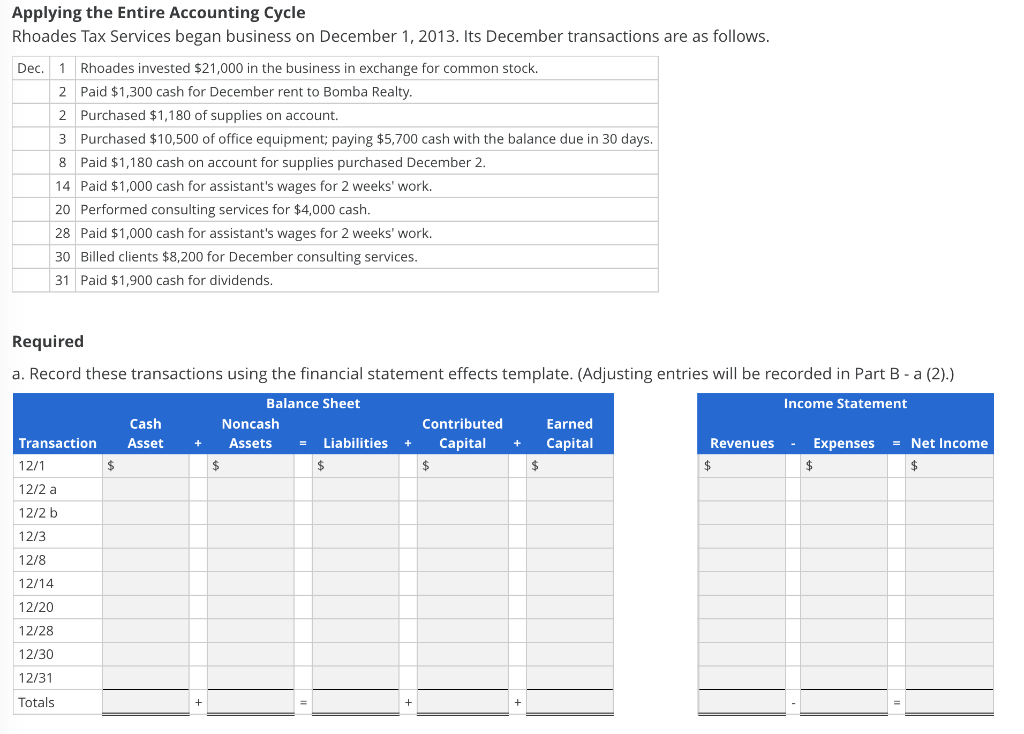

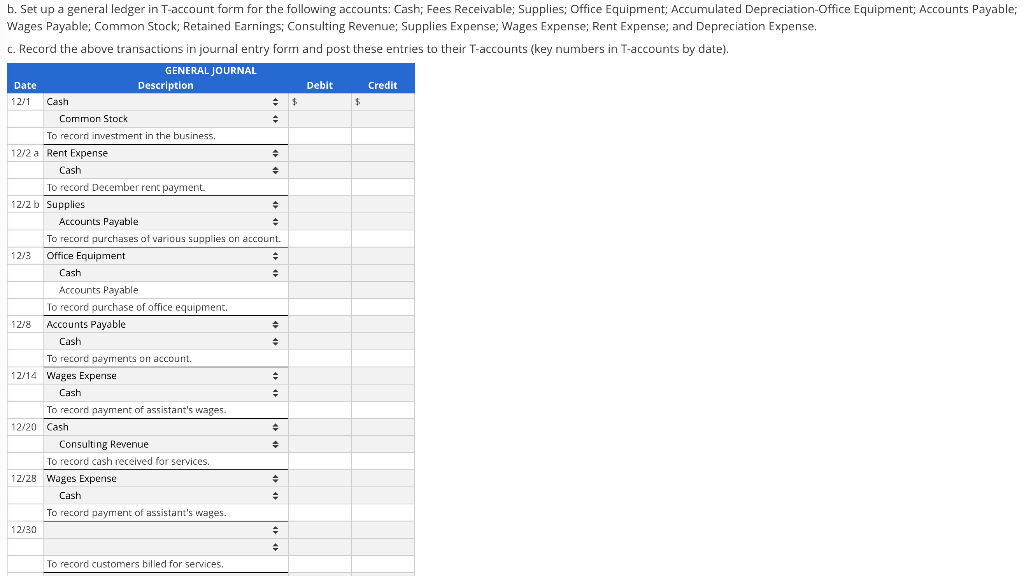

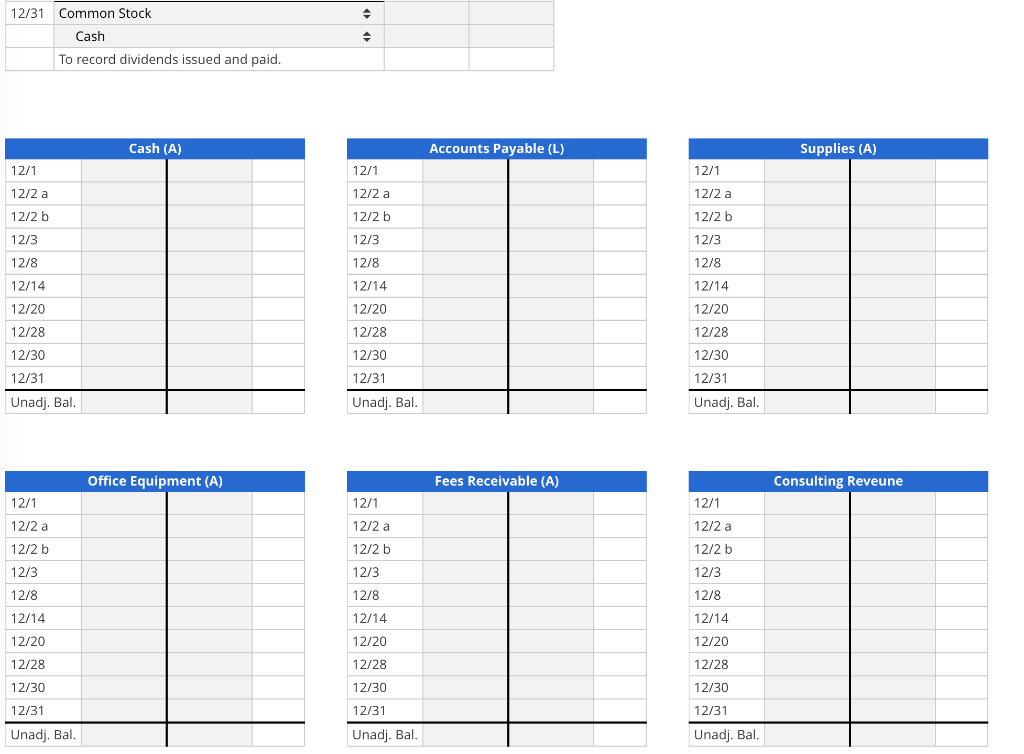

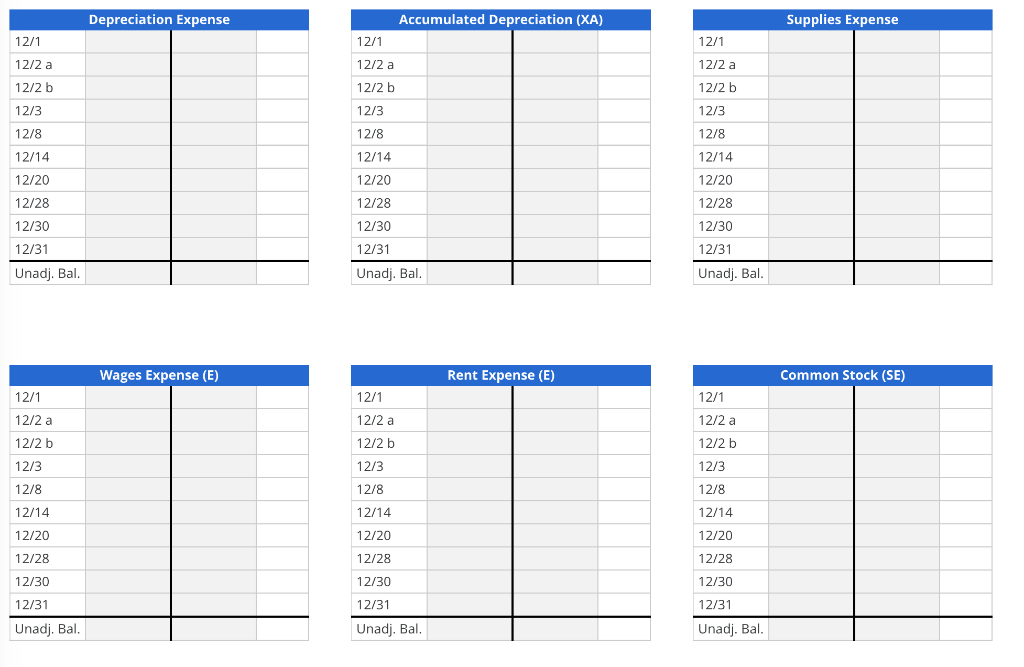

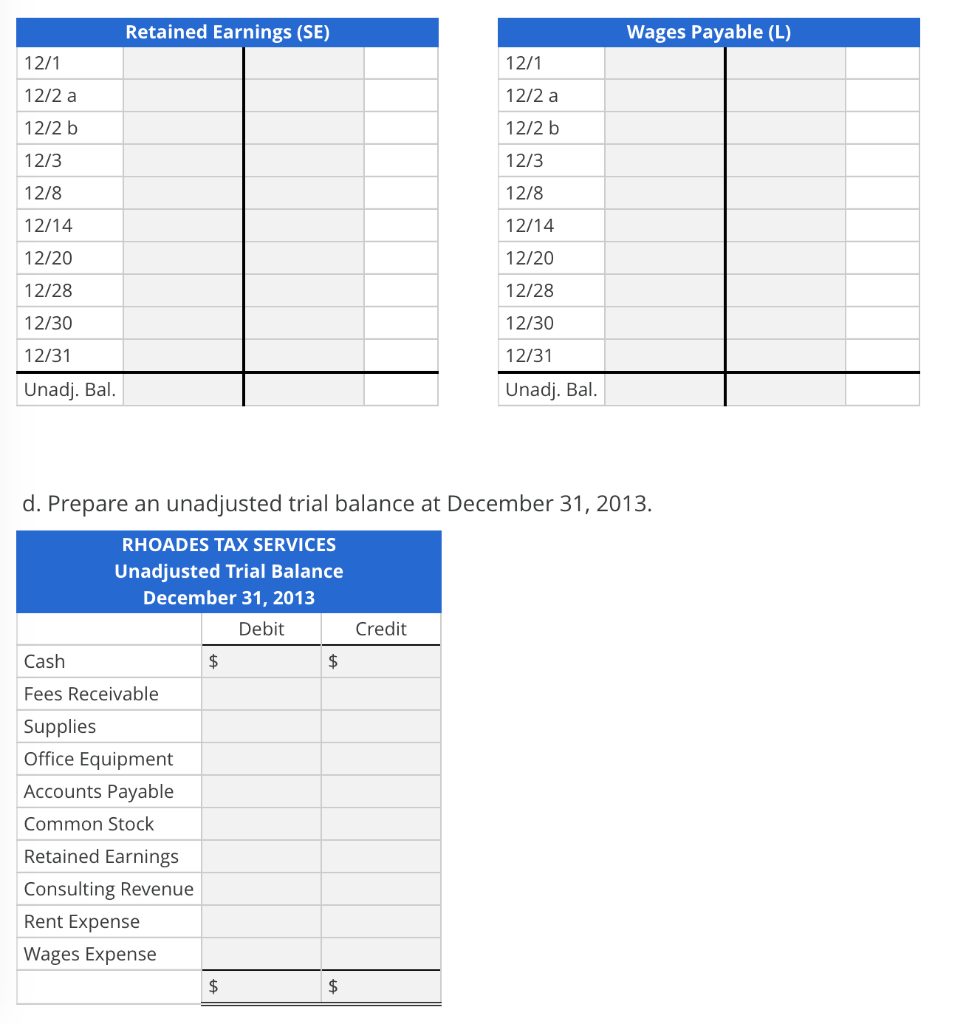

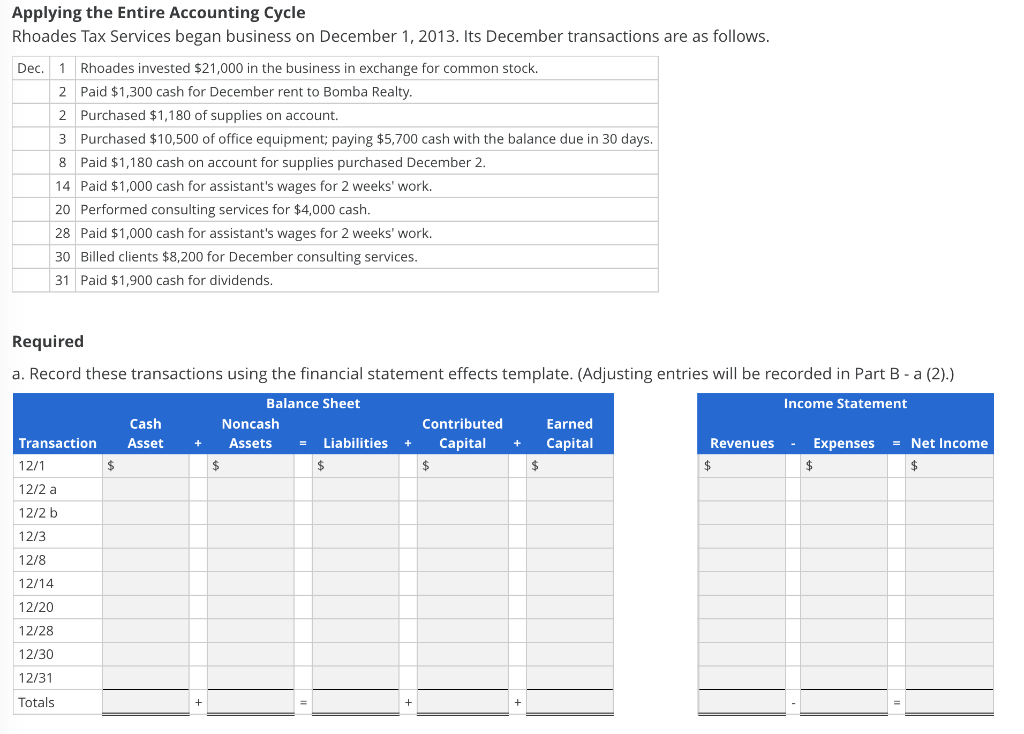

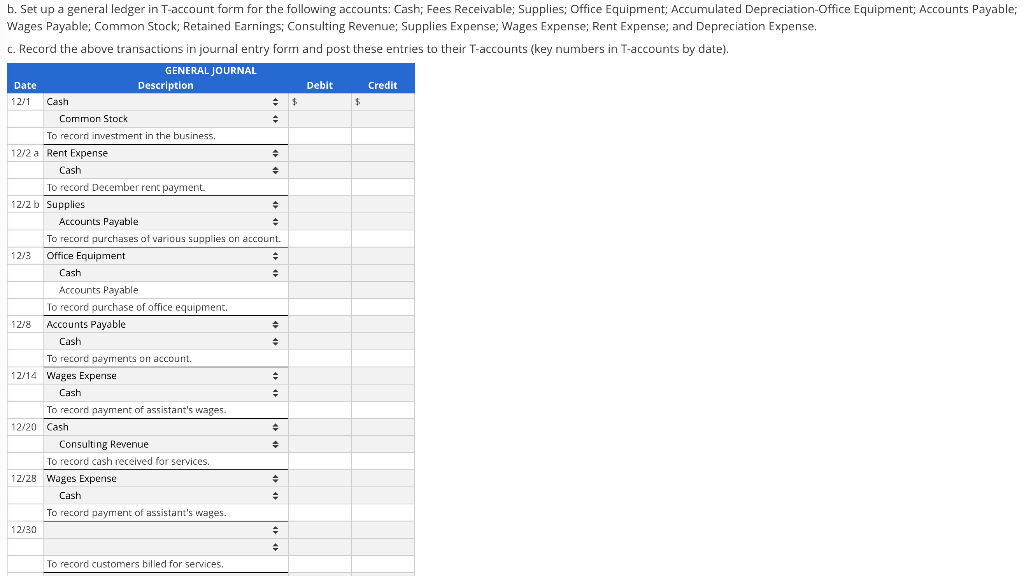

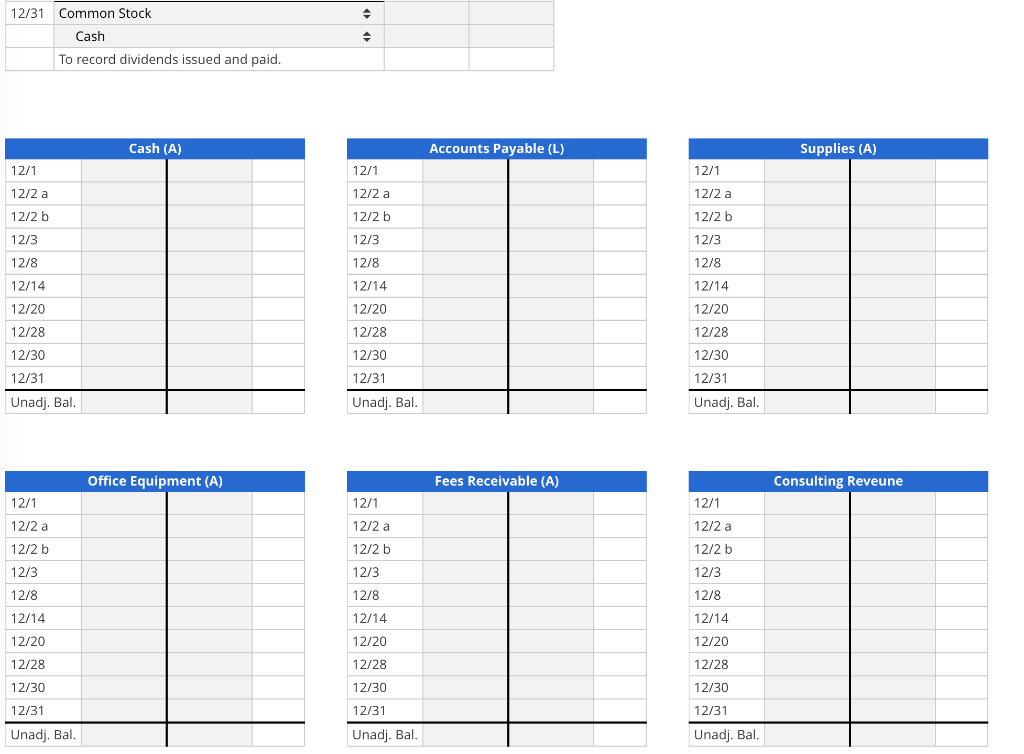

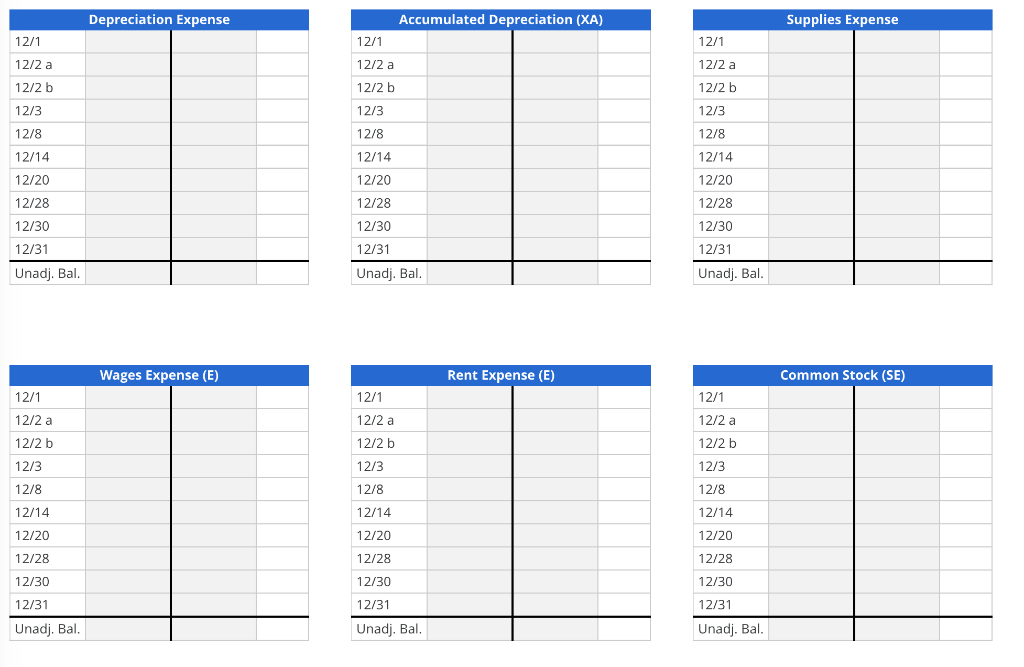

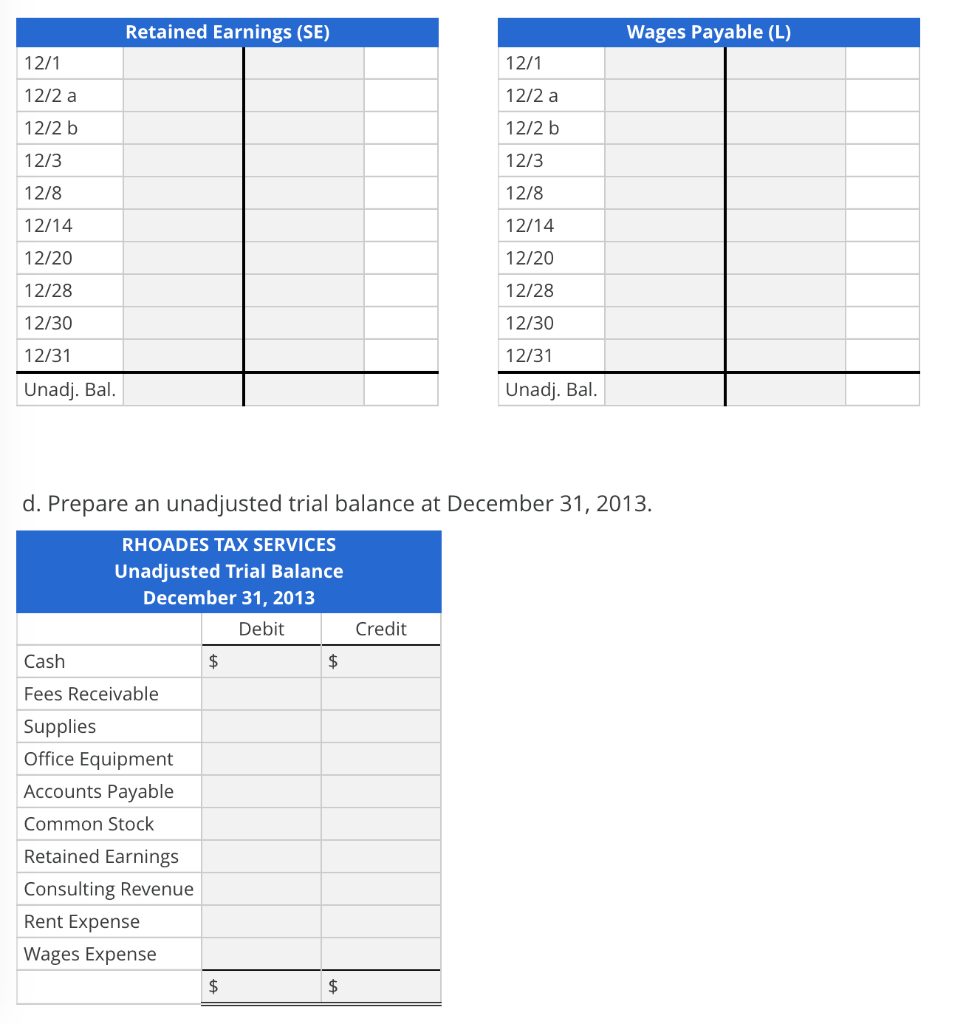

Applying the Entire Accounting Cycle Rhoades Tax Services began business on December 1, 2013. Its December transactions are as follows. Dec. 1 Rhoades invested $21,000 in the business in exchange for common stock. 