Applying Differential Analysis to Alternative Profit Scenarios Epson produces color cartridges for inkjet printers. Suppose cartridges are sold to mail-order distributors for $5.20 each.

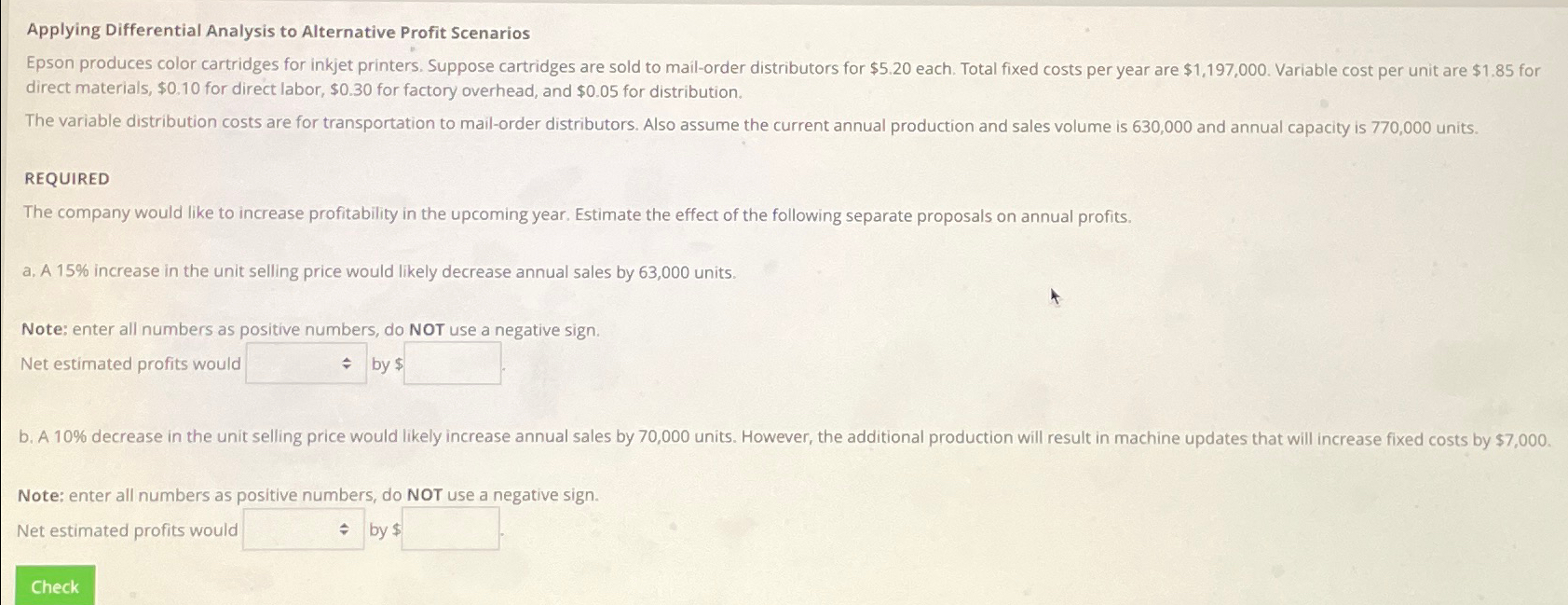

Applying Differential Analysis to Alternative Profit Scenarios Epson produces color cartridges for inkjet printers. Suppose cartridges are sold to mail-order distributors for $5.20 each. Total fixed costs per year are $1,197,000. Variable cost per unit are $1.85 for direct materials, $0.10 for direct labor, $0.30 for factory overhead, and $0.05 for distribution. The variable distribution costs are for transportation to mail-order distributors. Also assume the current annual production and sales volume is 630,000 and annual capacity is 770,000 units. REQUIRED The company would like to increase profitability in the upcoming year. Estimate the effect of the following separate proposals on annual profits. a. A 15% increase in the unit selling price would likely decrease annual sales by 63,000 units. Note: enter all numbers as positive numbers, do NOT use a negative sign. Net estimated profits would by $ b. A 10% decrease in the unit selling price would likely increase annual sales by 70,000 units. However, the additional production will result in machine updates that will increase fixed costs by $7,000. Note: enter all numbers as positive numbers, do NOT use a negative sign. Net estimated profits would Check by $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To estimate the effects of the proposed changes on annual profits we will perform a differential analysis for each scenario Here is how you can calcul...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started