Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Approximately how much will the Franklins have to set aside today to fund tuition for Robert Jr. 6 years at the university if he begins

Approximately how much will the Franklins have to set aside today to fund tuition for Robert Jr. 6 years at the university if he begins attending AT THE END of this year? Suppose tuition is curr $33,480 per year, and assume a 8.9% rate of return on assets used for this goal.

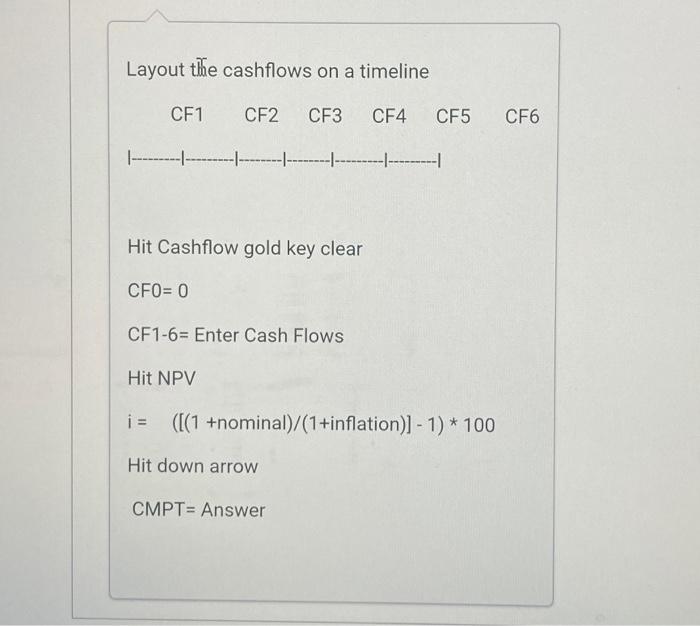

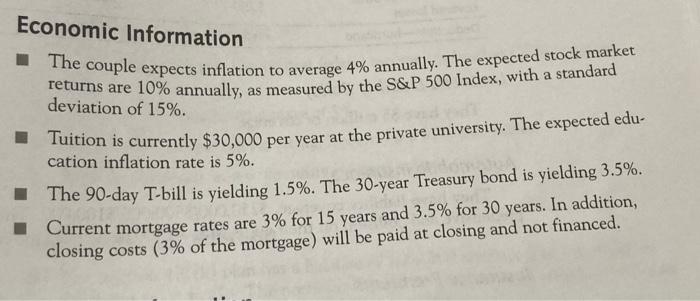

Layout the cashflows on a timeline Hit Cashflow gold key clear CFO=0 CF1-6= Enter Cash Flows Hit NPV i=([(1+nominal)/(1+inflation)]1)100 Hit down arrow CMPT= Answer Economic Information The couple expects inflation to average 4% annually. The expected stock market returns are 10% annually, as measured by the S\&P 500 Index, with a standard deviation of 15%. Tuition is currently $30,000 per year at the private university. The expected education inflation rate is 5%. The 90 -day T-bill is yielding 1.5%. The 30 -year Treasury bond is yielding 3.5%. Current mortgage rates are 3% for 15 years and 3.5% for 30 years. In addition, closing costs ( 3% of the mortgage) will be paid at closing and not financed

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started