Question

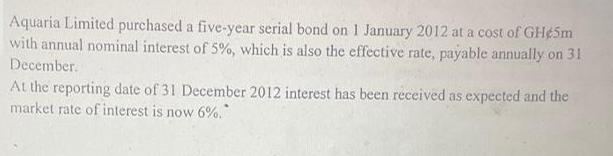

Aquaria Limited purchased a five-year serial bond on 1 January 2012 at a cost of GH*5m with annual nominal interest of 5%, which is

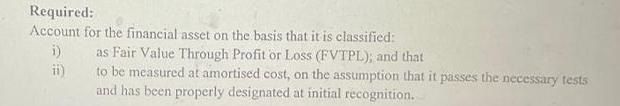

Aquaria Limited purchased a five-year serial bond on 1 January 2012 at a cost of GH*5m with annual nominal interest of 5%, which is also the effective rate, payable annually on 31 December. At the reporting date of 31 December 2012 interest has been received as expected and the market rate of interest is now 6%. Required: Account for the financial asset on the basis that it is classified: i) as Fair Value Through Profit or Loss (FVTPL); and that ii) to be measured at amortised cost, on the assumption that it passes the necessary tests and has been properly designated at initial recognition.

Step by Step Solution

3.34 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Face value 5 million Coupon rate 5 5000000 x 005 2500...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial and Managerial Accounting the basis for business decisions

Authors: Jan Williams, Susan Haka, Mark Bettner, Joseph Carcello

16th edition

0077664078, 978-0077664077, 78111048, 978-0078111044

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App