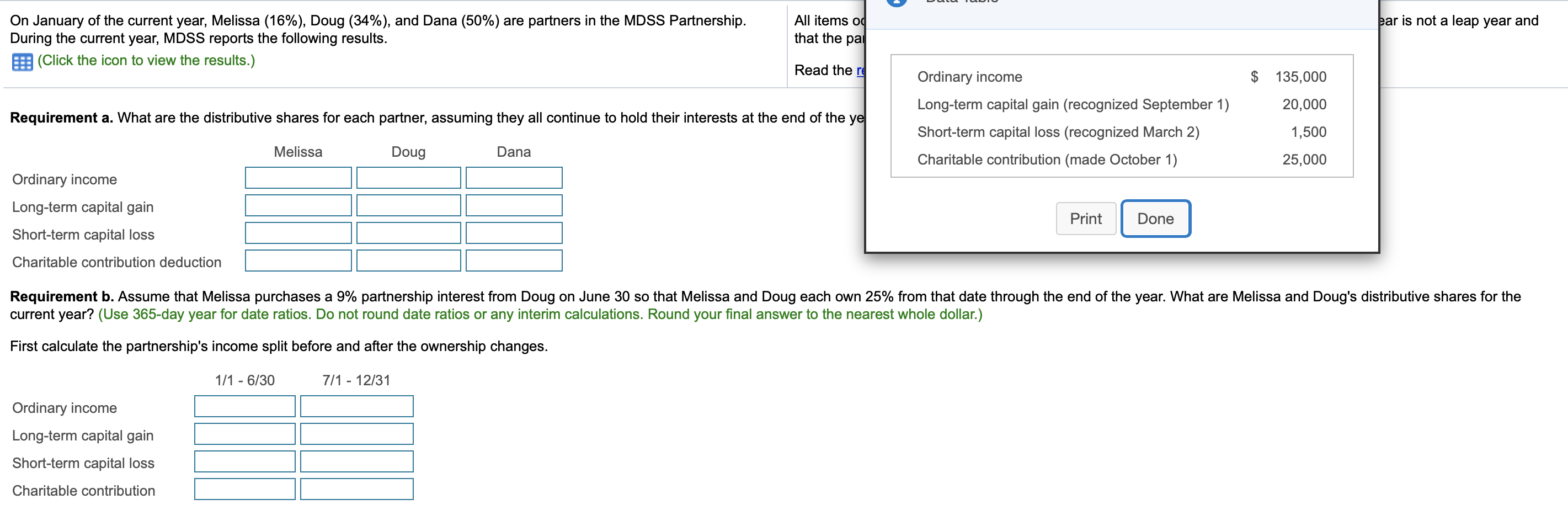

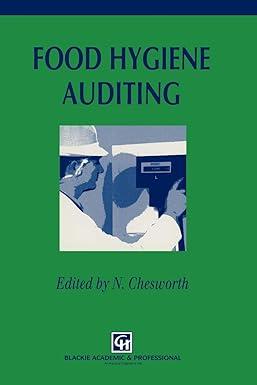

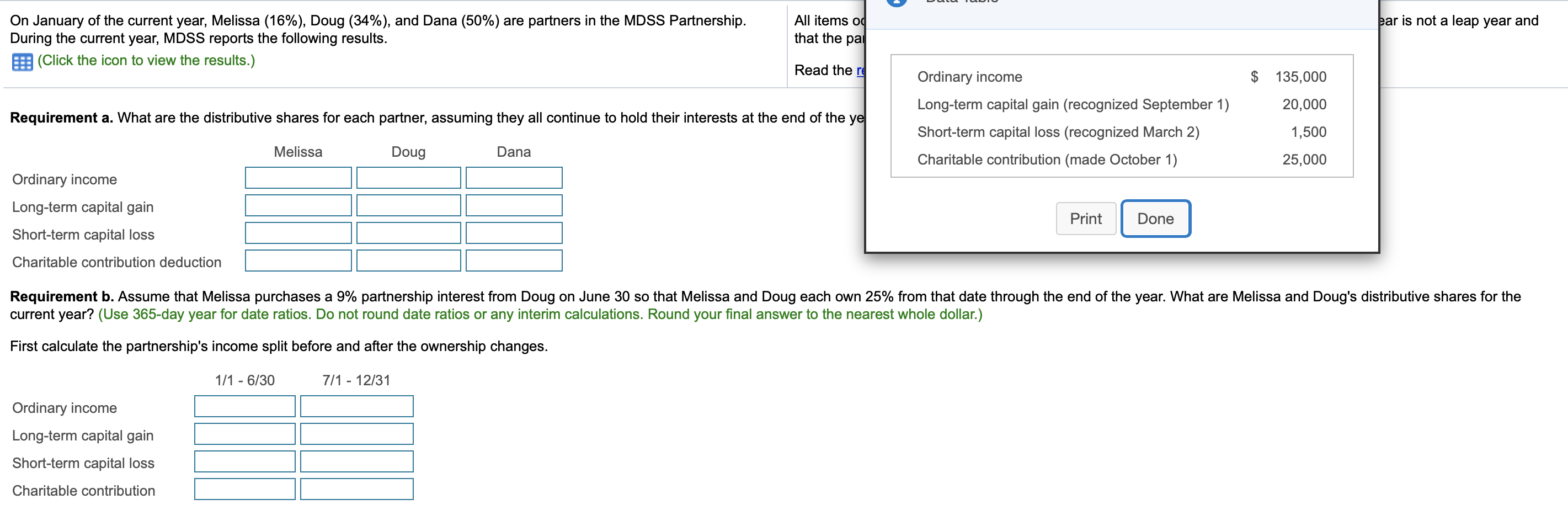

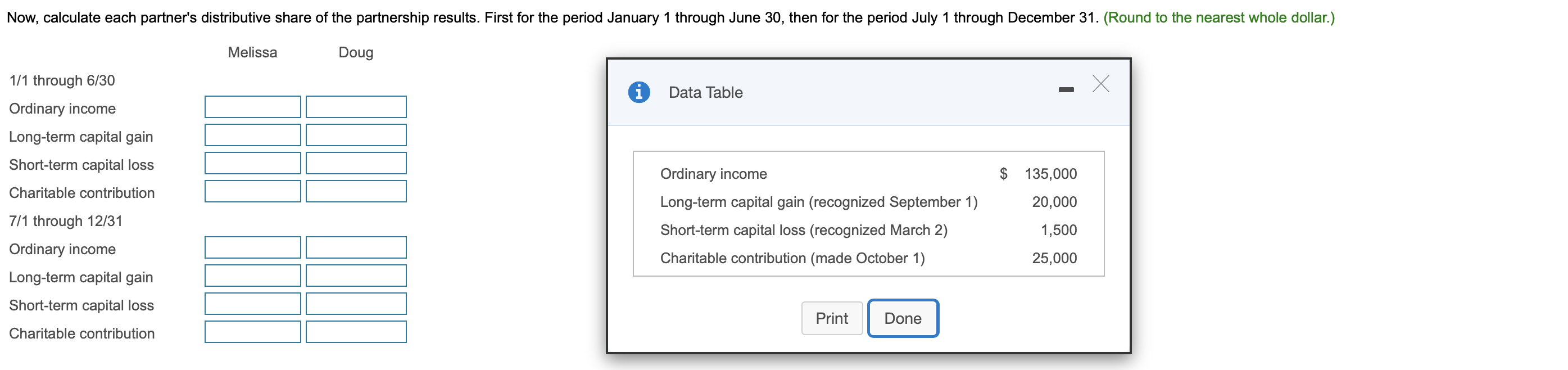

ar is not a leap year and On January of the current year, Melissa (16%), Doug (34%), and Dana (50%) are partners in the MDSS Partnership. During the current year, MDSS reports the following results. (Click the icon to view the results.) All items od that the pai Read the re Ordinary income $ 135,000 20,000 Requirement a. What are the distributive shares for each partner, assuming they all continue to hold their interests at the end of the ye Long-term capital gain (recognized September 1) Short-term capital loss (recognized March 2) Charitable contribution (made October 1) 1,500 Melissa Doug Dana 25,000 Ordinary income Long-term capital gain Print Done Short-term capital loss Charitable contribution deduction Requirement b. Assume that Melissa purchases a 9% partnership interest from Doug on June 30 so that Melissa and Doug each own 25% from that date through the end of the year. What are Melissa and Doug's distributive shares for the current year? (Use 365-day year for date ratios. Do not round date ratios or any interim calculations. Round your final answer to the nearest whole dollar.) First calculate the partnership's income split before and after the ownership changes. 1/1 - 6/30 7/1 - 12/31 Ordinary income Long-term capital gain Short-term capital loss Charitable contribution Now, calculate each partner's distributive share of the partnership results. First for the period January 1 through June 30, then for the period July 1 through December 31. (Round to the nearest whole dollar.) Melissa Doug 1/1 through 6/30 Ordinary income i Data Table Long-term capital gain Short-term capital loss $ 135,000 Charitable contribution 20,000 Ordinary income Long-term capital gain (recognized September 1) Short-term capital loss (recognized March 2) Charitable contribution (made October 1) 7/1 through 12/31 Ordinary income Long-term