Answered step by step

Verified Expert Solution

Question

1 Approved Answer

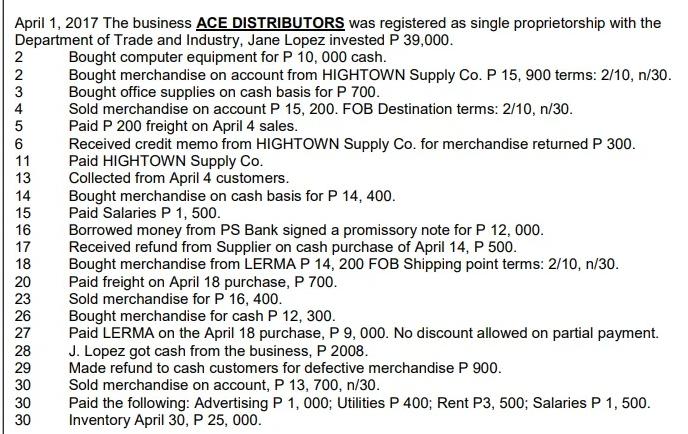

April 1, 2017 The business ACE DISTRIBUTORS was registered as single proprietorship with the Department of Trade and Industry, Jane Lopez invested P 39,000.

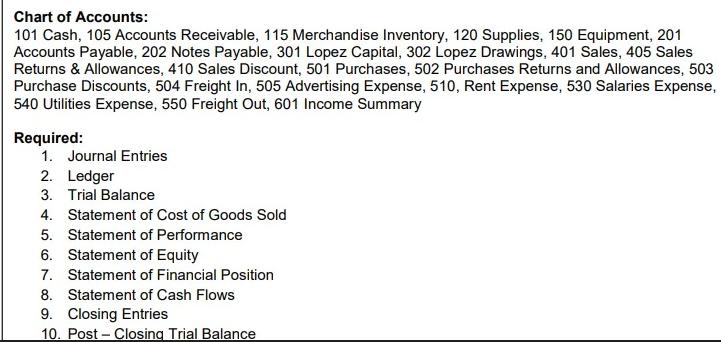

April 1, 2017 The business ACE DISTRIBUTORS was registered as single proprietorship with the Department of Trade and Industry, Jane Lopez invested P 39,000. 2 22 Bought computer equipment for P 10,000 cash. Bought merchandise on account from HIGHTOWN Supply Co. P 15, 900 terms: 2/10, n/30. Bought office supplies on cash basis for P 700. Received credit memo from HIGHTOWN Supply Co. for merchandise returned P 300. Paid HIGHTOWN Supply Co. Bought merchandise on cash basis for P 14, 400. 3 4 Sold merchandise on account P 15, 200. FOB Destination terms: 2/10, n/30. 5 Paid P 200 freight on April 4 sales. 6 11 13 Collected from April 4 customers. 14 15 16 17 18 20 23 26 27 28 29 30 30 30 Paid Salaries P 1, 500. Borrowed money from PS Bank signed a promissory note for P 12, 000. Received refund from Supplier on cash purchase of April 14, P 500. Bought merchandise from LERMA P 14, 200 FOB Shipping point terms: 2/10, n/30. Paid freight on April 18 purchase, P 700. Sold merchandise for P 16, 400. Bought merchandise for cash P 12, 300. Paid LERMA on the April 18 purchase, P 9, 000. No discount allowed on partial payment. J. Lopez got cash from the business, P 2008. Made refund to cash customers for defective merchandise P 900. Sold merchandise on account, P 13, 700, n/30. Paid the following: Advertising P 1, 000; Utilities P 400; Rent P3, 500; Salaries P 1, 500. Inventory April 30, P 25,000. Chart of Accounts: 101 Cash, 105 Accounts Receivable, 115 Merchandise Inventory, 120 Supplies, 150 Equipment, 201 Accounts Payable, 202 Notes Payable, 301 Lopez Capital, 302 Lopez Drawings, 401 Sales, 405 Sales Returns & Allowances, 410 Sales Discount, 501 Purchases, 502 Purchases Returns and Allowances, 503 Purchase Discounts, 504 Freight In, 505 Advertising Expense, 510, Rent Expense, 530 Salaries Expense, 540 Utilities Expense, 550 Freight Out, 601 Income Summary Required: 1. Journal Entries 2. Ledger 3. Trial Balance 4. Statement of Cost of Goods Sold 5. Statement of Performance 6. Statement of Equity 7. Statement of Financial Position 8. Statement of Cash Flows 9. Closing Entries 10. Post-Closing Trial Balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

ACE DISTRIBUTORS Journal Entries Date Explanation DR Account CR Account Apr 1 Capital Investment Lopez Jane LJ 39000 Lopez Jane LJ 39000 Apr 2 Equipment 10000 Cash 10000 Apr 2 Purchase HIGHTOWN Supply ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started