Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a)Prepare journal entries to record all necessary transactions for MAD Outdoors for December 2018 in the general journal. Omit journal explanations and closing entries. (b)Prepare

(a)Prepare journal entries to record all necessary transactions for MAD Outdoors for December 2018 in the general journal. Omit journal explanations and closing entries.

(b)Prepare the Income Statement and Statement of Financial Position MAD Outdoors, in good form, for December 2018.

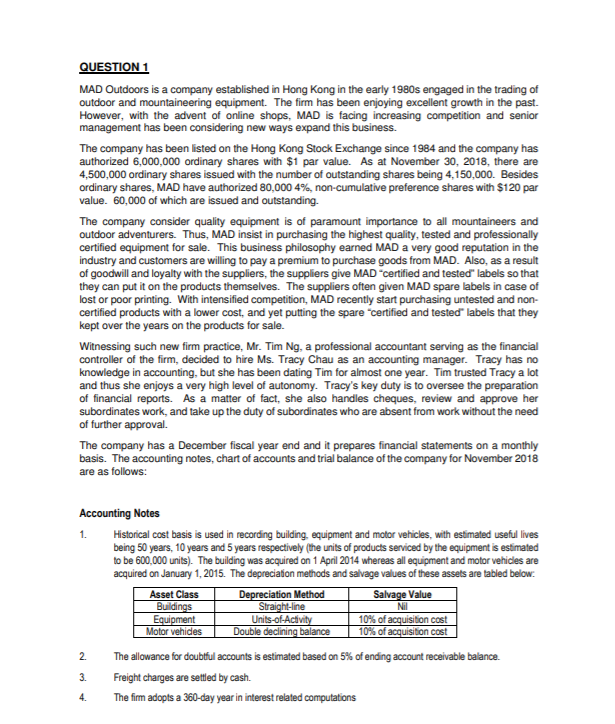

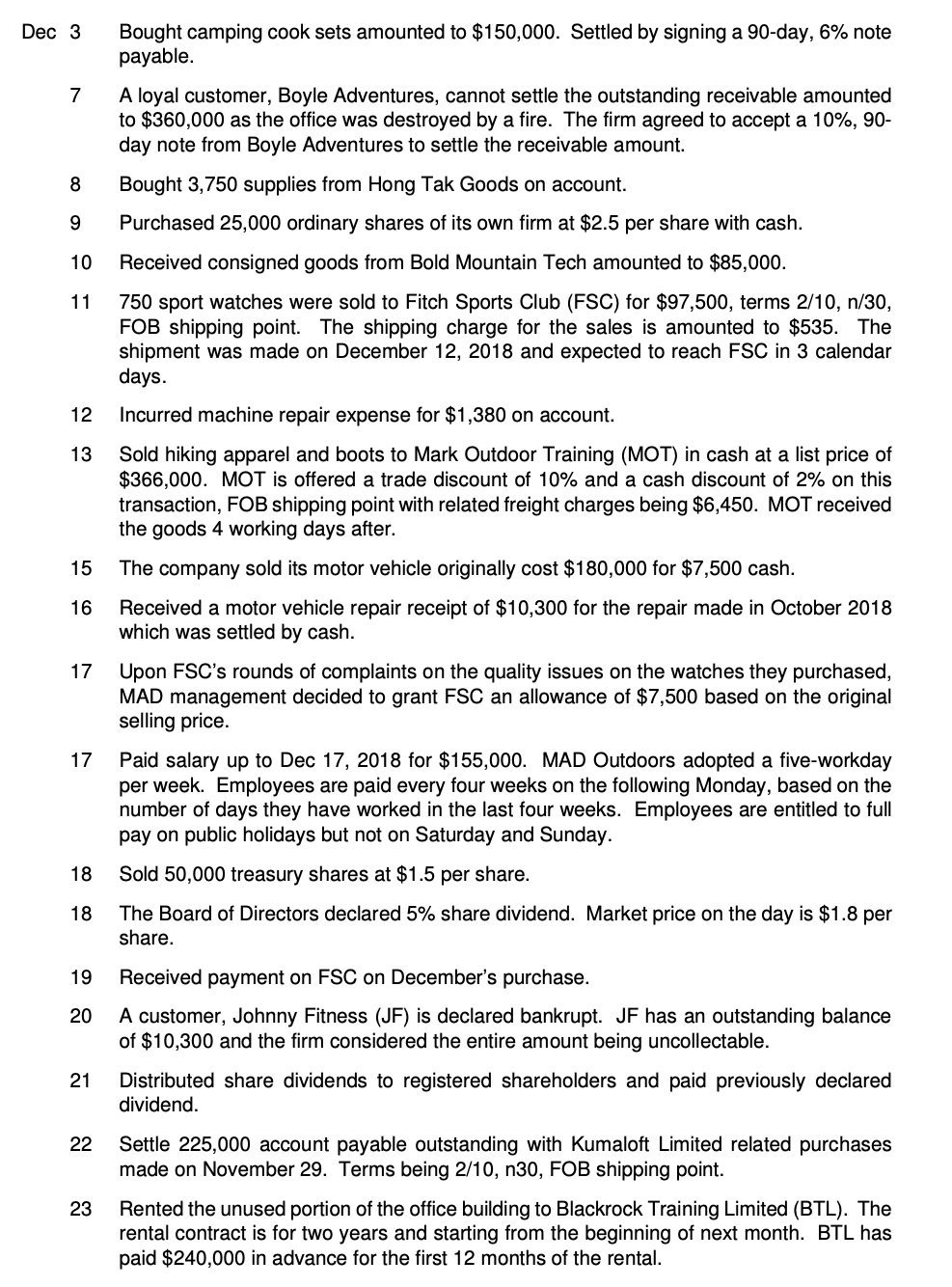

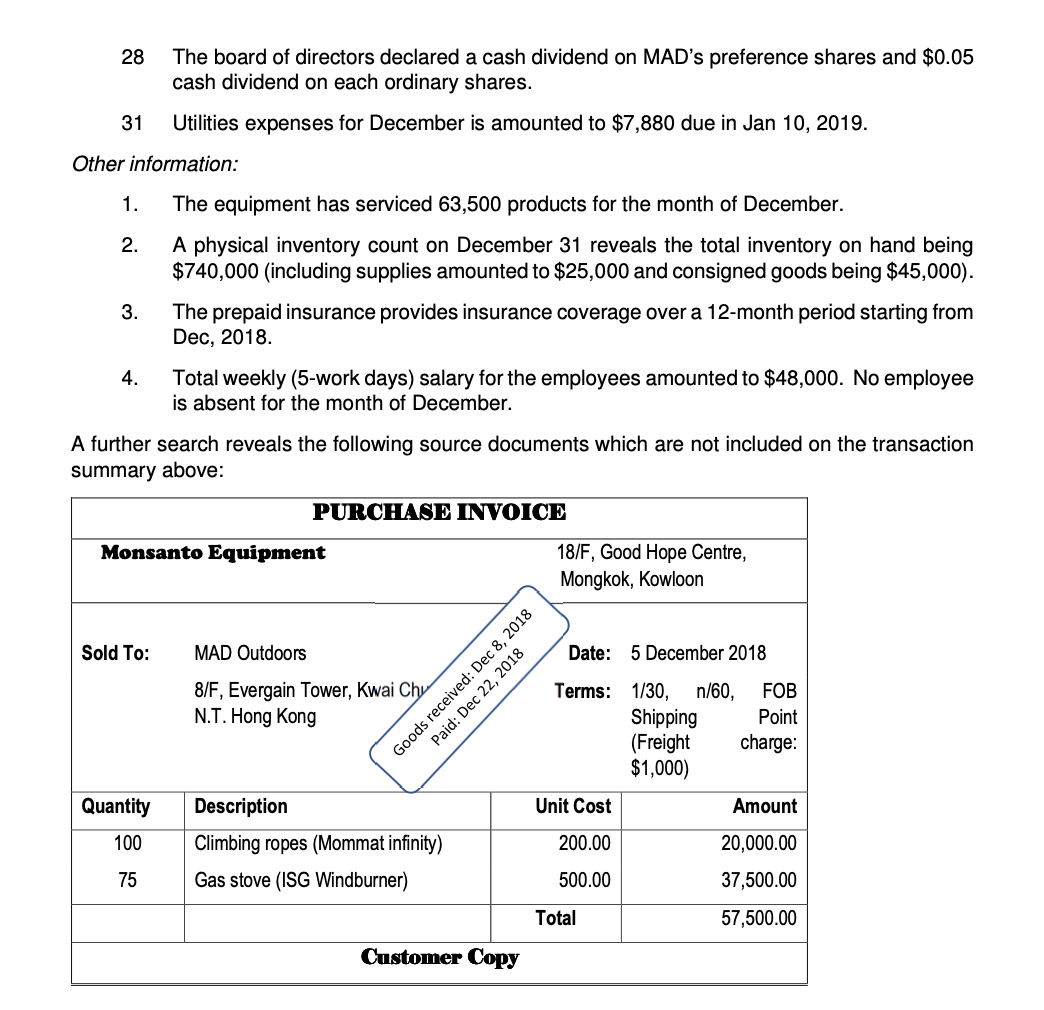

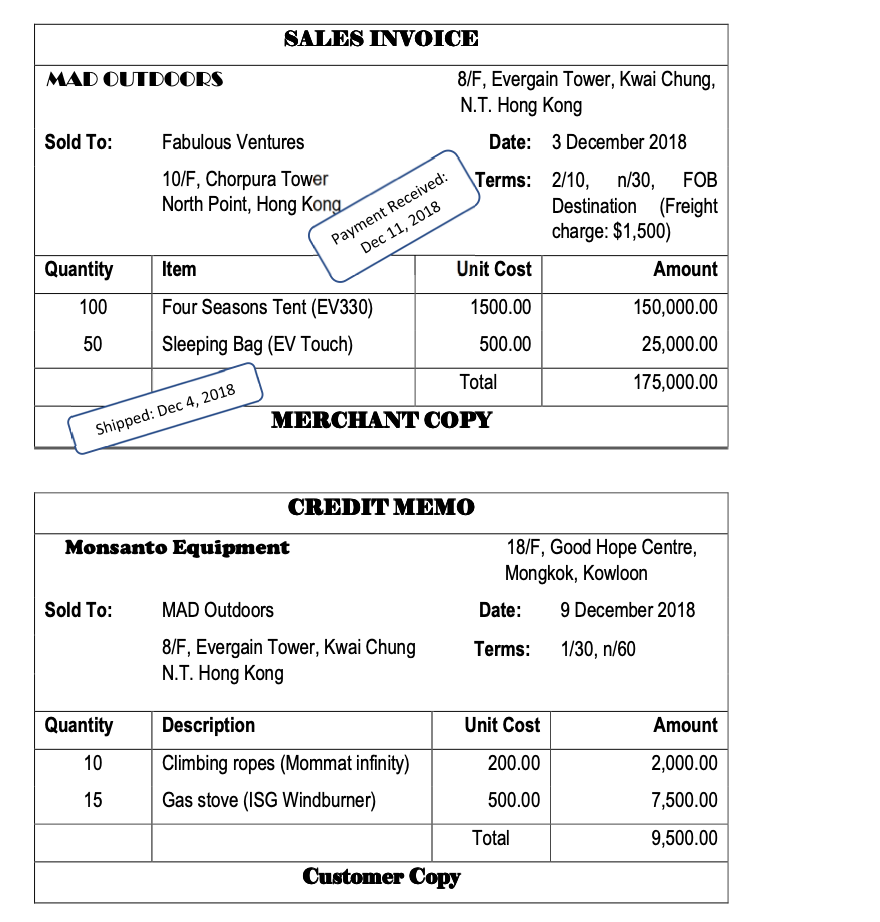

QUESTION 1 MAD Outdoors is a company established in Hong Kong in the early 1980s engaged in the trading of outdoor and mountaineering equipment. The firm has been enjoying excellent growth in the past. However, with the advent of online shops, MAD is facing increasing competition and senior management has been considering new ways expand this business. The company has been listed on the Hong Kong Stock Exchange since 1984 and the company has authorized 6,000,000 ordinary shares with $1 par value. As at November 30, 2018, there are 4,500,000 ordinary shares issued with the number of outstanding shares being 4,150,000. Besides ordinary shares, MAD have authorized 80,000 4%, non-cumulative preference shares with $120 par value. 60,000 of which are issued and outstanding. The company consider quality equipment is of paramount importance to all mountaineers and outdoor adventurers. Thus, MAD insist in purchasing the highest quality, tested and professionally certified equipment for sale. This business philosophy earned MAD a very good reputation in the industry and customers are willing to pay a premium to purchase goods from MAD. Also, as a result of goodwill and loyalty with the suppliers, the suppliers give MAD "certified and tested" labels so that they can put it on the products themselves. The suppliers often given MAD spare labels in case of lost or poor printing. With intensified competition, MAD recently start purchasing untested and non- certified products with a lower cost, and yet putting the spare "certified and tested" labels that they kept over the years on the products for sale. Witnessing such new firm practice, Mr. Tim Ng, a professional accountant serving as the