capital gain 1,500 25,000 Short-term capital loss Print Done Charitable contribution ar is not a leap year and On January of the current year, Melissa (16%), Doug (34%), and Dana (50%) are partners in the MDSS Partnership. During the current year, MDSS reports the following results. (Click the icon to view the results.) All items od that the pai Read the re Ordinary income $ 135,000 20,000 Requirement a. What are the distributive shares for each partner, assuming they all continue to hold their interests at the end of the ye Long-term capital gain (recognized September 1) Short-term capital loss (recognized March 2) Charitable contribution (made October 1) 1,500 Melissa Doug Dana 25,000 Ordinary income Long-term capital gain Print Done Short-term capital loss Charitable contribution deduction Requirement b. Assume that Melissa purchases a 9% partnership interest from Doug on June 30 so that Melissa and Doug each own 25% from that date through the end of the year. What are Melissa and Doug's distributive shares for the current year? (Use 365-day year for date ratios. Do not round date ratios or any interim calculations. Round your final answer to the nearest whole dollar.) First calculate the partnership's income split before and after the ownership changes. 1/1 - 6/30 7/1 - 12/31 Ordinary income Long-term capital gain Short-term capital loss Charitable contribution Now, calculate each partner's distributive share of the partnership results. First for the period January 1 through June 30, then for the period July 1 through December 31. (Round to the nearest whole dollar.) Melissa Doug 1/1 through 6/30 Ordinary income i Data Table Long-term capital gain Short-term capital loss $ 135,000 Charitable contribution 20,000 Ordinary income Long-term capital gain (recognized September 1) Short-term capital loss (recognized March 2) Charitable contribution (made October 1) 7/1 through 12/31 Ordinary income Long-term capital gain 1,500 25,000 Short-term capital loss Print Done Charitable contribution