Answered step by step

Verified Expert Solution

Question

1 Approved Answer

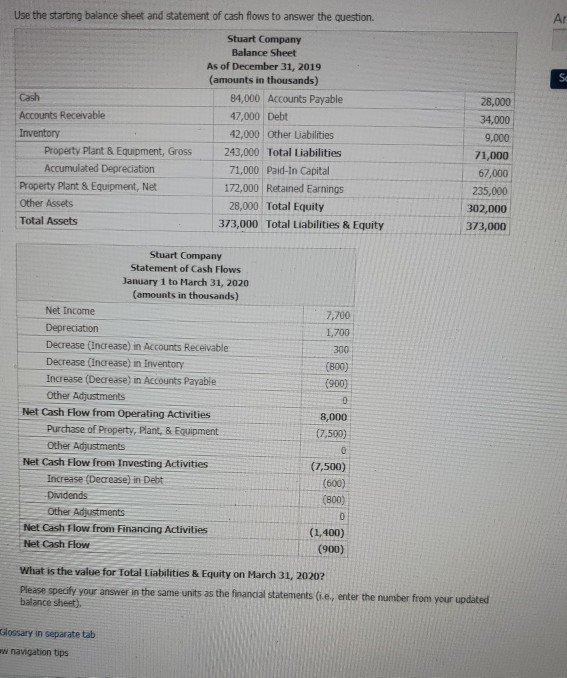

Ar So Use the starting balance sheet and statement of cash flows to answer the question. Stuart Company Balance Sheet As of December 31, 2019

Ar So Use the starting balance sheet and statement of cash flows to answer the question. Stuart Company Balance Sheet As of December 31, 2019 (amounts in thousands) Cash 84,000 Accounts Payable Accounts Receivable 47,000 Debt Inventory 42,000 Other Liabilities Property Plant & Equipment, Gross 243,000 Total Liabilities Accumulated Depreciation 71,000 Paid In Capital Property Plant & Equipment, Net 172,000 Retained Earnings Other Assets 28,000 Total Equity Total Assets 373,000 Total Liabilities & Equity 28,000 34,000 9,000 71,000 67,000 235,000 302,000 373,000 Stuart Company Statement of Cash Flows January 1 to March 31, 2020 (amounts in thousands) Net Income Depreciation Decrease (Increase) in Accounts Receivable Decrease (increase) in Inventory Increase (Decrease) in Accounts Payable Other Adjustments Net Cash Flow from Operating Activities Purchase of Property, plant, & Equipment Other Adjustments Net Cash Flow from Investing Activities Increase (Decrease) in Debt Dividends Other Adjustments Net Cash Flow from Financing Activities Net Cash Flow 7,700 1,700 300 (800) (900) 0 8,000 (7,500) 0 (7,500) (600) (800) 0 (1,400) (900) What is the value for Total Liabilities & Equity on March 31, 2020? Please specify your answer in the same units as the financial statements (ie., enter the number from your updated balance sheet), Glossary in separate tab w navigation tips

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started