financial controller of the firm, decided to hire Ms. Tracy Chau as an accounting manager. Tracy has no knowledge in accounting, but she has been dating Tim for almost one year. Tim trusted Tracy a lot and thus she enjoys a very high level of autonomy. Tracy's key duty is to oversee the preparation of financial reports. As a matter of fact, she also handles cheques, review and approve her subordinates work, and take up the duty of subordinates who are absent from work without the need of further approval. The company has a December fiscal year end and it prepares financial statements on a monthly basis. The accounting notes, chart of accounts and trial balance of the company for November 2018 are as follows: Accounting Notes 1. Historical cost basis is used in recording building, equipment and motor vehicles, with estimated useful lives being 50 years, 10 years and 5 years respectively (the units of products serviced by the equipment is estimated to be 600,000 units). The building was acquired on 1 April 2014 whereas all equipment and motor vehicles are acquired on January 1, 2015. The depreciation methods and salvage values of these assets are tabled below: Salvage Value Nil Depreciation Method Straight-line Units-of-Activity Double declining balance Asset Class Buildings Equipment Motor vehides 10% of acquisition cost 10% of acquisition cost 2. The allowance for doubtful accounts is estimated based on 5% of ending account receivable balance. 3. Freight charges are settled by cash. 4. The firm adopts a 360-day year in interest related computations Dec 3 Bought camping cook sets amounted to $150,000. Settled by signing a 90-day, 6% note payable. A loyal customer, Boyle Adventures, cannot settle the outstanding receivable amounted to $360,000 as the office was destroyed by a fire. The firm agreed to accept a 10%, 90- day note from Boyle Adventures to settle the receivable amount. Bought 3,750 supplies from Hong Tak Goods on account. Purchased 25,000 ordinary shares of its own firm at $2.5 per share with cash. Received consigned goods from Bold Mountain Tech amounted to $85,000. 10 750 sport watches were sold to Fitch Sports Club (FSC) for $97,500, terms 2/10, n/30, FOB shipping point. The shipping charge for the sales is amounted to $535. The shipment was made on December 12, 2018 and expected to reach FSC in 3 calendar days. 11 Incurred machine repair expense for $1,380 on account. 