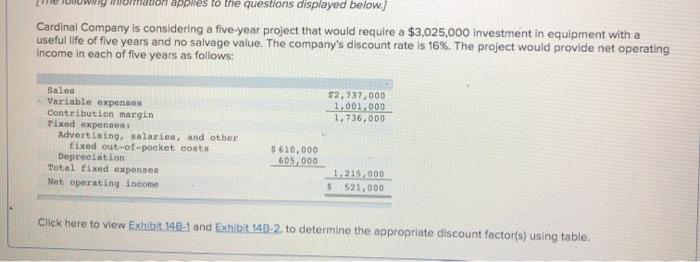

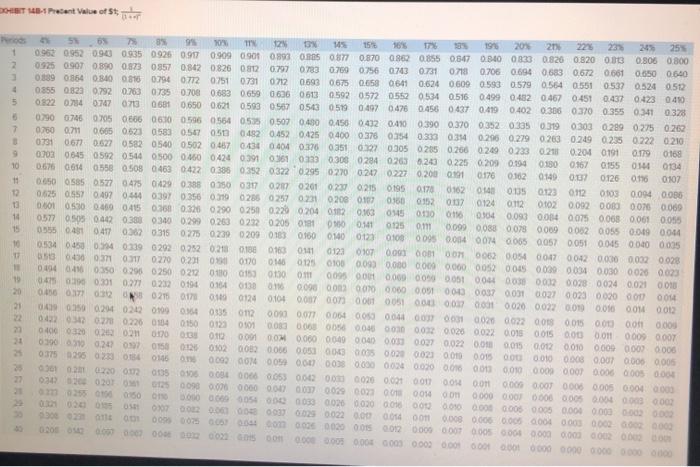

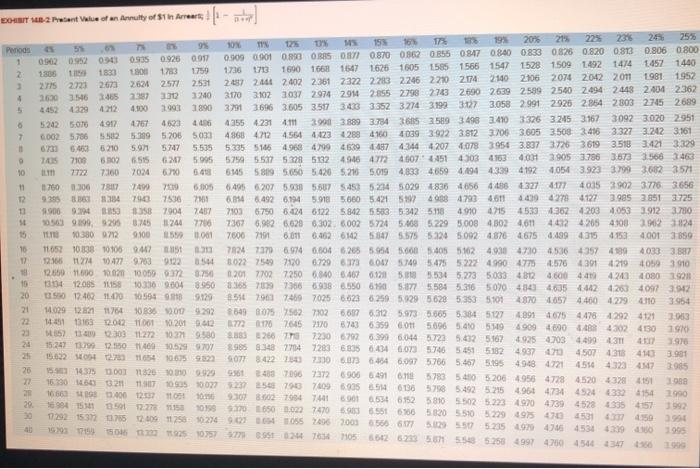

applies to the questions displayed below. Cardinal Company is considering a five-year project that would require a $3,025,000 Investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 16%. The project would provide net operating Income in each of five years as follows: 52,237,000 1,002,000 1.736.000 Salon Variable expenses Contribution margin Tixed expenses Advertising, salaries, and other Fixed out-of-pocket costs Depreciation Total fixed expenses Net operating income $610,000 605,000 1,215,000 5 521.000 Click here to view Exhibit 148-1 and Exhibit 140-2, to determine the appropriate discount factor(s) using table. DOT140-1 Precent Value of State 2 4 5 2 9 10 11 TO 14 53 6 3 95 YO TIN 12 15 194 20% 2013 22 23 25% 09630952 09009350926 097 09090901 0.893 0.05 0877 0.870 0.862 0.855 0.347 0340 0823 0.826 0.820 0.313 0.806 0.800 0925 0907 0.890 0.873 0857 0.842 0.826 0812 0797 0783 0.750 0.756 043 0731 0718 07060694 0683 0,672 0.061 06500640 0.3390.864 084008160794 0772 0.751 0731 0712 0693 0675 0.6580641 0.624 06090593 0.579 0564 0.551 0537 0.524 0.512 0855 0823 0.792 0.763 07350708 0.683 0659 0.636 06130592 0572 0.552 0534 0.5160499 0.482 0.467 0.451 0.437 0.423 0450 09220734077 0703 06810650 0.621 0593 567 05630519 0497 0.478 0.456 0437 0.419 0.402 0.336 0370 0.355 0.341 0328 0790071460050866 0510 0556 05640535 0507 0.400 0.456 042 041 0.390 0.370 0352 0.335 0319 03030.2890275 0.262 0760 0.71 06650623 05830.54705 0492 0.452 0425 0.400 0.375 0.54 0.33 0.314 0.295 0.279 0.2630249 0235 0222 0210 0731 06770627 05820540 0502 0.467 0.4340404 0.376 0351 027 0.3050 2050 2060249 0.233 0.21 0.2040191 0.179 0168 0.702 0645059205440500 0.400.4240391 0.361 0823 0300 02840263 0.23 0.225 0209 0.194 0.180 0167 0.155 010134 0.6750654 0538 0508 0463 0422 0.336 0352 03220295 0270 0207 0.2270200 0:01 0176 0.162 0.140 0.37 0126 0176 0107 050058505774750429 0.3880750031702070201 02 02150195 0.178 0162 014 0.135 0123 0112 003 0.094 000 0.625 0557 0.49705440.397 0.356 0.19 0285 0257 0231 02000187 0360 0152 0.037 0124 0.112 002 0.092008000750.000 0.001 030 0.400.450.500.326 0290 0.250 0.228 0204 02 0163 015 0110 011 0304 0.093 00840075 0.063 0061 0.05 05770505 0442 03810340 0.299 0.263 022 0.205 011 000 0.541 0125 011 0.099 0088 0.078 0000 00620055 0.0190044 05550431 0417 0.32 031502750230 0209 0183 01600140012301000095 00040074006500570051004500400005 0534 0450 0.74 03390292 0252 0.2180188 010 041 0123 0107 000 0001 007 0062 005400470042 0.000 0.002 0.028 3 450 037 0377 0270 023100170 0.14012501000093 0.00000000000005200150039003400300025 0.023 0.0940416 