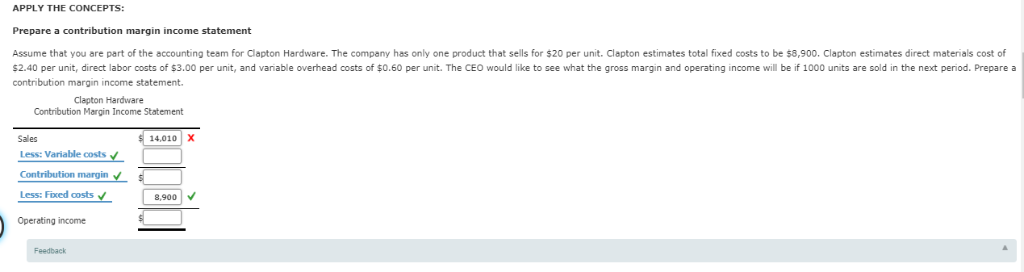

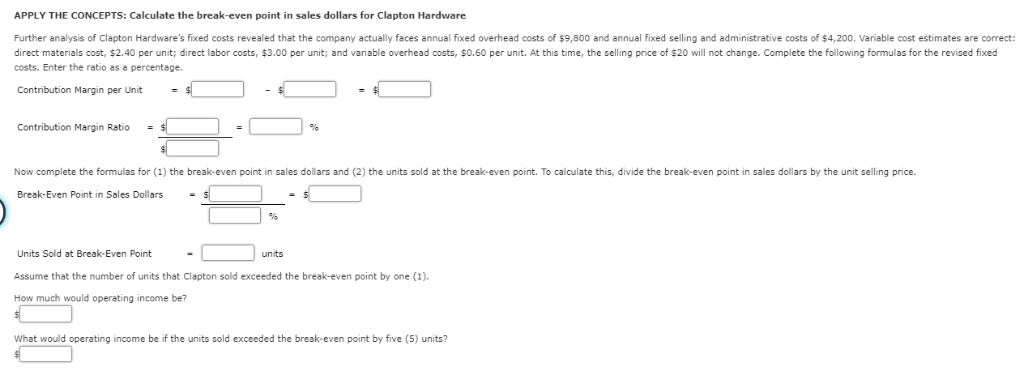

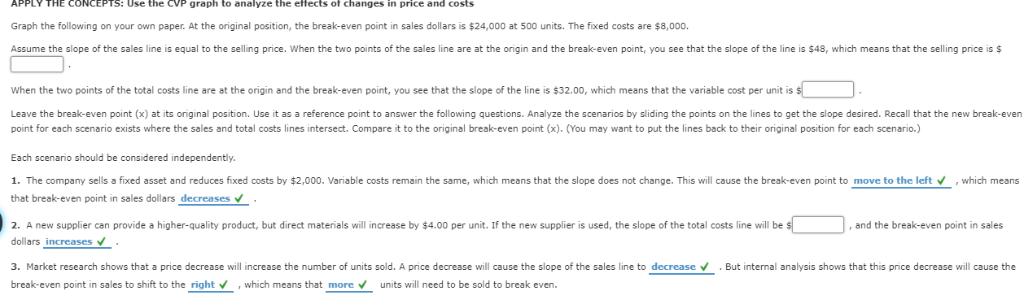

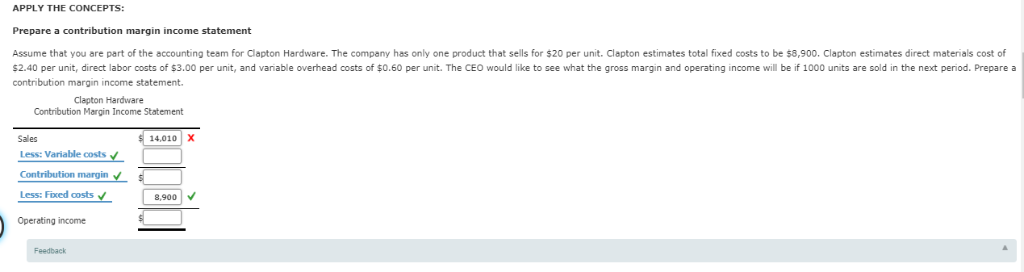

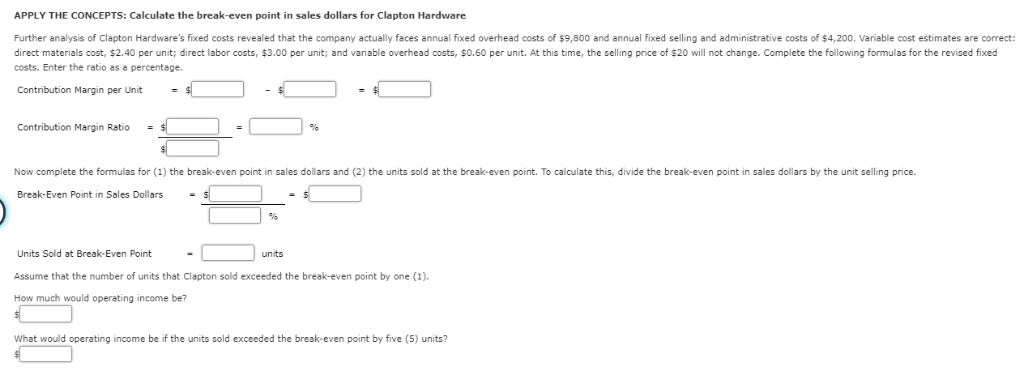

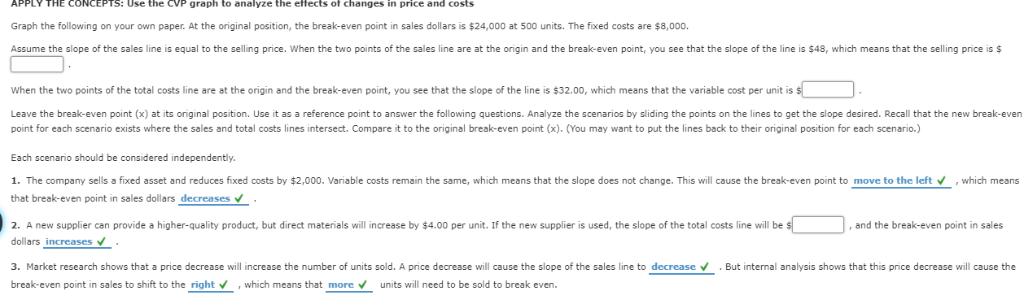

APPLY THE CONCEPTS: Prepare a contribution margin income statement Assume that you are part of the accounting team for Clapton Hardware. The company has only one product that sells for $20 per unit. Clapton estimates total fixed costs to be $8,900. Clapton estimates direct materials cost of $2.40 per unit, direct labor costs of $3.00 per unit, and variable overhead costs of $0.60 per unit. The CEO would like to see what the gross margin and operating income will be if 1000 units are sold in the next period. Prepare a contribution margin income statement. Clapton Hardware Contribution Margin Income Statement 14.010 X Sales Less: Variable costs Contribution margin Less: Fixed costs 8.900 Operating income Feedback APPLY THE CONCEPTS: Calculate the break-even point in sales dollars for Clapton Hardware Further analysis of Clapton Hardware's fixed costs revealed that the company actually faces annual fixed overhead costs of $9,800 and annual fixed selling and administrative costs of $4,200. Variable cost estimates are correct: this time, the selling price f$20 will not change. Complete the following formulas f direct materials cost, $2.40 per unit; direct labor costs, $3.00 per unit; and variable overhead costs, $0.60 per unit. rthe revised fixed costs. Enter the ratio as a percentage Contribution Margin per Unit Contribution Margin Ratio Now complete the formulas for (1) the break-even point sales dollars and (2) the units sold at the break-even point. To calculate this, divide the break-even point in sales dollars by the unit selling price. Break-Even Point in Sales Dollars Units Sold at Break-Even Point units Assume that the number of units that Clapton sold exceeded the break-even point by one (1) How much would operating income be? What would operating income