Answered step by step

Verified Expert Solution

Question

1 Approved Answer

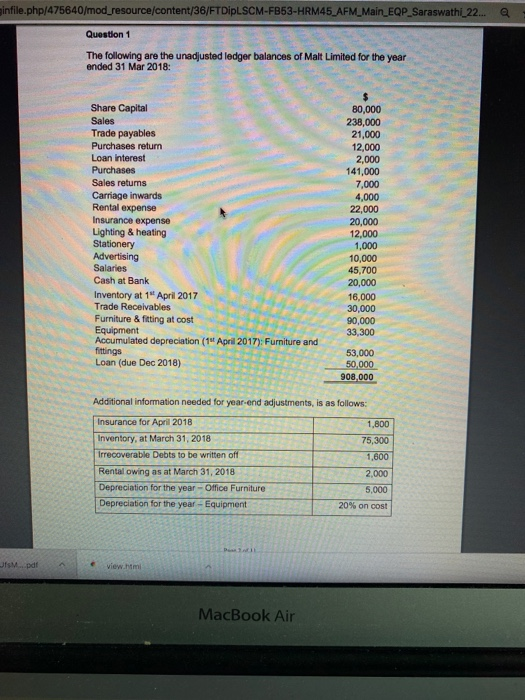

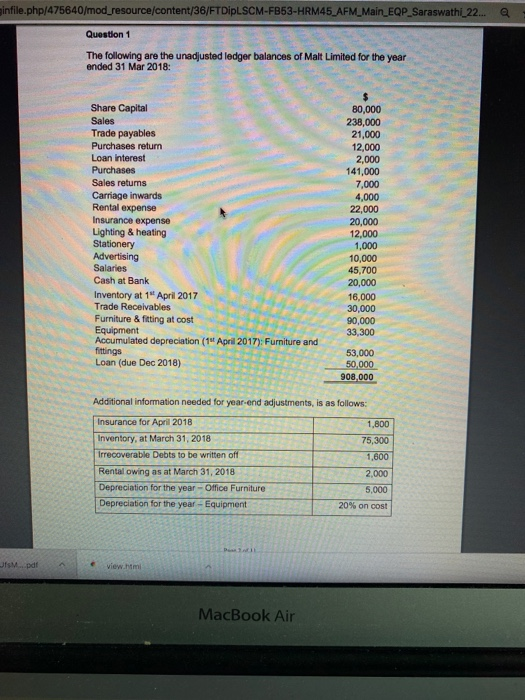

a,Prepare a classified income statement for the year ended March 31 2019 b, Prepare a statement of financial position as that date infile.php/475640/mod_resource/content/36/FTDIPL.SCM-FB53-HRM45_AFM_Main_EQP_Saraswathi_22... Question 1

a,Prepare a classified income statement for the year ended March 31 2019

infile.php/475640/mod_resource/content/36/FTDIPL.SCM-FB53-HRM45_AFM_Main_EQP_Saraswathi_22... Question 1 The following are the unadjusted ledger balances of Malt Limited for the year ended 31 Mar 2018: Share Capital Sales Trade payables Purchases return Loan Interest Purchases Sales retums Carriage inwards Rental expense Insurance expense Lighting & heating Stationery Advertising Salaries Cash at Bank Inventory at 14 April 2017 Trade Receivables Furniture & fitting at cost Equipment Accumulated depreciation (14 April 2017): Furniture and fittings Loan (due Dec 2018) 80,000 238,000 21,000 12,000 2,000 141,000 7,000 4,000 22,000 20,000 12,000 1,000 10,000 45,700 20,000 16,000 30,000 90,000 33,300 53,000 50,000 908,000 Additional Information needed for year-end adjustments, is as follows: Insurance for April 2018 1,800 Inventory, at March 31, 2018 75,300 Irrecoverable Debts to be written off 1,600 Rental owing as at March 31, 2018 2,000 Depreciation for the year-Office Furniture 5,000 Depreciation for the year - Equipment 20% on cost ufs M.pdf view.mi MacBook Air infile.php/475640/mod_resource/content/36/FTDIPL.SCM-FB53-HRM45_AFM_Main_EQP_Saraswathi_22... Question 1 The following are the unadjusted ledger balances of Malt Limited for the year ended 31 Mar 2018: Share Capital Sales Trade payables Purchases return Loan Interest Purchases Sales retums Carriage inwards Rental expense Insurance expense Lighting & heating Stationery Advertising Salaries Cash at Bank Inventory at 14 April 2017 Trade Receivables Furniture & fitting at cost Equipment Accumulated depreciation (14 April 2017): Furniture and fittings Loan (due Dec 2018) 80,000 238,000 21,000 12,000 2,000 141,000 7,000 4,000 22,000 20,000 12,000 1,000 10,000 45,700 20,000 16,000 30,000 90,000 33,300 53,000 50,000 908,000 Additional Information needed for year-end adjustments, is as follows: Insurance for April 2018 1,800 Inventory, at March 31, 2018 75,300 Irrecoverable Debts to be written off 1,600 Rental owing as at March 31, 2018 2,000 Depreciation for the year-Office Furniture 5,000 Depreciation for the year - Equipment 20% on cost ufs M.pdf view.mi MacBook Air b, Prepare a statement of financial position as that date

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started