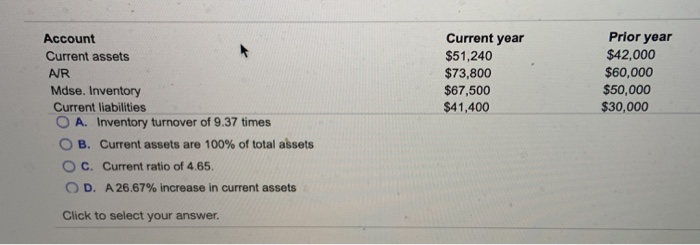

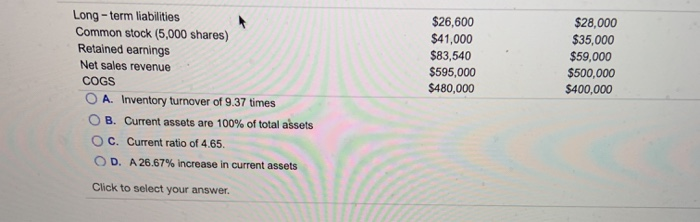

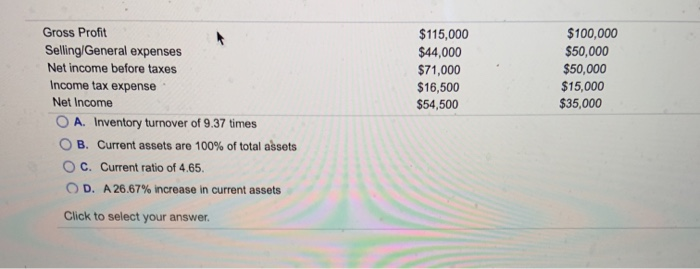

AR A. Inventory turnover of 9.37 times B. Current assets are 100% of total assets C. Current ratio of 4.65. OD. A 26.67% increase in current assets Current year $51,240 $73,800 $67,500 $41,400 Account Current assets AR Mdse. Inventory Current liabilities O A. Inventory turnover of 9.37 times B. Current assets are 100% of total assets c. Current ratio of 4.65. OD. A 26.67% increase in current assets Prior year $42,000 $60,000 $50,000 $30,000 Click to select your answer. Long-term liabilities Common stock (5,000 shares) Retained earnings Net sales revenue COGS A. Inventory turnover of 9.37 times B. Current assets are 100% of total assets C. Current ratio of 4.65 D. A 26.67% increase in current assets $26,600 $41,000 $83,540 $595,000 $480,000 $28,000 $35,000 $59,000 $500,000 $400,000 Click to select your answer. $115,000 $44,000 $71,000 $16,500 $54,500 $100,000 $50,000 $50,000 $15,000 $35,000 Gross Profit Selling/General expenses Net income before taxes Income tax expense Net Income O A. Inventory turnover of 9.37 times B. Current assets are 100% of total assets OC. Current ratio of 4.65. OD. A 26.67% increase in current assets Click to select your answer. Net Income $54,500 What would a horizontal analysis report with respect to current assets show? AR A. Inventory turnover of 9.37 times B. Current assets are 100% of total assets C. Current ratio of 4.65. OD. A 26.67% increase in current assets Current year $51,240 $73,800 $67,500 $41,400 Account Current assets AR Mdse. Inventory Current liabilities O A. Inventory turnover of 9.37 times B. Current assets are 100% of total assets c. Current ratio of 4.65. OD. A 26.67% increase in current assets Prior year $42,000 $60,000 $50,000 $30,000 Click to select your answer. Long-term liabilities Common stock (5,000 shares) Retained earnings Net sales revenue COGS A. Inventory turnover of 9.37 times B. Current assets are 100% of total assets C. Current ratio of 4.65 D. A 26.67% increase in current assets $26,600 $41,000 $83,540 $595,000 $480,000 $28,000 $35,000 $59,000 $500,000 $400,000 Click to select your answer. $115,000 $44,000 $71,000 $16,500 $54,500 $100,000 $50,000 $50,000 $15,000 $35,000 Gross Profit Selling/General expenses Net income before taxes Income tax expense Net Income O A. Inventory turnover of 9.37 times B. Current assets are 100% of total assets OC. Current ratio of 4.65. OD. A 26.67% increase in current assets Click to select your answer. Net Income $54,500 What would a horizontal analysis report with respect to current assets show