Appropriate formulas, including cell references must be presented. "data that appears to be a copy/paste" when a formula/cell reference is appropriate will not earn credit.

Appropriate formulas, including cell references must be presented. "data that appears to be a copy/paste" when a formula/cell reference is appropriate will not earn credit.

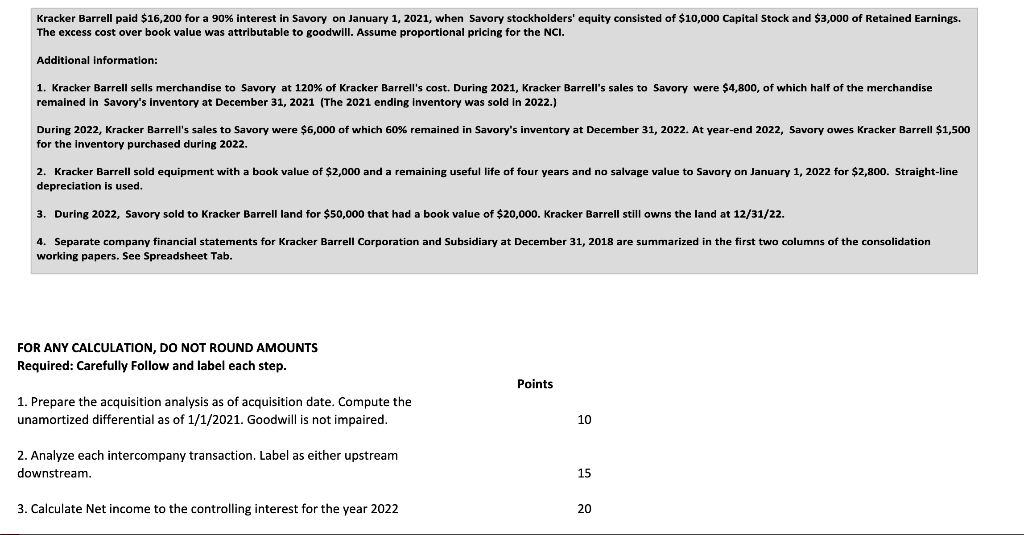

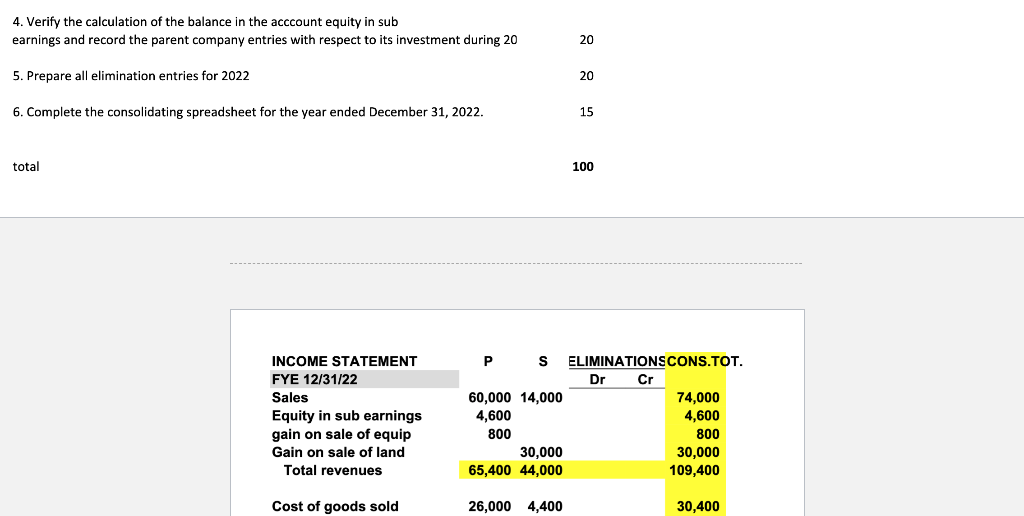

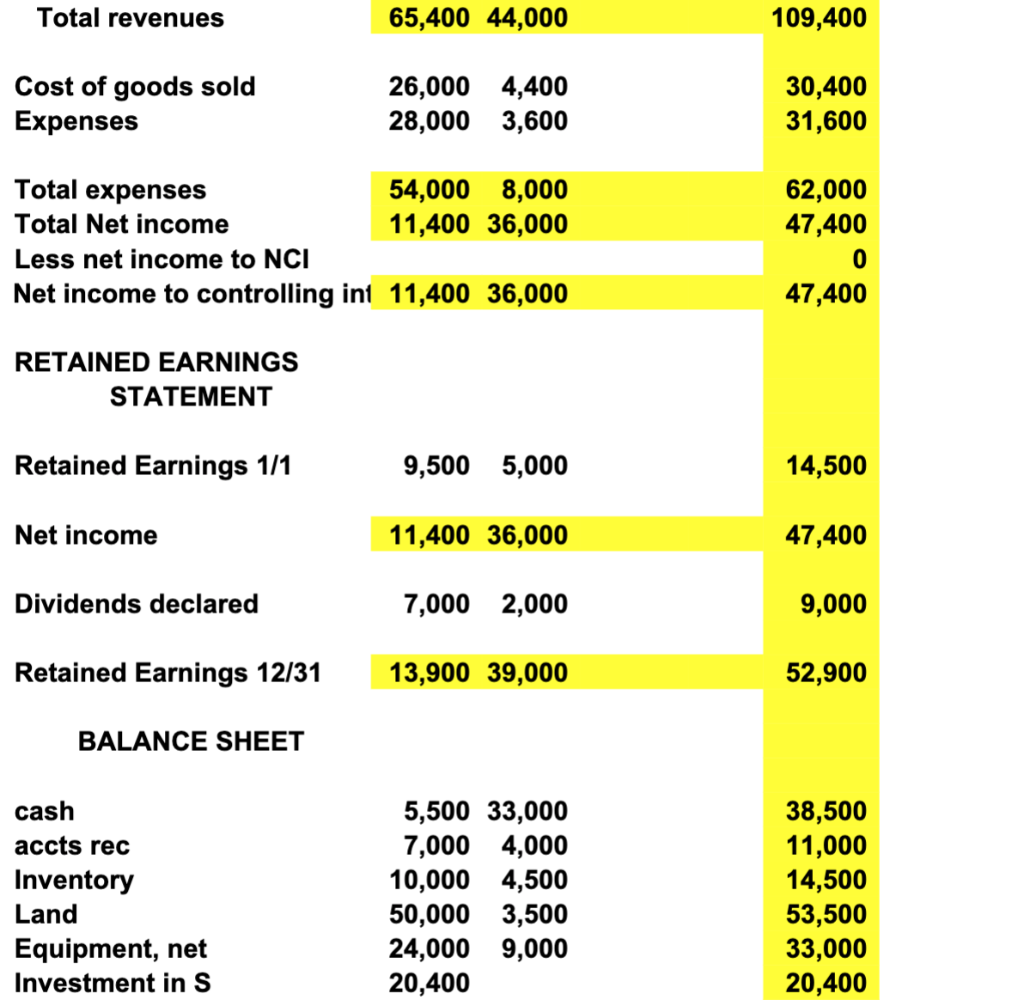

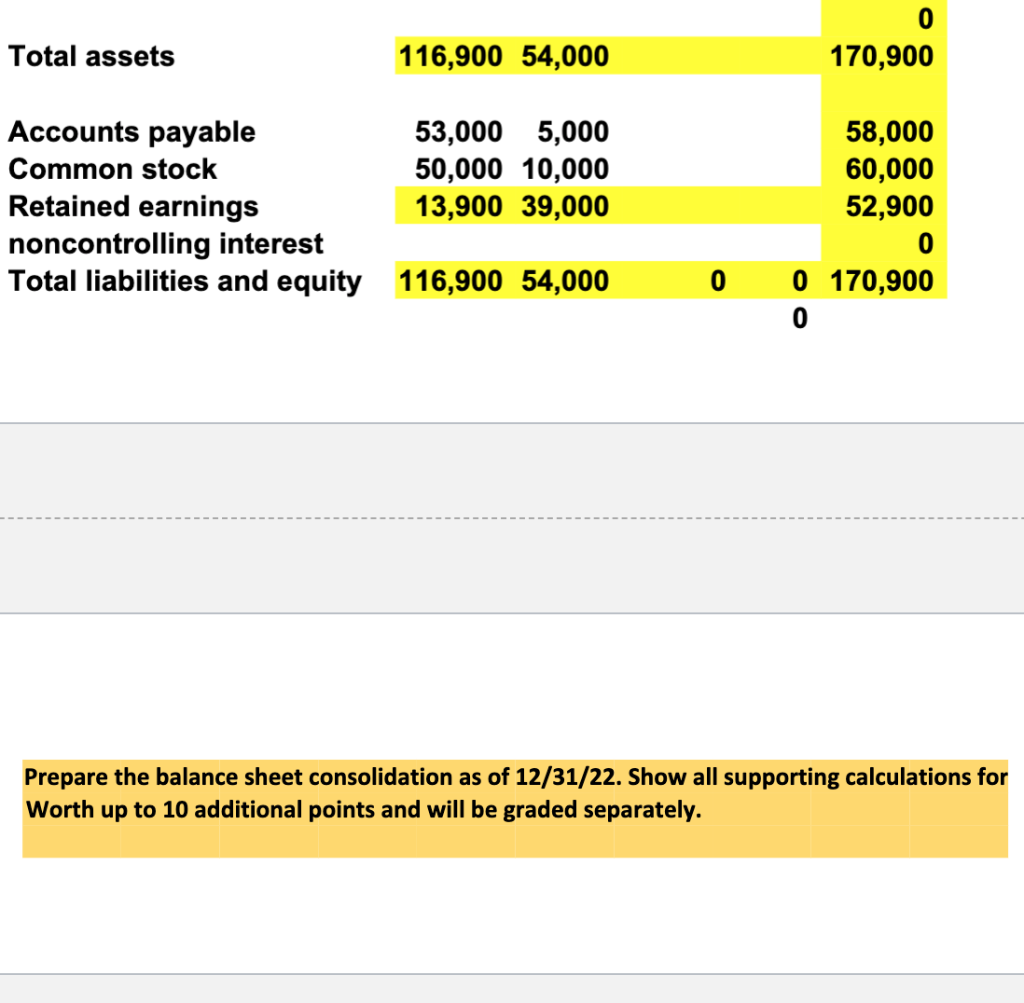

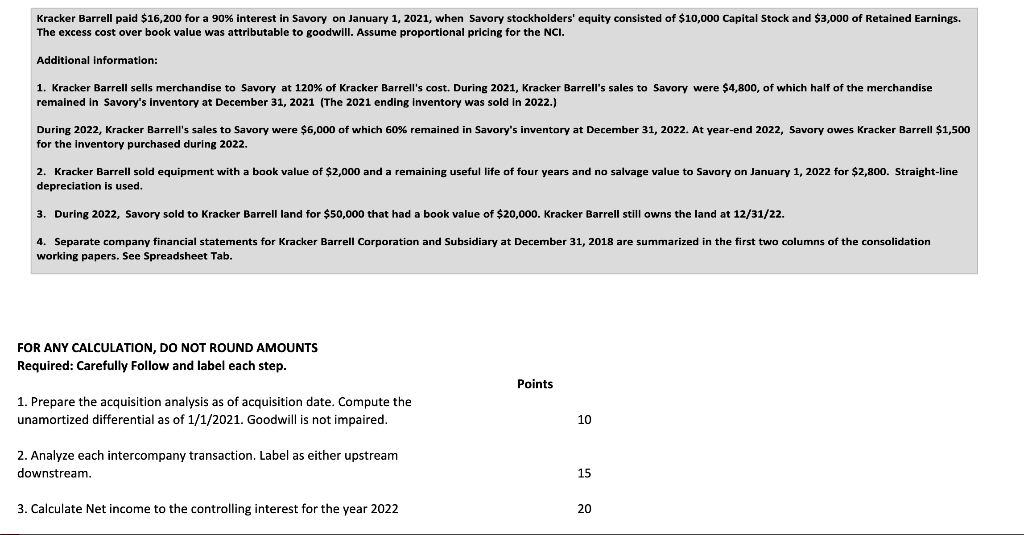

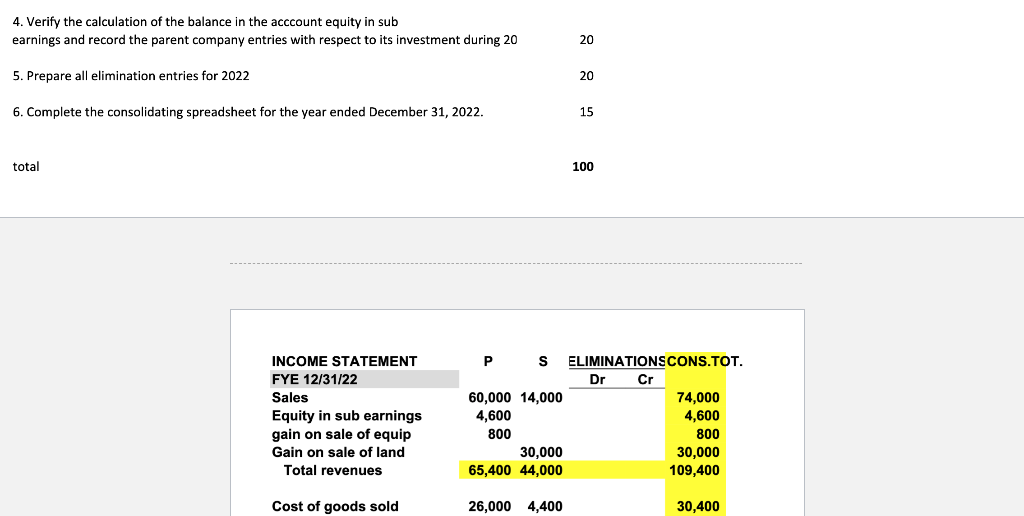

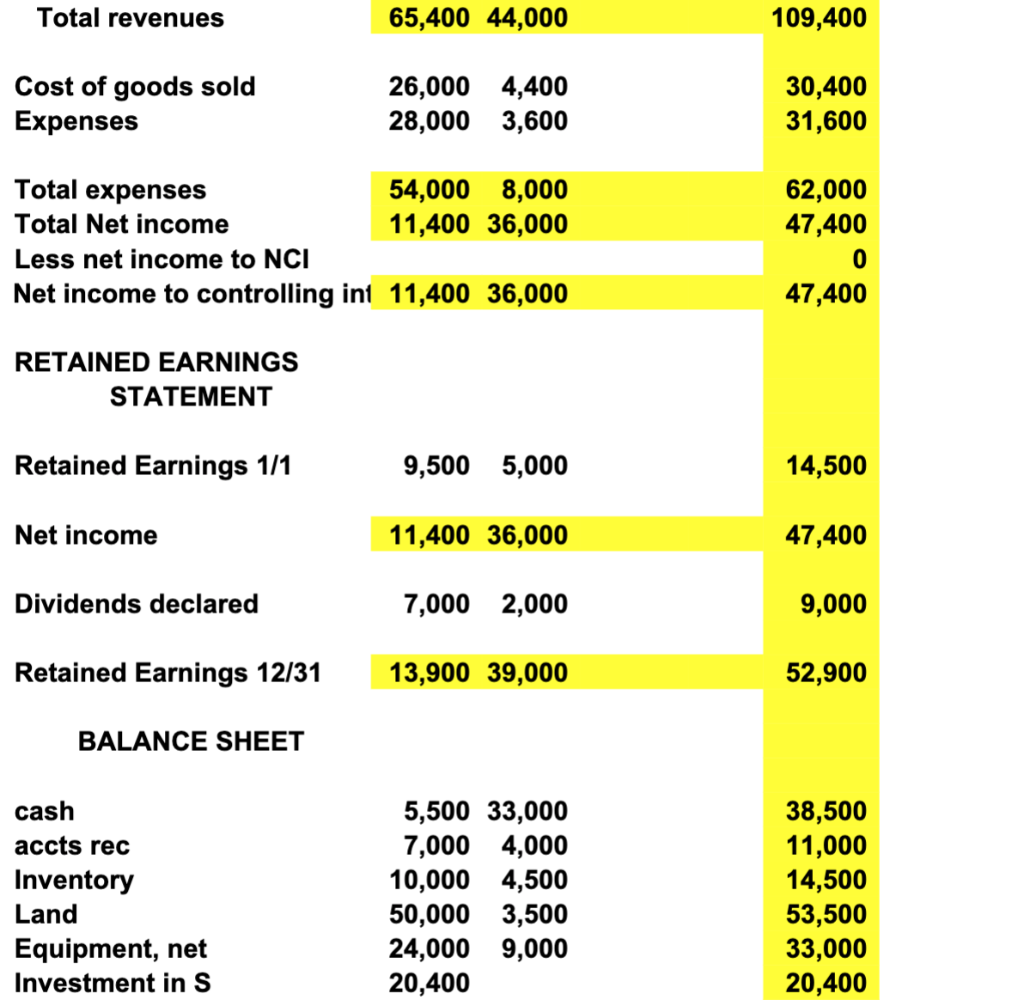

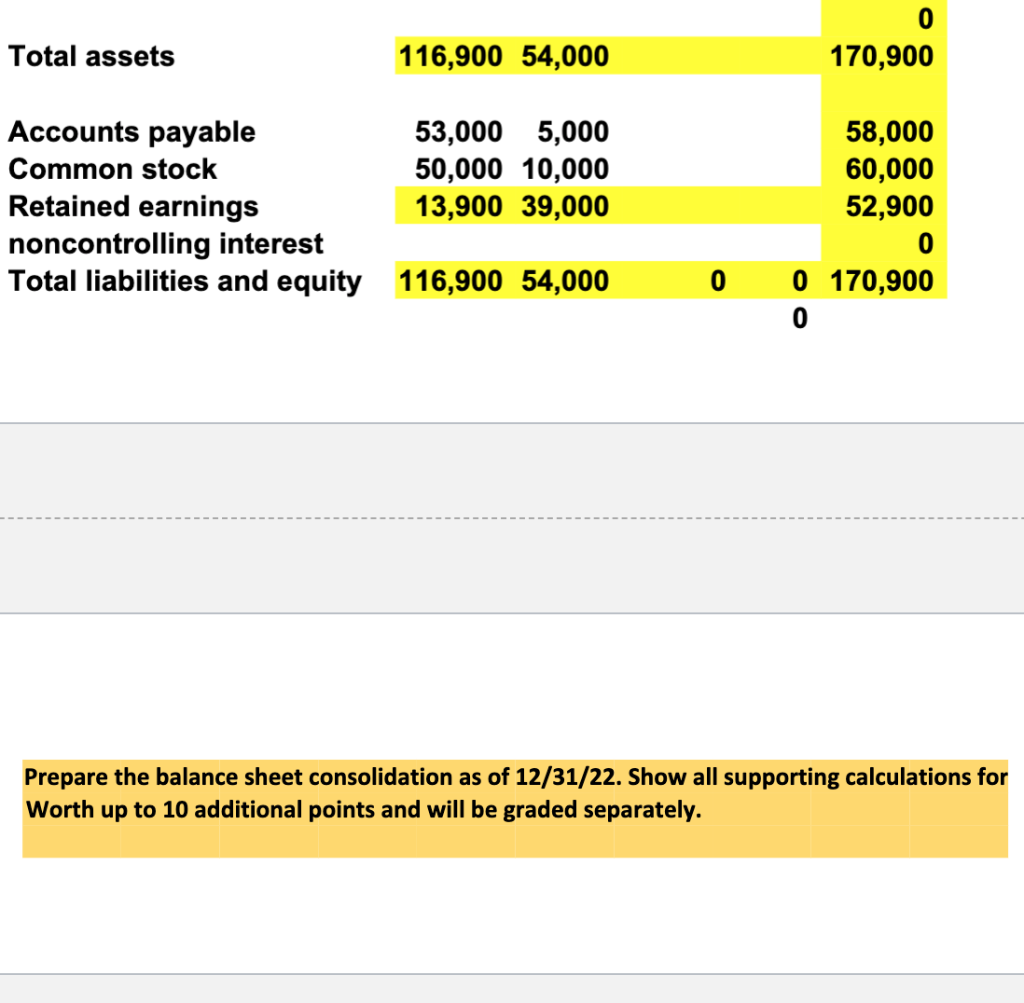

Kracker Barrell paid $16,200 for a 90% interest in Savory on January 1, 2021, when Savory stockholders' equity consisted of $10,000 Capital Stock and $3,000 of Retained Earnings. The excess cost over book value was attributable to