2 Paid $1,300 cash for December rent to Bomba Realty. 2 Purchased $1,180 of supplies on account. 3 Purchased $10,500 of office equipment; paying $5,700 cash with the balance due in 30 days. 8 Paid $1,180 cash on account for supplies purchased December 2. 14 Paid $1,000 cash for assistant's wages for 2 weeks' work. 20 Performed consulting services for $4,000 cash. 28 Paid $1,000 cash for assistant's wages for 2 weeks' work. 30 Billed clients $8,200 for December consulting services. 31 Paid $1,900 cash for dividends. Required a. Record these transactions using the financial statement effects template. (Adjusting entries will be recorded in Part B - a (2).) Balance Sheet Income Statement Cash Noncash Contributed Earned Transaction Asset Assets Liabilities Capital Capital Revenues - Expenses = Net Income 12/1 $ $ $ 12/2 a 12/2b + + + 12/3 12/8 12/14 12/20 12/28 12/30 12/31 Totals . b. Set up a general ledger in T-account form for the following accounts: Cash; Fees Receivable; Supplies; Office Equipment; Accumulated Depreciation Office Equipment; Accounts Payable; Wages Payable; Common Stock; Retained Earnings: Consulting Revenue; Supplies Expense; Wages Expense; Rent Expense; and Depreciation Expense. c. Record the above transactions in journal entry form and post these entries to their T-accounts (key numbers in T-accounts by date). GENERAL JOURNAL Date Description Debit Credit 12/1 Cash $ Common Stock To record investment in the business. 12/2 a Rent Expense Cash + To record December rent payment 12/2 b Supplies Accounts Payable To record purchases of various supplies on account. 12/3 Office Equipment Cash Accounts Payable To record purchase of office equipment. 12/8 Accounts Payable Cash To record payments on account. 12/14 Wages Expense Cash To record payment of assistant's wages. 