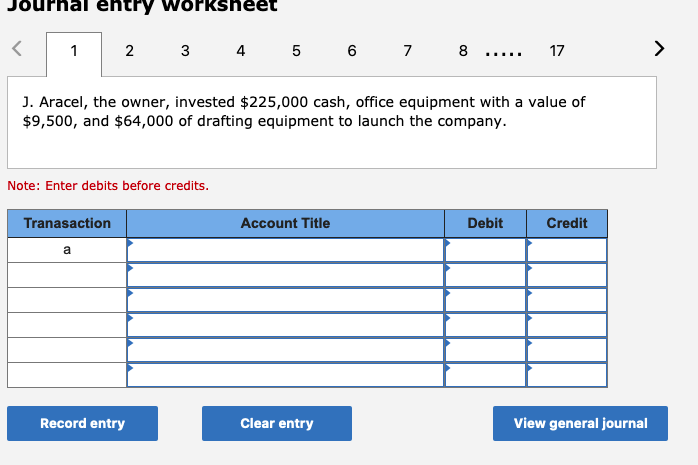

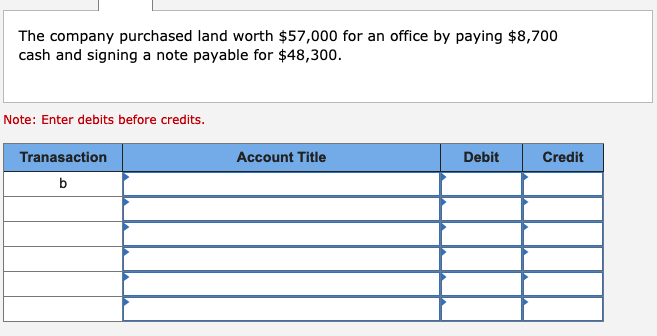

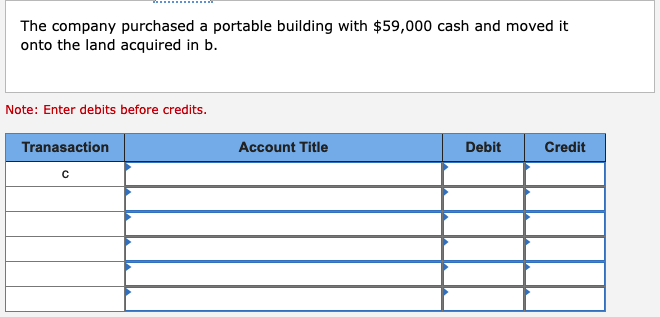

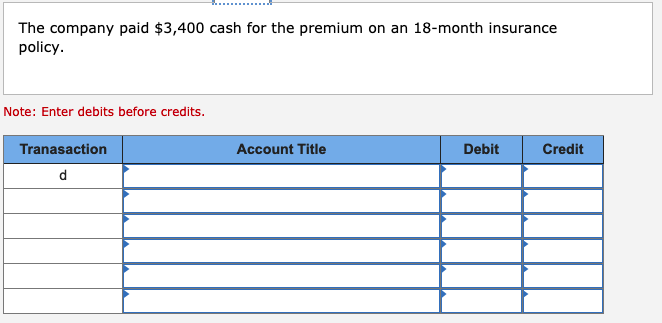

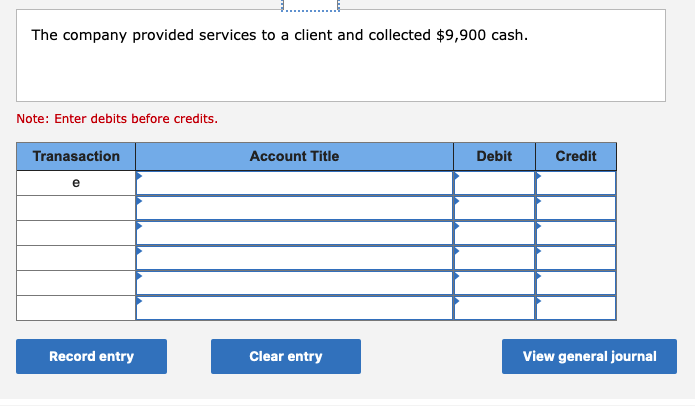

