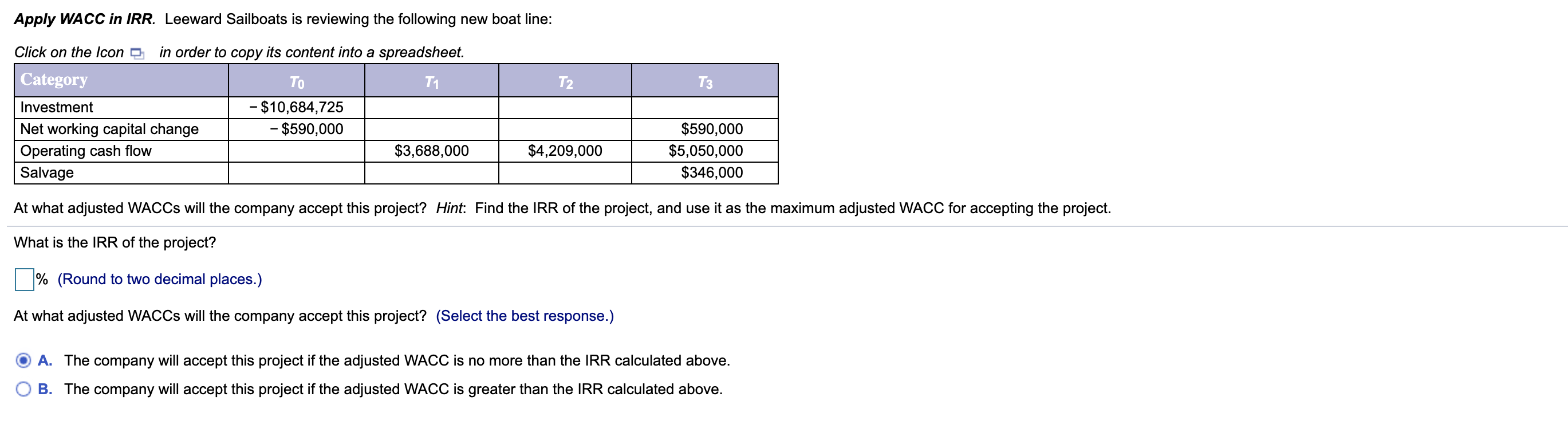

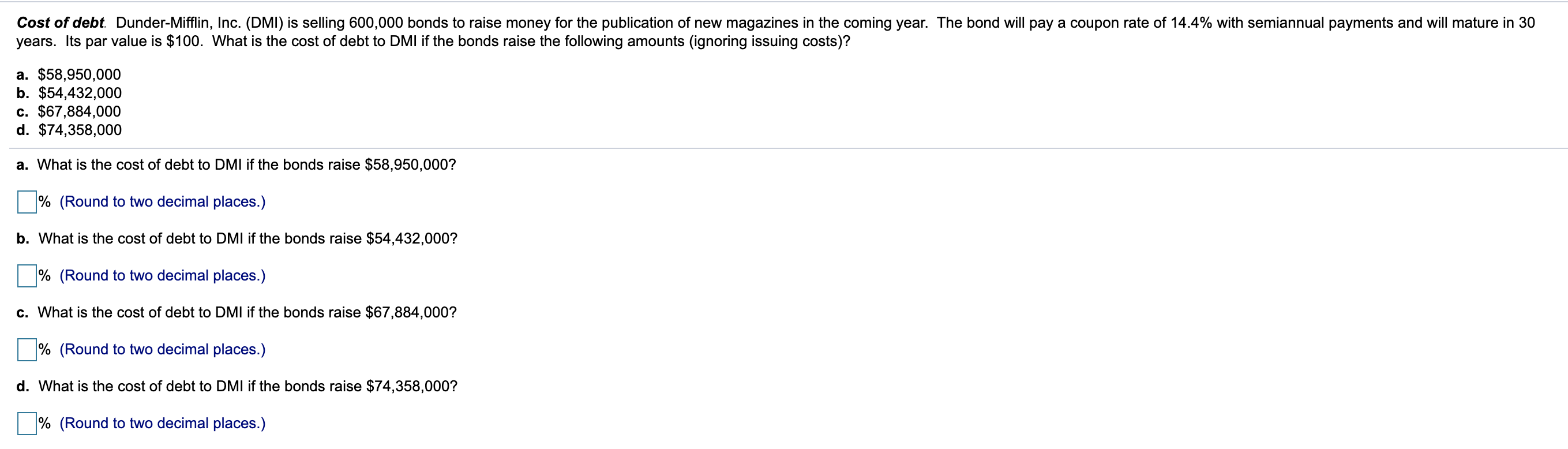

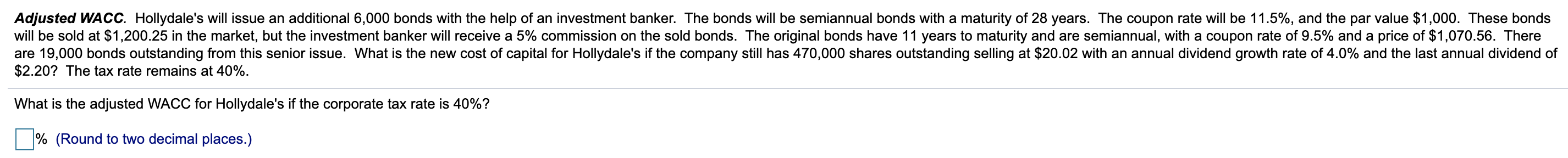

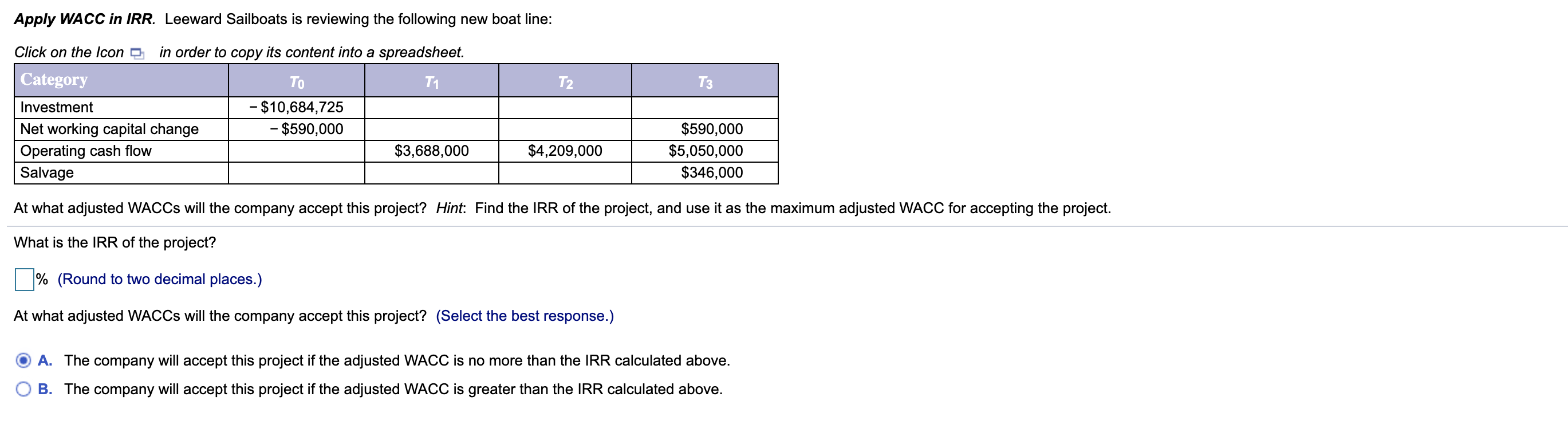

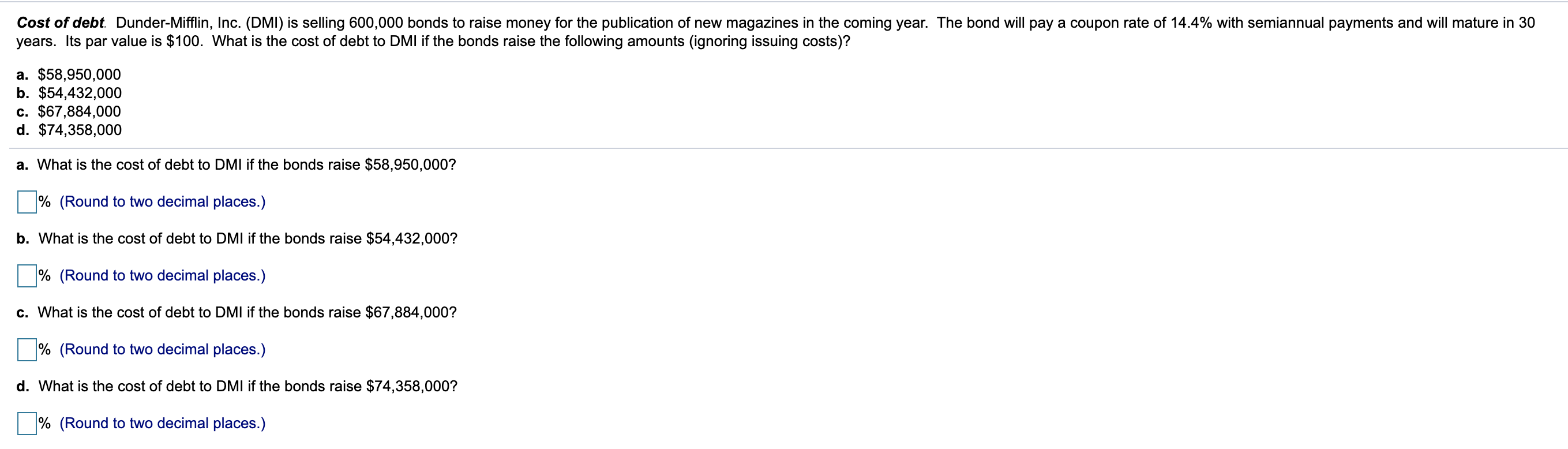

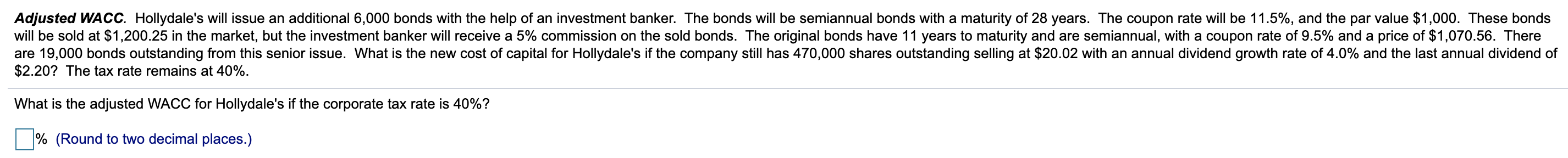

Apply WACC in IRR. Leeward Sailboats is reviewing the following new boat line: in order to copy its content into a spreadsheet. Click on the Icon Category T2 T3 - $10,684,725 - $590,000 Investment Net working capital change Operating cash flow Salvage $3,688,000 $4,209,000 $590,000 $5,050,000 $346,000 At what adjusted WACCs will the company accept this project? Hint: Find the IRR of the project, and use it as the maximum adjusted WACC for accepting the project. What is the IRR of the project? | % (Round to two decimal places.) At what adjusted WACCs will the company accept this project? (Select the best response.) O A. The company will accept this project if the