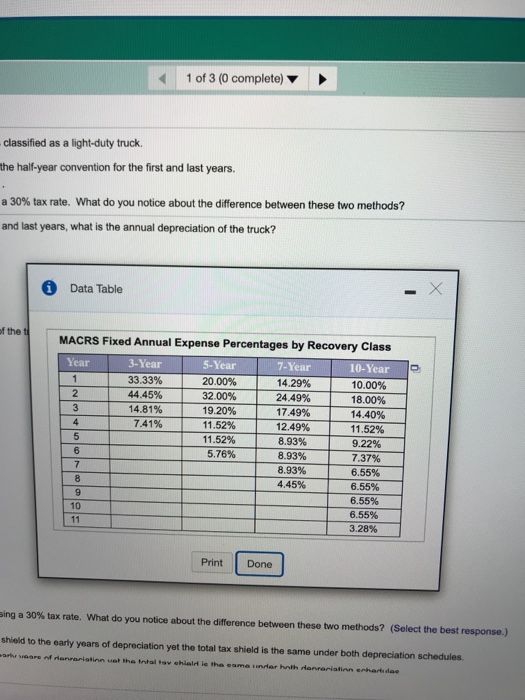

apreciation expense. Brock Florist Company buys a new delivery truck for $30,000. It is classified as a light-duty truck Calculate the depreciation schedule using a five-year life, straight-line depreciation, and the half-year convention for the first and last years. - Calculate the depreciation schedule using a five-year life and MACRS depreciation, im - Compare the depreciation schedules from parts (a) and (b) before and after taxes using a 30% tax rate. What do you notice about the difference between these two methods? Using a five-year life, straight-line depreciation, and the half-year convention for the first and last years, what is the annual depreciation of the truck? (Round to the nearest dollar.) Vhat is the depreciation for the first and last years? (Round to the nearest dollar.) b. Using a five-year life and MACRS depreciation, what is the annual depreciation of the truck for year 1? $ (Round to the nearest dollar.) What is the annual depreciation of the truck for year 2? $ (Round to the nearest dollar.) What is the annual depreciation of the truck for year 3? $ (Round to the nearest dollar) What is the annual depreciation of the truck for year 4? (Round to the nearest dollar) What is the annual depreciation of the truck for year 57 $ (Round to the nearest dollar) What is the annual depreciation of the truck for year 6? $ (Round to the nearest dollar) c. Compare the depreciation des from parts) and (b) before and after taxes using a 30% tax rate. What do you notice about the difference between these two methods (Sectie U Te r ence on method of depreciation moves up the tax shield to the early years of depreciation yet the total tax shield is the same under both depreciation sched Click to select your answers 1 of 3 (0 complete) Classified as a light-duty truck he half-year convention for the first and last years. 30% tax rate. What do you notice about the difference between these two methods? and last years, what is the annual depreciation of the truck? Data Table MACRS Fixed Annual Expense Percentages by Recovery Class Year 3-Year 5-Year 7. Year 10-Year 33.33% 20.00% 14.29% 10.00% 44.45% 32 00% 24.49% 18.00% 14.81% 19.20% 17.49% 14.40% 7.41% 11.52% 12.49% 11.52% 5 11.52% 8.93% 9.22% 6 T L 5.76% 8.93% 7.37% 8.93% 6.55% 8 4.45% 6.55% 6.55% 6.55% 3.28% Bacolo Print Done Done ing a 30% tax rate. What do you notice about the difference between these two methods? (Select the best response shield to the early years of depreciation yot the total tax shield is the same under both depreciation schedules enristinn at the totovchisi le the came under hath donariation erhardee apreciation expense. Brock Florist Company buys a new delivery truck for $30,000. It is classified as a light-duty truck Calculate the depreciation schedule using a five-year life, straight-line depreciation, and the half-year convention for the first and last years. - Calculate the depreciation schedule using a five-year life and MACRS depreciation, im - Compare the depreciation schedules from parts (a) and (b) before and after taxes using a 30% tax rate. What do you notice about the difference between these two methods? Using a five-year life, straight-line depreciation, and the half-year convention for the first and last years, what is the annual depreciation of the truck? (Round to the nearest dollar.) Vhat is the depreciation for the first and last years? (Round to the nearest dollar.) b. Using a five-year life and MACRS depreciation, what is the annual depreciation of the truck for year 1? $ (Round to the nearest dollar.) What is the annual depreciation of the truck for year 2? $ (Round to the nearest dollar.) What is the annual depreciation of the truck for year 3? $ (Round to the nearest dollar) What is the annual depreciation of the truck for year 4? (Round to the nearest dollar) What is the annual depreciation of the truck for year 57 $ (Round to the nearest dollar) What is the annual depreciation of the truck for year 6? $ (Round to the nearest dollar) c. Compare the depreciation des from parts) and (b) before and after taxes using a 30% tax rate. What do you notice about the difference between these two methods (Sectie U Te r ence on method of depreciation moves up the tax shield to the early years of depreciation yet the total tax shield is the same under both depreciation sched Click to select your answers 1 of 3 (0 complete) Classified as a light-duty truck he half-year convention for the first and last years. 30% tax rate. What do you notice about the difference between these two methods? and last years, what is the annual depreciation of the truck? Data Table MACRS Fixed Annual Expense Percentages by Recovery Class Year 3-Year 5-Year 7. Year 10-Year 33.33% 20.00% 14.29% 10.00% 44.45% 32 00% 24.49% 18.00% 14.81% 19.20% 17.49% 14.40% 7.41% 11.52% 12.49% 11.52% 5 11.52% 8.93% 9.22% 6 T L 5.76% 8.93% 7.37% 8.93% 6.55% 8 4.45% 6.55% 6.55% 6.55% 3.28% Bacolo Print Done Done ing a 30% tax rate. What do you notice about the difference between these two methods? (Select the best response shield to the early years of depreciation yot the total tax shield is the same under both depreciation schedules enristinn at the totovchisi le the came under hath donariation erhardee