12 Sold hiking apparel and boots to Mark Outdoor Training (MOT) in cash at a list price of $366,000. MOT is offered a trade discount of 10% and a cash discount of 2% on this transaction, FOB shipping point with related freight charges being $6,450. MOT received the goods 4 working days after. 13 The company sold its motor vehicle originally cost $180,000 for $7,500 cash. 15 Received a motor vehicle repair receipt of $10,300 for the repair made in October 2018 which was settled by cash. 16 Upon FSC's rounds of complaints on the quality issues on the watches they purchased, MAD management decided to grant FSC an allowance of $7,500 based on the original selling price. 17 Paid salary up to Dec 17, 2018 for $155,000. MAD Outdoors adopted a five-workday per week. Employees are paid every four weeks on the following Monday, based on the number of days they have worked in the last four weeks. Employees are entitled to full pay on public holidays but not on Saturday and Sunday. 17 Sold 50,000 treasury shares at $1.5 per share. 18 The Board of Directors declared 5% share dividend. Market price on the day is $1.8 per 18 share. Received payment on FSC on December's purchase. 19 A customer, Johnny Fitness (JF) is declared bankrupt. JF has an outstanding balance of $10,300 and the firm considered the entire amount being uncollectable. 20 21 Distributed share dividends to registered shareholders and paid previously declared dividend. Settle 225,000 account payable outstanding with Kumaloft Limited related purchases made on November 29. Terms being 2/10, n30, FOB shipping point. 22 23 Rented the unused portion of the office building to Blackrock Training Limited (BTL). The rental contract is for two years and starting from the beginning of next month. BTL has paid $240,000 in advance for the first 12 months of the rental. The board of directors declared a cash dividend on MAD's preference shares and $0.05 cash dividend on each ordinary shares. 28 Utilities expenses for December is amounted to $7,880 due in Jan 10, 2019. 31 Other information: The equipment has serviced 63,500 products for the month of December. 1. A physical inventory count on December 31 reveals the total inventory on hand being $740,000 (including supplies amounted to $25,000 and consigned goods being $45,000). 2. 