goodwill. Assume proportional pricing for the NCI. Additional information: 1. Kracker Barrell sells merchandise to Savory at 120% of Kracker Barrell's cost. During 2021, Kracker Barrell's sales to Savory were $4,800, of which half of the merchandise remained in Savory's inventory at December 31, 2021 (The 2021 ending inventory was sold in 2022.) During 2022, Kracker Barrell's sales to Savory were \$6,000 of which 60\% remained in Savory's inventory at December 31, 2022. At year-end 2022, Savory owes Kracker Barrell \$1,500 for the inventory purchased during 2022. 2. Kracker Barrell sold equipment with a book value of $2,000 and a remaining useful life of four years and no salvage value to Savory on January 1,2022 for $2,800. Straight-line depreciation is used. 3. During 2022, Savory sold to Kracker Barrell land for $50,000 that had a book value of $20,000. Kracker Barrell still owns the land at 12/31/22. 4. Separate company financial statements for Kracker Barrell Corporation and Subsidiary at December 31,2018 are summarized in the first two columns of the consolidation working papers. See Spreadsheet Tab. 4. Verify the calculation of the balance in the acccount equity in sub earnings and record the parent company entries with respect to its investment during 20 20 5. Prepare all elimination entries for 2022 20 6. Complete the consolidating spreadsheet for the year ended December 31, 2022. 15 total 100 \begin{tabular}{lrrrr} INCOME STATEMENT & P & S & \multicolumn{2}{c}{ ELIMINATIONSCONS.TOT. } \\ FYE 12/31/22 & & & Dr & Cr \\ Sales & 60,000 & 14,000 & & 74,000 \\ Equity in sub earnings & 4,600 & & 4,600 \\ gain on sale of equip & 800 & & 800 \\ Gain on sale of land & \multicolumn{3}{c}{30,000} & 30,000 \\ Total revenues & 65,400 & 44,000 & 109,400 \\ Cost of goods sold & 26,000 & 4,400 & 30,400 \end{tabular} Prepare the balance sheet consolidation as of 12/31/22. Show all supporting calculations for Worth up to 10 additional points and will be graded separately. Kracker Barrell paid $16,200 for a 90% interest in Savory on January 1, 2021, when Savory stockholders' equity consisted of $10,000 Capital Stock and $3,000 of Retained Earnings. The excess cost over book value was attributable to goodwill. Assume proportional pricing for the NCI. Additional information: 1. Kracker Barrell sells merchandise to Savory at 120% of Kracker Barrell's cost. During 2021, Kracker Barrell's sales to Savory were $4,800, of which half of the merchandise remained in Savory's inventory at December 31, 2021 (The 2021 ending inventory was sold in 2022.) During 2022, Kracker Barrell's sales to Savory were \$6,000 of which 60\% remained in Savory's inventory at December 31, 2022. At year-end 2022, Savory owes Kracker Barrell \$1,500 for the inventory purchased during 2022. 2. Kracker Barrell sold equipment with a book value of $2,000 and a remaining useful life of four years and no salvage value to Savory on January 1,2022 for $2,800. Straight-line depreciation is used. 3. During 2022, Savory sold to Kracker Barrell land for $50,000 that had a book value of $20,000. Kracker Barrell still owns the land at 12/31/22. 4. Separate company financial statements for Kracker Barrell Corporation and Subsidiary at December 31,2018 are summarized in the first two columns of the consolidation working papers. See Spreadsheet Tab. 4. Verify the calculation of the balance in the acccount equity in sub earnings and record the parent company entries with respect to its investment during 20 20 5. Prepare all elimination entries for 2022 20 6. Complete the consolidating spreadsheet for the year ended December 31, 2022. 15 total 100 \begin{tabular}{lrrrr} INCOME STATEMENT & P & S & \multicolumn{2}{c}{ ELIMINATIONSCONS.TOT. } \\ FYE 12/31/22 & & & Dr & Cr \\ Sales & 60,000 & 14,000 & & 74,000 \\ Equity in sub earnings & 4,600 & & 4,600 \\ gain on sale of equip & 800 & & 800 \\ Gain on sale of land & \multicolumn{3}{c}{30,000} & 30,000 \\ Total revenues & 65,400 & 44,000 & 109,400 \\ Cost of goods sold & 26,000 & 4,400 & 30,400 \end{tabular} Prepare the balance sheet consolidation as of 12/31/22. Show all supporting calculations for Worth up to 10 additional points and will be graded separately

Appropriate formulas, including cell references must be presented. "data that appears to be a copy/paste" when a formula/cell reference is appropriate will not earn credit.

Appropriate formulas, including cell references must be presented. "data that appears to be a copy/paste" when a formula/cell reference is appropriate will not earn credit.