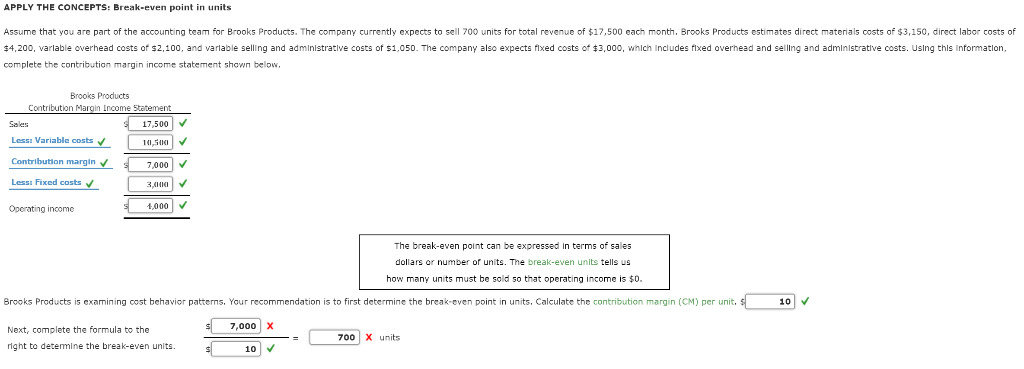

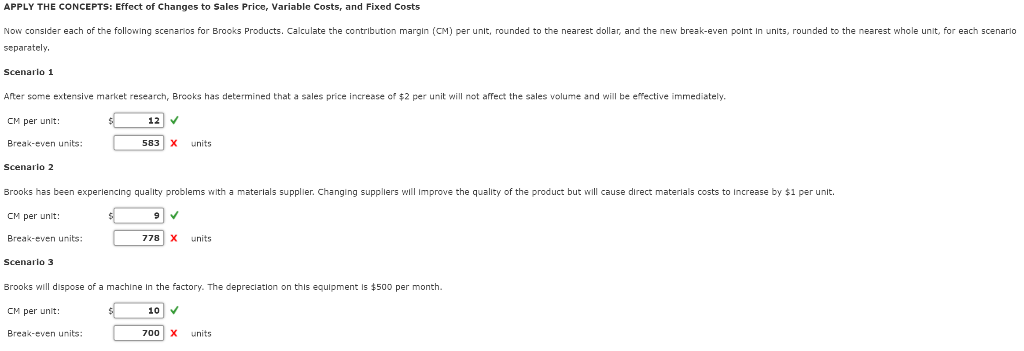

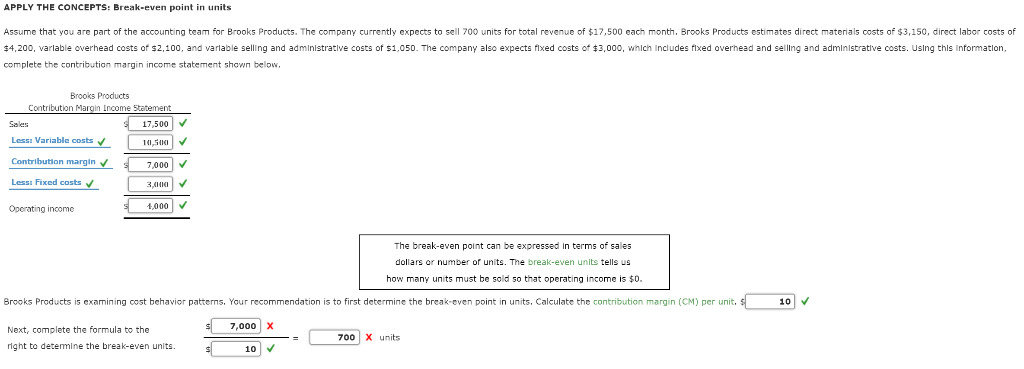

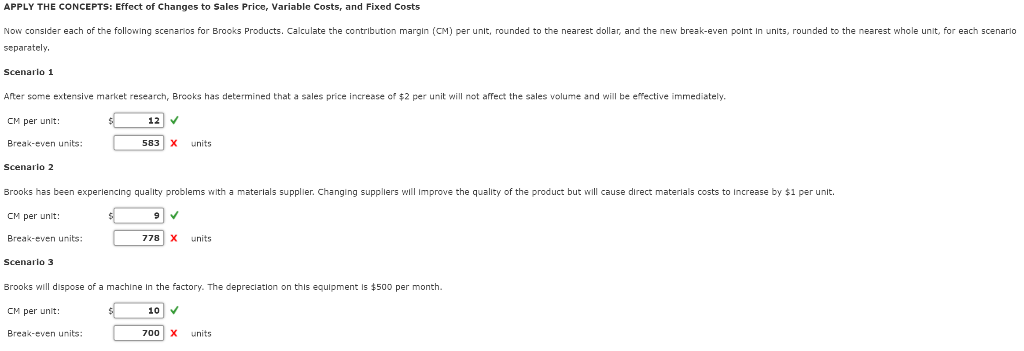

APPLY THE CONCEPTS: Break-even point in units Assume that you are part of the accounting team for Brooks Products. The company currently expects to sell 700 units for total revenue of $17,500 each month. Brooks Products estimates direct materials costs of $3,150, direct labor costs of $4,200, varlabie overhead costs of S2, 100, and variable selling and administrative costs of $1.050. The company also expects rixed costs of3,000, wilch includes rixed overhead and selling and administrative costs. using this Information. complete the contribution margin income statement shown below Brooks Products Contribution Ma ncome Statement 17,500 Sales 1 Lessi Variable costs Contribution margin 7,000 Lessa Fixed costs 1,000 Operating income The break-even point can be expressed In terms of sales dollars or number of units. The break-even units tells us how many units must be sold so that operating income is $0 10 Brooks Products is examining cost behavior patterns, Your recommendation is to first determine the break-even point in units, Calculate the contribution margin (CM) per unit. 7,000 X Next, complete the formula to the 700X units right to detemine the break-even units. 10 APPLY THE CONCEPTS: Effect of Changes to Sales Price, Variable Costs, and Fixed Costs Now consider each of the following scenarios for Brooks Products. Calculate the contribution margin (CM) per unlt, rounded to the nearest dollar, and the new break-even polnt In units, rounded to the nearest whole unit, for each scenarid separately Scenario 1 After some extensive market research, Brooks has determined that a sales price increase of $2 per unit will not affect the sales volume and will be effective immediately. CM per unit: Break-even units: 12 X units 583 Scenario 2 Brooks has been experiencing quality problems with a materials supplier. Changing suppliers will improve the quality of the product but will cause direct materials costs to Increase by $1 per unit. CM per unit: Break-even units: Scenario 3 778 X units Srooks will dispose of a machine In the factory. The depreclation on thls equipment is $500 per month. CM per unit: Break-even units: 10 units 700 X