3. The prepaid insurance provides insurance coverage over a 12-month period starting from Dec, 2018. Total weekly (5-work days) salary for the employees amounted to $48,000. No employee is absent for the month of December. 4. A further search reveals the following source documents which are not included on the transaction summary above: PURCHASE INVOICE Monsanto Equipment 18/F, Good Hope Centre, Mongkok, Kowloon MAD Outdoors Sold To: Date: 5 December 2018 8/F, Evergain Tower, Kwai Chy N.T. Hong Kong Terms: 1/30, n/60, Shipping (Freight $1,000) FOB Point charge: Unit Cost Quantity Description Amount 200.00 100 Climbing ropes (Mommat infinity) 20,000.00 Gas stove (ISG Windburner) 500.00 75 37,500.00 Total 57,500.00 Customer Copy Goods received: Dec 8, 2018 Paid: Dec 22, 2018 SALES INVOICE MAD OUTDOORS 8/F, Evergain Tower, Kwai Chung, N.T. Hong Kong Sold To: Fabulous Ventures Date: 3 December 2018 10/F, Chorpura Tower North Point, Hong Kong Payment Received: Dec 11, 2018 \Terms: 2/10, n/30, Destination (Freight charge: $1,500) FOB Quantity Item Unit Cost Amount Four Seasons Tent (EV330) 100 1500.00 150,000.00 50 Sleeping Bag (EV Touch) 500.00 25,000.00 Total 175,000.00 MERCHANT COPY Shipped: Dec 4, 2018 CREDIT MEMO Monsanto Equipment 18/F, Good Hope Centre, Mongkok, Kowloon Sold To: MAD Outdoors 9 December 2018 Date: 8/F, Evergain Tower, Kwai Chung N.T. Hong Kong Terms: 1/30, n/60 Quantity Description Unit Cost Amount 10 Climbing ropes (Mommat infinity) 200.00 2,000.00 Gas stove (ISG Windburner) 15 500.00 7,500.00 Total 9,500.00 Customer Copy QUESTION 1 MAD Outdoors is a company established in Hong Kong in the early 1980s engaged in the trading of outdoor and mountaineering equipment. The firm has been enjoying excellent growth in the past. However, with the advent of online shops, MAD is facing increasing competition and senior management has been considering new ways expand this business. The company has been listed on the Hong Kong Stock Exchange since 1984 and the company has authorized 6,000,000 ordinary shares with $1 par value. As at November 30, 2018, there are 4,500,000 ordinary shares issued with the number of outstanding shares being 4,150,000. Besides ordinary shares, MAD have authorized 80,000 4%, non-cumulative preference shares with $120 par value. 