be if the units sold exceeded the break-even point by five (5) units? APPLY THE CONCEPTS: Use the CVP graph to analyze the ettects of changes in price and costs Graph the following on your own paper. At the original position, the break-even point sales dollars is $24,000 at 500 units, The fixed costs are $8.000. Assume the slope of the sales line is equal to the selling price. When the two points of the sales line are at the origin and the break-even point, you see that the slope of the line is $48, which means that the selling price is$ When the two points of the total costs line are at the origin and the break-even point, vou see that the slope of the line is $32.00, which means that the variable cost per unit is s Leave the break-even point (x) tits original position. Use it as a reference point to answer the following questions. Analyze the scenarios sliding the points on the lines to get the slope desired. Recall that the new break-even point for each scenario exists where the sales and total costs lines intersect. Compare it to the original break-even point (x). (You may want to put the lines back to their original position for each scenario.) Each scenario should be considered independentiv. 1. The company sells a fixed asset and reduces fixed costs by $2,000. Variable costs remain the same, which means that the slope does not change. This will cause the break-even point to move to the left which means that break-even point in sales dollars decreases . f the total costs line will be s new supplier can provide a higher-quality product, but direct materials will increase by $4.00 per unit. If the new supplier used, the slope and the break-even point in sales dollars increases 3. Market research shows that a price decrease will increase the number of units sold. A price decrease will cause the slope f the sales line to decrease v But internal analysis shows that this price decrease will cause the break-even point sales to shift to the right which means that more units will need to be sold to break even