annual salary. Employer pays 75%, Employee pays 25% . Group Life Insurance & ADD: Employers pay 100%. Rate 1.5% of total salary 6. Unemployment rate 0.85% 7. FICA 7.65% 8. Worker Comp rate: 80.68 per S100 of salary 9. Employer matches up to 4% of employee's contribution: Mary's contributes 5% to 401K. 10. Cell phone allowance: S600 annually 11. Tuition Reimbursement: $1.000 per course, up to 3 courses per year. Mary took 9 courses in 2020 per course, up to 3 courses per year. Mary took 9 courses in 2020 Required: Create a total compensation report: (100 Points) 1. Segregate report into the following sections: 1. Earnings 1. Benefits a. Discretionary Benefits b. Statutory Benefits c. Retirements d. Other Company provided Benefits 2. Time off 3. Total Compensation Value 4. Include a pie chart showing the following: Earned Income 1. Company-paid benefits it. Time Off Part #1: Compensation Report for the Year 2020 1. HR Manager Salary: 60,000 2. Bonus: 4% of annual salary 3. Paid Time Off: 20 days per year 4. Public Holidays recognized: 11 days 5. Benefits: 1. Health Insurance Monthly Premium: S600 for individual, 5900 for Employee & Children & S1200 for Family coverage, Mary selected Family coverage. Employer pay 100% for employee and 50% for dependent coverage, Dental & Vision Insurance: Monthly Premium: ss0 for individual, $75 for Employee & Children & $125 for Family coverage. Mary selected Family coverage. Employer pay 100% for employee and 50% for dependent coverage GAP Insurance: Monthly Premium: S75 for individual, S100 for Employee & Children & S125 for Family coverage. Mary selected Family coverage. Employer pay 100% for employee and 50% for dependent coverage. w Short-Term & Long-Term Disability: Short-Term rate: 1.4% of annual salary & Long-Term rate of 3% of annual salary. Employer pays 75%, Employee pays 25% . Group Life Insurance & ADD: Employers pay 100%. Rate 1.5% of total salary 6. Unemployment rate 0.85% 7. FICA 7.65% 8. Worker Comp rate: 80.68 per S100 of salary 9. Employer matches up to 4% of employee's contribution: Mary's contributes 5% to 401K. 10. Cell phone allowance: S600 annually 11. Tuition Reimbursement: $1.000 per course, up to 3 courses per year. Mary took 9 courses in 2020 per course, up to 3 courses per year. Mary took 9 courses in 2020 Required: Create a total compensation report: (100 Points) 1. Segregate report into the following sections: 1. Earnings 1. Benefits a. Discretionary Benefits b. Statutory Benefits c. Retirements d. Other Company provided Benefits 2. Time off 3. Total Compensation Value 4. Include a pie chart showing the following: Earned Income 1. Company-paid benefits it. Time Off Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started