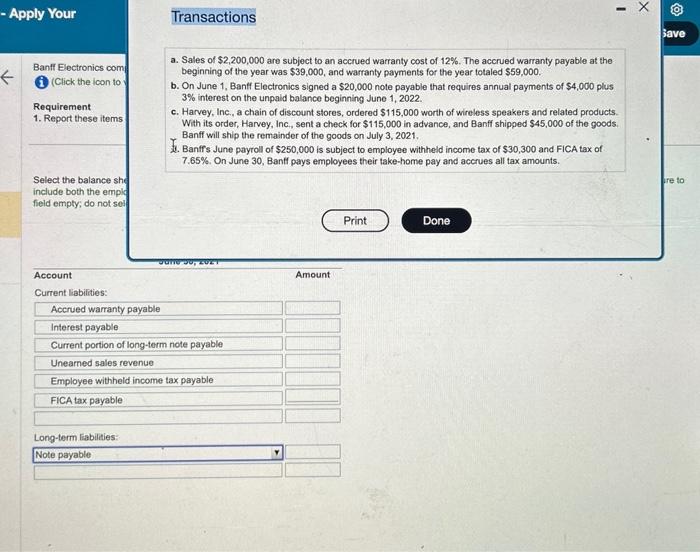

- Apply Your Transactions Banff Electronics com (1) (Click the icon to Requirement 1. Report these items Select the balance she include both the emply field empty; do not sel a. Sales of $2,200,000 are subject to an accrued warranty cost of 12%. The accrued warranty payable at the beginning of the year was $39,000, and warranty payments for the year totaled $59,000. b. On June 1, Banff Electronics signed a $20,000 note payable that requires annual payments of $4,000 plus 3% interest on the unpald balance beginning June 1, 2022. c. Harvey, Inc., a chain of discount stores, ordered $115,000 worth of wireless speakers and related products. With its order, Harvey, Inc, sent a check for $115,000 in advance, and Banff shipped $45,000 of the goods. Banff will ship the remainder of the goods on July 3, 2021. 2. Banffs June payroll of $250,000 is subject to employee withheid income tax of $30,300 and FICA tax of 7.65\%. On June 30, Banff pays employees their take-home pay and accrues all tax amounts. Account Amount Current liabilities: Accrued warranty payable Interest payable Current portion of long-term note payable Unearned sales revenue Employee withheld income tax payable FICA tax payable Long-term liabilities: Note payable - Apply Your Transactions Banff Electronics com (1) (Click the icon to Requirement 1. Report these items Select the balance she include both the emply field empty; do not sel a. Sales of $2,200,000 are subject to an accrued warranty cost of 12%. The accrued warranty payable at the beginning of the year was $39,000, and warranty payments for the year totaled $59,000. b. On June 1, Banff Electronics signed a $20,000 note payable that requires annual payments of $4,000 plus 3% interest on the unpald balance beginning June 1, 2022. c. Harvey, Inc., a chain of discount stores, ordered $115,000 worth of wireless speakers and related products. With its order, Harvey, Inc, sent a check for $115,000 in advance, and Banff shipped $45,000 of the goods. Banff will ship the remainder of the goods on July 3, 2021. 2. Banffs June payroll of $250,000 is subject to employee withheid income tax of $30,300 and FICA tax of 7.65\%. On June 30, Banff pays employees their take-home pay and accrues all tax amounts. Account Amount Current liabilities: Accrued warranty payable Interest payable Current portion of long-term note payable Unearned sales revenue Employee withheld income tax payable FICA tax payable Long-term liabilities: Note payable