60,000 of which are issued and outstanding. The company consider quality equipment is of paramount importance to all mountaineers and outdoor adventurers. Thus, MAD insist in purchasing the highest quality, tested and professionally certified equipment for sale. This business philosophy earned MAD a very good reputation in the industry and customers are willing to pay a premium to purchase goods from MAD. Also, as a result of goodwill and loyalty with the suppliers, the suppliers give MAD "certified and tested" labels so that they can put it on the products themselves. The suppliers often given MAD spare labels in case of lost or poor printing. With intensified competition, MAD recently start purchasing untested and non- certified products with a lower cost, and yet putting the spare "certified and tested" labels that they kept over the years on the products for sale. Witnessing such new firm practice, Mr. Tim Ng, a professional accountant serving as the financial controller of the firm, decided to hire Ms. Tracy Chau as an accounting manager. Tracy has no knowledge in accounting, but she has been dating Tim for almost one year. Tim trusted Tracy a lot and thus she enjoys a very high level of autonomy. Tracy's key duty is to oversee the preparation of financial reports. As a matter of fact, she also handles cheques, review and approve her subordinates work, and take up the duty of subordinates who are absent from work without the need of further approval. The company has a December fiscal year end and it prepares financial statements on a monthly basis. The accounting notes, chart of accounts and trial balance of the company for November 2018 are as follows: Accounting Notes 1. Historical cost basis is used in recording building, equipment and motor vehicles, with estimated useful lives being 50 years, 10 years and 5 years respectively (the units of products serviced by the equipment is estimated to be 600,000 units). The building was acquired on 1 April 2014 whereas all equipment and motor vehicles are acquired on January 1, 2015. The depreciation methods and salvage values of these assets are tabled below: Salvage Value Nil Depreciation Method Straight-line Units-of-Activity Double declining balance Asset Class Buildings Equipment Motor vehides 10% of acquisition cost 10% of acquisition cost 2. The allowance for doubtful accounts is estimated based on 5% of ending account receivable balance. 