Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bow plc acquired 75% of the shares in Tie ple on 1 January 20X1 for 80,000 when the balance of the retained earnings of

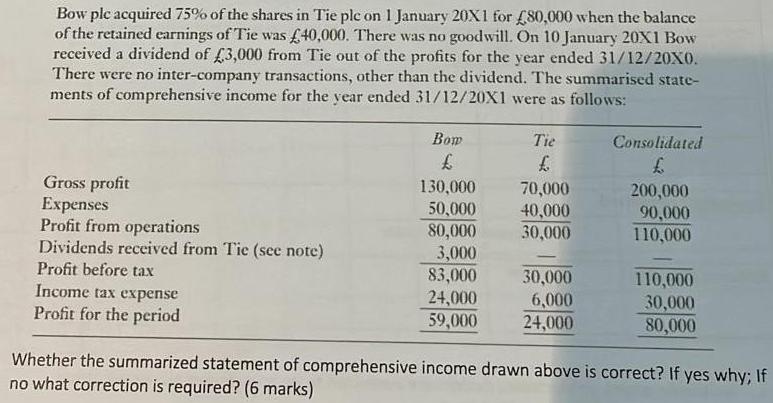

Bow plc acquired 75% of the shares in Tie ple on 1 January 20X1 for 80,000 when the balance of the retained earnings of Tie was 40,000. There was no goodwill. On 10 January 20X1 Bow received a dividend of 3,000 from Tie out of the profits for the year ended 31/12/20X0. There were no inter-company transactions, other than the dividend. The summarised state- ments of comprehensive income for the year ended 31/12/20X1 were as follows: Gross profit Expenses Profit from operations Dividends received from Tie (see note) Profit before tax Income tax expense Profit for the period Bow 130,000 50,000 80,000 3,000 83,000 24,000 59,000 Tie 70,000 40,000 30,000 30,000 6,000 24,000 Consolidated 200,000 90,000 110,000 110,000 30,000 80,000 Whether the summarized statement of comprehensive income drawn above is correct? If yes why; If no what correction is required? (6 marks)

Step by Step Solution

★★★★★

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER No The summarised statement of comprehensive income drawn is incorrect EXPLANATION In this in...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started