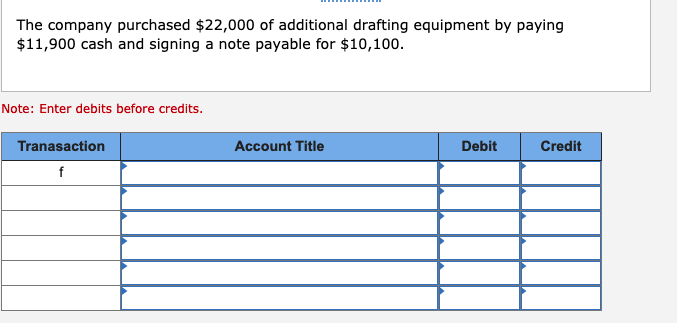

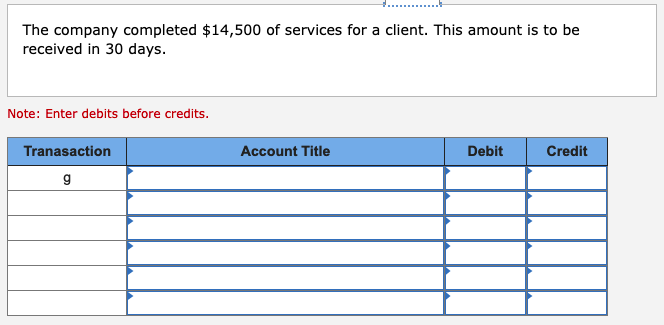

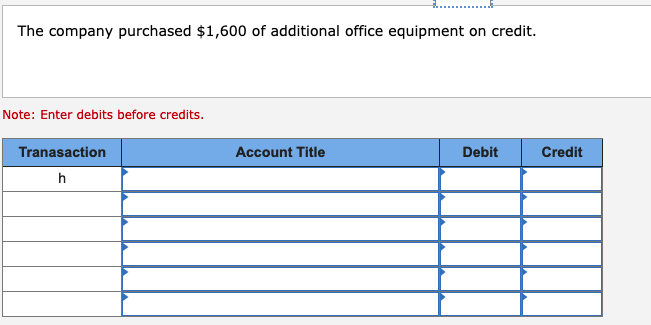

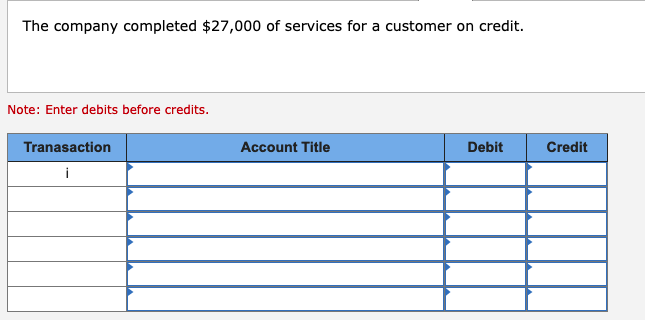

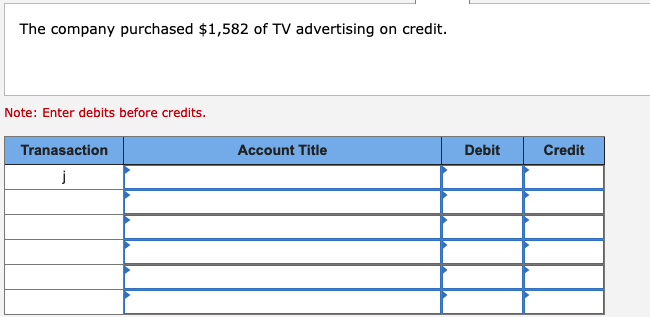

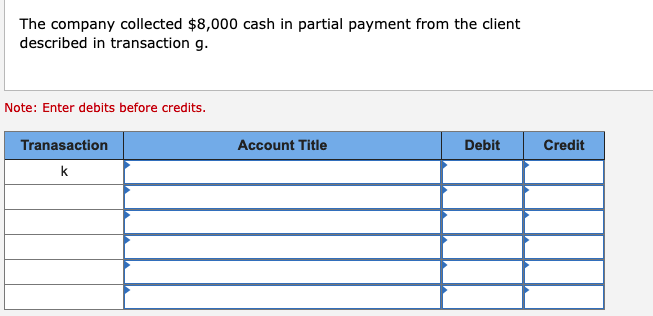