3. Freight charges are settled by cash. 4. The firm adopts a 360-day year in interest related computations Dec 3 Bought camping cook sets amounted to $150,000. Settled by signing a 90-day, 6% note payable. A loyal customer, Boyle Adventures, cannot settle the outstanding receivable amounted to $360,000 as the office was destroyed by a fire. The firm agreed to accept a 10%, 90- day note from Boyle Adventures to settle the receivable amount. Bought 3,750 supplies from Hong Tak Goods on account. Purchased 25,000 ordinary shares of its own firm at $2.5 per share with cash. Received consigned goods from Bold Mountain Tech amounted to $85,000. 10 750 sport watches were sold to Fitch Sports Club (FSC) for $97,500, terms 2/10, n/30, FOB shipping point. The shipping charge for the sales is amounted to $535. The shipment was made on December 12, 2018 and expected to reach FSC in 3 calendar days. 11 Incurred machine repair expense for $1,380 on account. 12 Sold hiking apparel and boots to Mark Outdoor Training (MOT) in cash at a list price of $366,000. MOT is offered a trade discount of 10% and a cash discount of 2% on this transaction, FOB shipping point with related freight charges being $6,450. MOT received the goods 4 working days after. 13 The company sold its motor vehicle originally cost $180,000 for $7,500 cash. 15 Received a motor vehicle repair receipt of $10,300 for the repair made in October 2018 which was settled by cash. 16 Upon FSC's rounds of complaints on the quality issues on the watches they purchased, MAD management decided to grant FSC an allowance of $7,500 based on the original selling price. 17 Paid salary up to Dec 17, 2018 for $155,000. MAD Outdoors adopted a five-workday per week. Employees are paid every four weeks on the following Monday, based on the number of days they have worked in the last four weeks. Employees are entitled to full pay on public holidays but not on Saturday and Sunday. 17 Sold 50,000 treasury shares at $1.5 per share. 18 The Board of Directors declared 5% share dividend. Market price on the day is $1.8 per 18 share. Received payment on FSC on December's purchase. 19 A customer, Johnny Fitness (JF) is declared bankrupt. JF has an outstanding balance of $10,300 and the firm considered the entire amount being uncollectable. 20 21 Distributed share dividends to registered shareholders and paid previously declared dividend. Settle 225,000 account payable outstanding with Kumaloft Limited related purchases made on November 29. Terms being 2/10, n30, FOB shipping point. 