0350029650250 0212 01800153 0150 0111 0095 000 0000 00005100440030001200280024 0.021 0010 0475 0.00301 0.271 0232 0194 014 01300 0.00000000000000001000003700310027 0023 0.000000 0.0032 021507080124 0014 010400070000100510000370000200022 0.01 0.0100010012 005002040219090900035012 000 007 0064 005 004 00003100260022 000 0015 000 000 000 043204202710022604 0.15001230901 00000000000000000120026002200150015000 04003200202 010 0011 00090007 010 000100000000490040000027002200001500020010 070 310020037095312505200620066005100030005002100210010095 000 000 0008 0.001 0.0050005 0000 0000 0000 0:3750295 020 01340009900005000000000000000000160000000000001 0.006 0005 0.004 301020022000050050100005300000020000000 Boston 125000000000000000002900210010 0.00 0.0010005000500040000 On 0000000005400000300026003000000000000000000000000000002 000000000000005001000002 OLM02005 OS 0.0000000000000000002 000 2500 om 00000000000000000000000000002 10 19 20 21 22 BOLT M-2 Value of an Annuity of $1 in Arreart 153 UN 16 198 20% 11 22 213 223 25 255 Pencas 53 0.806 0 800 1 09020952 0:34 09350 926 0917 0.909 0.901 0.80 00 0.870 0362 0.655 0817 0.84008330826 0.820 0813 1830 2 180 173 1750 1736 173 1457 1460 1690 1663 1647 1528 150914921474 1626 16051585 1566 1547 3 2.75 2673 2621 2577 2571 2.140 2106 2074 2012 2011 1981 1952 2.072448 2402 2361 2322 223 2246 22102774 4 2630 1140 2005 237 2012 3240 3170 302 3037 2974291 2955 27982 743 2690 2639 2599 2540 2494 2448 2404 2362 5 4452 429 29923890 3791 3696 3.605 3.517 3433 3352 3274 3199 3127 3.058 2.991 2925 2.854 2803 2745 2689 . 5.2425.000 4912 267 4523 4355 4.231 411 39003889 375436152519 3.498 3410 3326 32453167 3092 3020 2.951 7 6002 5.786 5582 5.399 5.206 5033 4868412 4.564 41232884160 40393922 3812 37063605 3508 3.416 3327 32423.161 5.463 5210 5.07 5747 5.535 5335 5146 4.968 479946394874344420740783950 3.83737263619 3518 3421 3329 7100 6102 6515 62759655754 557 5320 51324946477246074451 4303 4563 4031 3 905 3.756 3.673 35663463 10 7722 7160 7024 6145 5819 5.650 5.4205 210 5.019 4833 4659 4.194 433941924.054 3.923379936822571 11 760 306787 700 6.000 64956207 5.0385507 5453 5234 5029 48364656 445543274177 4005390237763656 12 935 136 134 790 7536 7360 6.814 6492 6194 5918568054215 40847934611 443942784127 3.98533513725 1900 14 153 1358 7904 7407 7103 57506424612258425583 5 342 5.118 4.910 4715 4533 1.3624.203 4053 3.912 3.780 0509 9.099,9295 0.745 1244 7700 7367 6,962 6629 6302 6.002 5724 5.468 5.229 500843024611 4432 42654108 2921824 15 T903800712 9.100 0001 7000 7191 6.611 6,46261425475575 5326 5.092 4.876 4675 4.4994315 4.753 4.0013850 10 11052 1003810105947 1151 7824 7370 6974 6,604 6265 954 5.60 5.405 5162 40384730 4536 437 4139 4033387 12 