Answered step by step

Verified Expert Solution

Question

1 Approved Answer

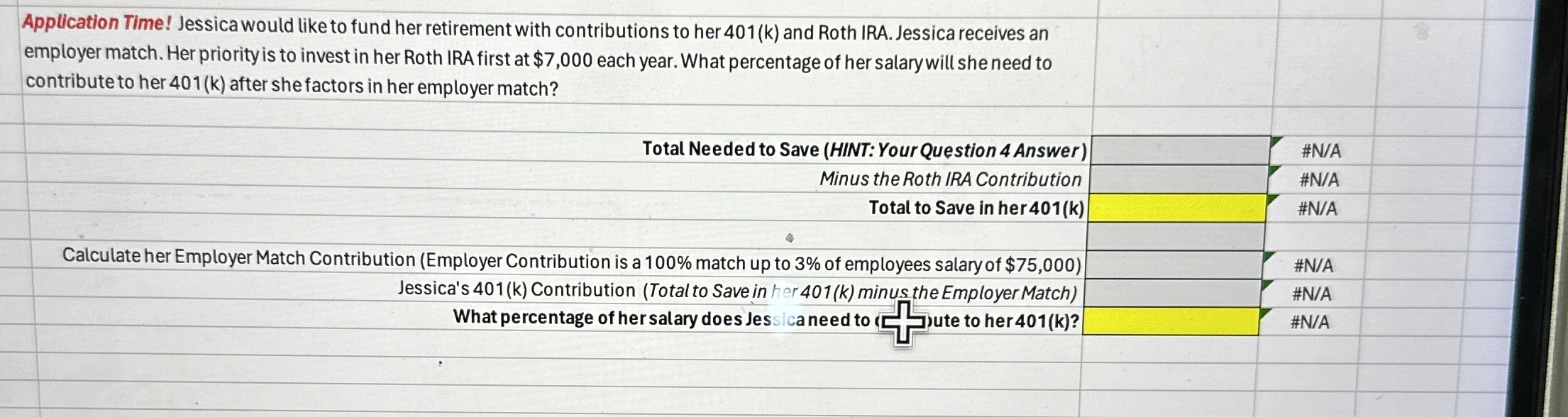

Application Time! Jessica would like to fund her retirement with contributions to her 4 0 1 ( k ) and Roth IRA. Jessica receives an

Application Time! Jessica would like to fund her retirement with contributions to her and Roth IRA. Jessica receives an employer match. Her priority is to invest in her Roth IRA first at $ each year. What percentage of her salary will she need to contribute to her after she factors in her employer match?

tableTotal Needed to Save HINT: Your Question Answer#NAMinus the Roth IRA Contribution,#NATotal to Save in her k#NACalculate her Employer Match Contribution Employer Contribution is a match up to of employees salary of $#NAJessicas Contribution Total to Save in her minus the Employer Match#NAtableWhat percentage of her salary does Jes sica need to Sute to her k#NA

fill in answer boxes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started