22 23 Rented the unused portion of the office building to Blackrock Training Limited (BTL). The rental contract is for two years and starting from the beginning of next month. BTL has paid $240,000 in advance for the first 12 months of the rental. The board of directors declared a cash dividend on MAD's preference shares and $0.05 cash dividend on each ordinary shares. 28 Utilities expenses for December is amounted to $7,880 due in Jan 10, 2019. 31 Other information: The equipment has serviced 63,500 products for the month of December. 1. A physical inventory count on December 31 reveals the total inventory on hand being $740,000 (including supplies amounted to $25,000 and consigned goods being $45,000). 2. 3. The prepaid insurance provides insurance coverage over a 12-month period starting from Dec, 2018. Total weekly (5-work days) salary for the employees amounted to $48,000. No employee is absent for the month of December. 4. A further search reveals the following source documents which are not included on the transaction summary above: PURCHASE INVOICE Monsanto Equipment 18/F, Good Hope Centre, Mongkok, Kowloon MAD Outdoors Sold To: Date: 5 December 2018 8/F, Evergain Tower, Kwai Chy N.T. Hong Kong Terms: 1/30, n/60, Shipping (Freight $1,000) FOB Point charge: Unit Cost Quantity Description Amount 200.00 100 Climbing ropes (Mommat infinity) 20,000.00 Gas stove (ISG Windburner) 500.00 75 37,500.00 Total 57,500.00 Customer Copy Goods received: Dec 8, 2018 Paid: Dec 22, 2018 SALES INVOICE MAD OUTDOORS 8/F, Evergain Tower, Kwai Chung, N.T. Hong Kong Sold To: Fabulous Ventures Date: 3 December 2018 10/F, Chorpura Tower North Point, Hong Kong Payment Received: Dec 11, 2018 \Terms: 2/10, n/30, Destination (Freight charge: $1,500) FOB Quantity Item Unit Cost Amount Four Seasons Tent (EV330) 100 1500.00 150,000.00 50 Sleeping Bag (EV Touch) 500.00 25,000.00 Total 175,000.00 MERCHANT COPY Shipped: Dec 4, 2018 CREDIT MEMO Monsanto Equipment 18/F, Good Hope Centre, Mongkok, Kowloon Sold To: MAD Outdoors 9 December 2018 Date: 8/F, Evergain Tower, Kwai Chung N.T. Hong Kong Terms: 1/30, n/60 Quantity Description Unit Cost Amount 10 Climbing ropes (Mommat infinity) 200.00 2,000.00 Gas stove (ISG Windburner) 15 500.00 7,500.00 Total 9,500.00 Customer CopyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started