12:10 11274104779.7039122 3022754971206729637306751405.4755223 4990 4775 4.576 491 42190503910 18 12.550 1.000 1.02110050072 3.750 0201770272506.840 6.467 0.121.185.534 5.27350334812 10 304 4.600 441 4240 1080 1921 12.085 1150 103369.604 8.950 3.36577386693885506105.775.584 5.316 507043434635 442 4253 4097392 20 13500 12.402 11.00 0594910 9.229 85517963745970256,623 62595029 5628 5.353 5101 4970657 4.400 4.279 410 21 3954 14.029221764 1083500 9292 3549 07525027802 6.687 632 5.973 5665 5384 5127 22 1445113163 204211001.2019.602 48914675 4478292 4121 3.000 2 M 7615 2170 51436359 015096 5.410 5594909 489043024130 2852 11400030311272 10371 9.580 38832667 19 2.230 679263996.044 572354251674925 4.70344993 24 15:2473790295041525 9707 3.985 3348 2704 4779 7283 683504346.073574654515182 493770 25 15.632 51004 27010540675952 SOT 3.4227823300736454 6:0975766 5.467 5.19549418 4721 45074318410 3.901 20 154 14375 00 78200929 3487096 237269006491 6578354005 2064.956 4728 4520 43284151 3985 16.30 03:21 11709359032 232 254 796 1088 20 760093559146136 758 54925215 16662406 2007 49644734 45244332154 1990 11051 9.307 300275047441 29. 1994 150 15172273156 8.9016534 652 5810 5.502 5.2234920 473945284335 457 10153101650007470 3655665320 5510 52294975 470 1992 30 1729215377 0755 200 112581627490216410557896300356061775255075215994706 4501 150 2990 40 506 1925 075777.55 27667105 4531 42190 66426223561715.543 5.25849974700 4541 34750 6. What is the project's Internal rate of return? Project's internal rate of return % 7. What is the project's payback period? (Round your answer to 2 decimal places.) Project's payback period years 8. What is the project's simple rate of return for each of the five years? (Round your answer to 2 decimal places.) Simple rate of return % 13. Assume a postaudit showed that all estimates (including total sales) were exactly correct except for the variable expense ratio, which actually turned out to be 50%. What was the project's actual net present value? (Negative amount should be indicated by a minus sign. Round intermediate calculations and final answer to the nearest whole dollar amount.) Not present value 14. Assume a postaudit showed that all estimates (including total sales) were exactly correct except for the variable expense ratio, which actually turned out to be 50%. What was the project's actual payback period? (Round your answer to 2 decimal places.) Payback period years 15. Assume a postaudit showed that all estimates (including total sales) were exactly correct except for the variable expense ratio, which actually turned out to be 50%. What was the project's actual simple rate of return? (Round your answer to 2 decimal places.) Simple rate of room