12/20 Cash Consulting Revenue To record cash received for services. 12/28 Wages Expense Cash To record payment of assistant's wages. 12/30 > To record customers billed for services, 12/31 Common Stock Cash To record dividends issued and paid. Cash (A) Accounts Payable (L) Supplies (A) 12/1 12/1 12/1 12/2 a 12/2 a 12/2 b 12/2 a 12/2 b 12/2b 12/3 12/3 12/3 12/8 12/8 12/14 12/14 12/8 12/14 12/20 12/20 12/20 12/28 12/28 12/28 12/30 12/30 12/30 12/31 12/31 12/31 Unadj. Bal. Unadj. Bal. Unadj. Bal. Office Equipment (A) Fees Receivable (A) Consulting Reveune 12/1 12/1 12/1 12/2 a 12/2b 12/2 a 12/2 b 12/2 a 12/2b 12/3 12/3 12/3 12/8 12/8 12/8 12/14 12/14 12/14 12/20 12/20 12/20 12/28 12/28 12/28 12/30 12/30 12/30 12/31 12/31 12/31 Unadj. Bal. Unadj. Bal. Unadj. Bal. Depreciation Expense Accumulated Depreciation (XA) Supplies Expense 12/1 12/1 12/1 12/2 a 12/2 a 12/2 b 12/2 a 12/2 b 12/2 b 12/3 12/3 12/3 12/8 12/14 12/20 12/8 12/14 12/8 12/14 12/20 12/20 12/28 12/28 12/28 12/30 12/31 12/30 12/31 Unadj. Bal. 12/30 12/31 Unadj. Bal. Unadj. Bal Wages Expense (E) Rent Expense (E) Common Stock (SE) 12/1 12/1 12/2 a 12/1 12/2 a 12/2 a 12/2 b 12/2b 12/3 12/2 b 12/3 12/3 12/8 12/8 12/8 12/14 12/14 12/14 12/20 12/20 12/20 12/28 12/28 12/28 12/30 12/30 12/30 12/31 12/31 12/31 Unadj. Bal. Unadj. Bal. Unadj. Bal. Retained Earnings (SE) Wages Payable (L) 12/1 12/1 12/2 a 12/2 a 12/2 b 12/2 b 12/3 12/3 12/8 12/8 12/14 12/14 12/20 12/20 12/28 12/28 12/30 12/30 12/31 12/31 Unadj. Bal. Unadj. Bal. d. Prepare an unadjusted trial balance at December 31, 2013. RHOADES TAX SERVICES Unadjusted Trial Balance December 31, 2013 Debit Credit Cash $ $ Fees Receivable Supplies Office Equipment Accounts Payable Common Stock Retained Earnings Consulting Revenue Rent Expense Wages Expense $ $