Answered step by step

Verified Expert Solution

Question

1 Approved Answer

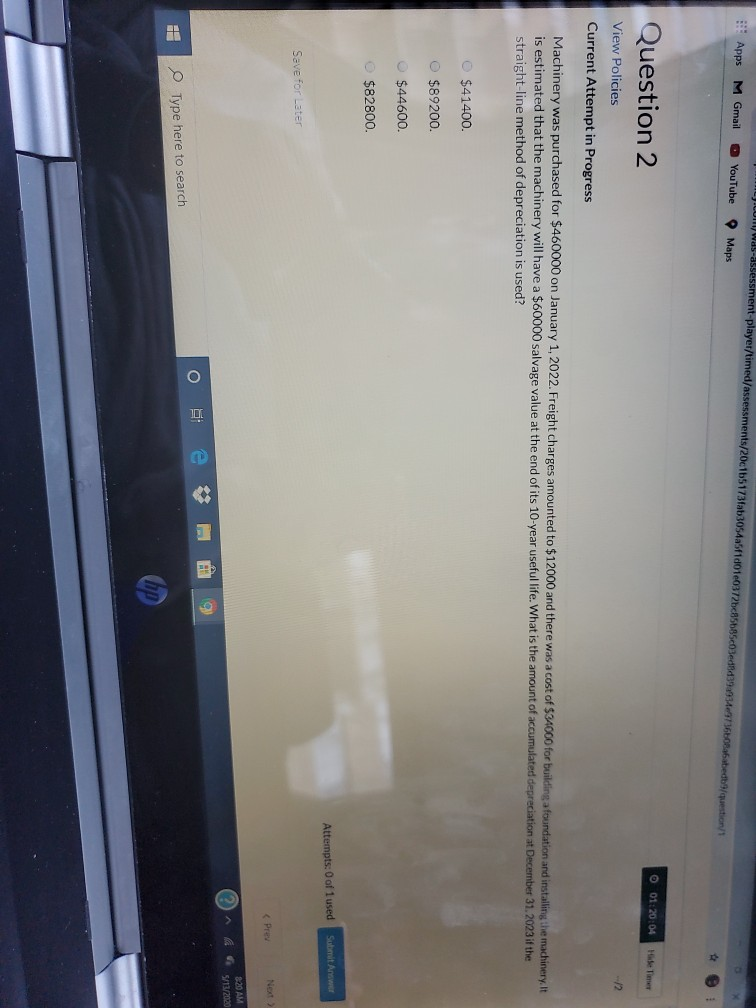

!! Apps M Gmail MI Was-assessment-player/timed/assessments/20c1b5173fab3054a5f1d01e0372bc85685c0ed1439093497360bbed/question Maps YouTube Question 2 01:20:04 Se Ter View Policies Current Attempt in Progress Machinery was purchased for $460000 on

!! Apps M Gmail MI Was-assessment-player/timed/assessments/20c1b5173fab3054a5f1d01e0372bc85685c0ed1439093497360bbed/question Maps YouTube Question 2 01:20:04 Se Ter View Policies Current Attempt in Progress Machinery was purchased for $460000 on January 1, 2022. Freight charges amounted to $12000 and there was a cost of $34000 for building a foundation and installing the machinery. It is estimated that the machinery will have a $60000 salvage value at the end of its 10-year useful life. What is the amount of accumulated depreciation at December 31, 2023 if the straight-line method of depreciation is used? $41400. $89200. $44600. $82800. Attempts: 0 of 1 used Submit Answer Save for Later

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started