adjusted WACC is no more than the IRR calculated above. OB. The company will accept this project if the adjusted WACC is greater than the IRR calculated above. Cost of debt. Dunder-Mifflin, Inc. (DMI) is selling 600,000 bonds to raise money for the publication of new magazines in the coming year. The bond will pay a coupon rate of 14.4% with semiannual payments and will mature in 30 years. Its par value is $100. What is the cost of debt to DMI if the bonds raise the following amounts (ignoring issuing costs)? a. $58,950,000 b. $54,432,000 c. $67,884,000 d. $74,358,000 a. What is the cost of debt to DMI if the bonds raise $58,950,000? % (Round to two decimal places.) b. What is the cost of debt to DMI if the bonds raise $54,432,000? % (Round to two decimal places.) c. What is the cost of debt to DMI if the bonds raise $67,884,000? % (Round to two decimal places.) d. What is the cost of debt to DMI if the bonds raise $74,358,000? | % (Round to two decimal places.) Adjusted WACC. Hollydale's will issue an additional 6,000 bonds with the help of an investment banker. The bonds will be semiannual bonds with a maturity of 28 years. The coupon rate will be 11.5%, and the par value $1,000. These bonds will be sold at $1,200.25 in the market, but the investment banker will receive a 5% commission on the sold bonds. The original bonds have 11 years to maturity and are semiannual, with a coupon rate of 9.5% and a price of $1,070.56. There are 19,000 bonds outstanding from this senior issue. What is the new cost of capital for Hollydale's if the company still has 470,000 shares outstanding selling at $20.02 with an annual dividend growth rate of 4.0% and the last annual dividend of $2.20? The tax rate remains at 40%. What is the adjusted WACC for Hollydale's if the corporate tax rate is 40%? % (Round to two decimal places.)