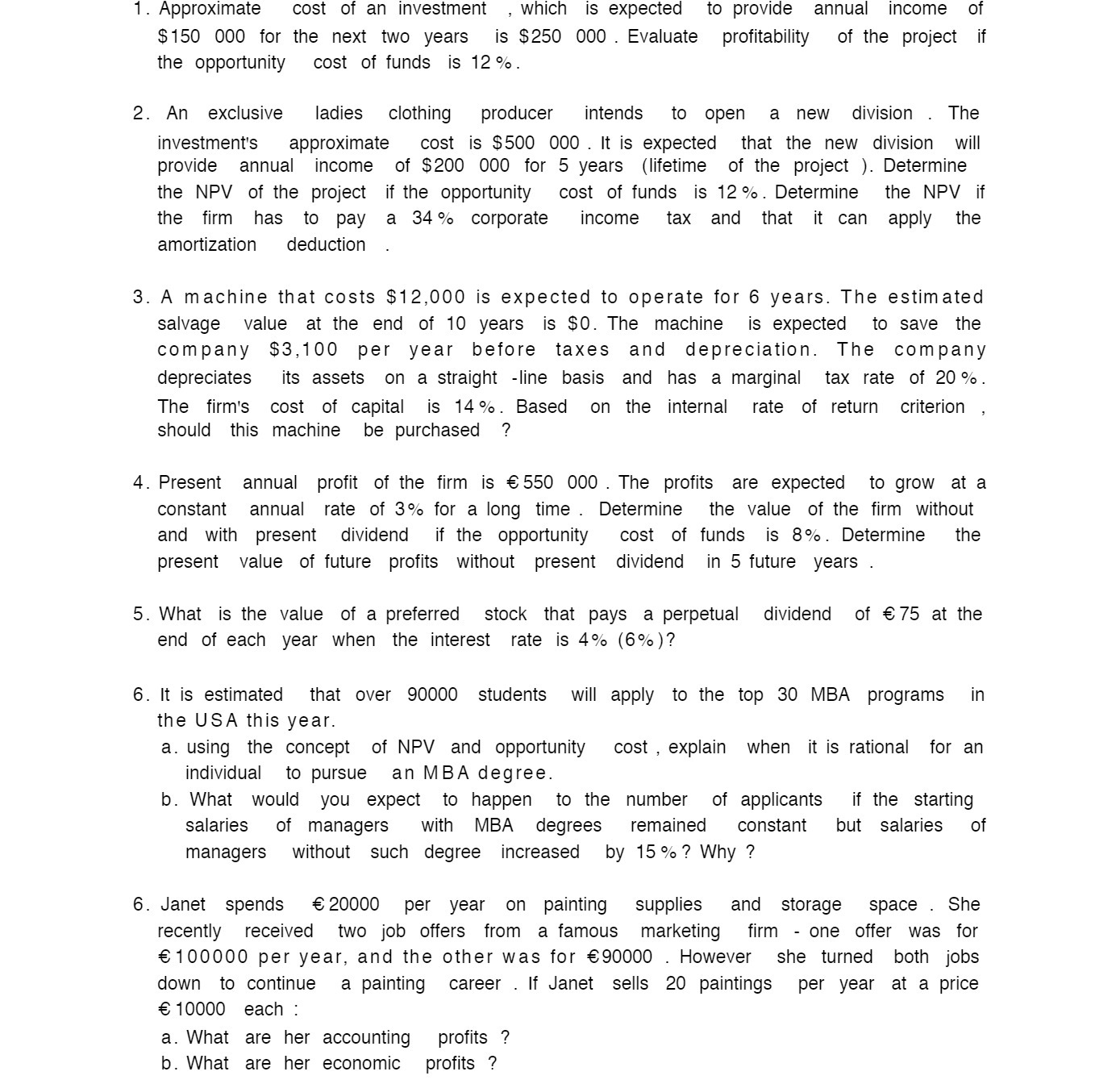

.Approximate cost of an investment ,which is expected to provide annual income of $150 000 for the next two years is $250 000. Evaluate profitability of the project if the opportunity cost of funds is 12%. An exclusive ladies clothing producer intends to open a new division . The investment's approximate cost is $500 000. It is expected that the new division will provide annual income of $200 000 for 5 years (lifetime of the project ). Determine the NPV of the project if the opportunity cost of funds is 12%. Determine the NPV if the firm has to pay a 34% corporate income tax and that it can apply the amortization deduction . A machine that costs $12,000 is expected to operate for 6 years. The estimated salvage value at the end of 10 years is $0. The machine is expected to save the company $3,100 per year before taxes and depreciation. The company depreciates its assets on a straight -line basis and has a marginal tax rate of 20%. The firm's cost of capital is 14%. Based on the internal rate of return criterion should this machine be purchased ? . Present annual profit of the firm is 550 000 . The profits are expected to grow at a constant annual rate of 3% for a long time. Determine the value of the firm without and with present dividend if the opportunity cost of funds is 8%. Determine the present value of future profits without present dividend in 5 future years. .What is the value of a preferred stock that pays a perpetual dividend of 75 at the end of each year when the interest rate is 4% (6%)? .It is estimated that over 90000 students will apply to the top 30 MBA programs in the USA this year. a. using the concept of NPV and opportunity cost, explain when it is rational for an individual to pursue an MBA degree. b. What would you expect to happen to the number of applicants if the starting salaries of managers with MBA degrees remained constant but salaries of managers without such degree increased by 15%? Why ? .Janet spends 20000 per year on painting supplies and storage space. She recently received two job offers from a famous marketing firm - one offer was for 100000 per year, and the other was for 90000 . However she turned both jobs down to continue a painting career . If Janet sells 20 paintings per year at a price 10000 each : a. What are her accounting profits ? b. What are her economic profits