Apprentice Corporation purchased a pulp and paper mill in Northwestern Ontario on March 1, 2021. The Ontario Ministry of the Environment is requiring that

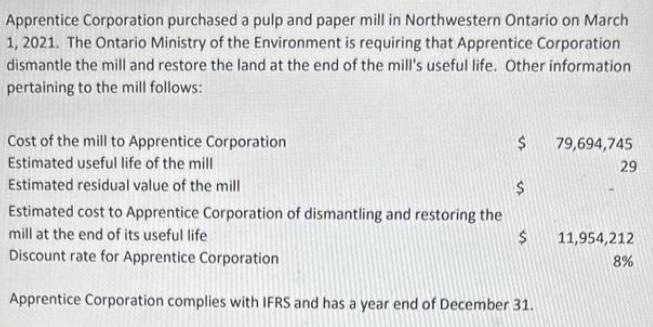

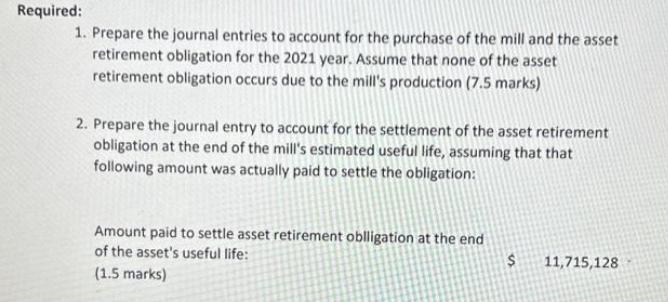

Apprentice Corporation purchased a pulp and paper mill in Northwestern Ontario on March 1, 2021. The Ontario Ministry of the Environment is requiring that Apprentice Corporation dismantle the mill and restore the land at the end of the mill's useful life. Other information pertaining to the mill follows: Cost of the mill to Apprentice Corporation Estimated useful life of the mill Estimated residual value of the mill $ $ Estimated cost to Apprentice Corporation of dismantling and restoring the mill at the end of its useful life $ Discount rate for Apprentice Corporation Apprentice Corporation complies with IFRS and has a year end of December 31. 79,694,745 29 11,954,212 8% Required: 1. Prepare the journal entries to account for the purchase of the mill and the asset retirement obligation for the 2021 year. Assume that none of the asset retirement obligation occurs due to the mill's production (7.5 marks) 2. Prepare the journal entry to account for the settlement of the asset retirement obligation at the end of the mill's estimated useful life, assuming that that following amount was actually paid to settle the obligation: Amount paid to settle asset retirement obligation at the end of the asset's useful life: (1.5 marks) $ 11,715,128

Step by Step Solution

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started