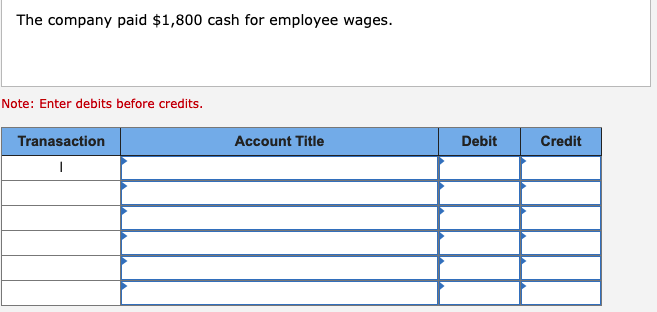

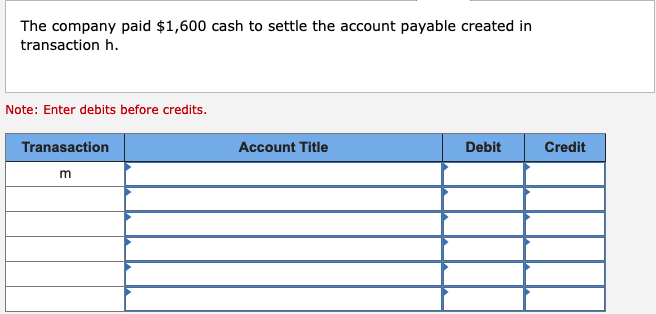

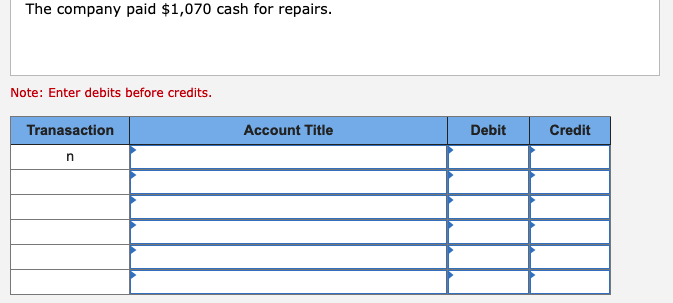

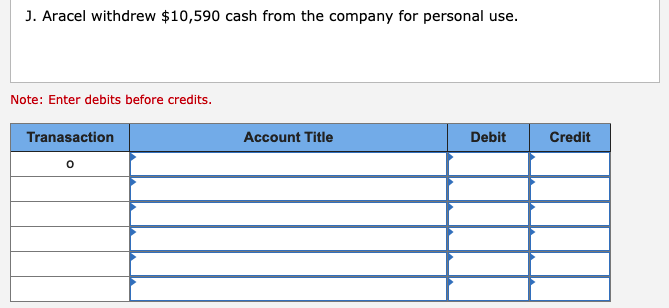

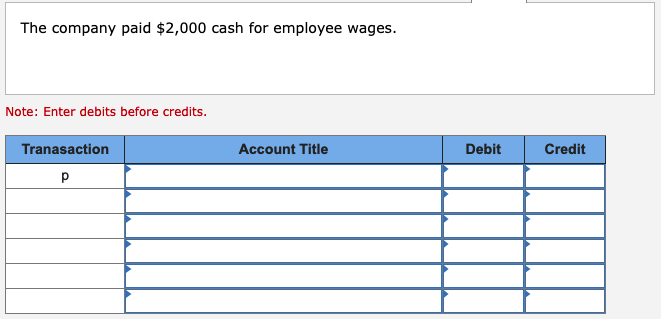

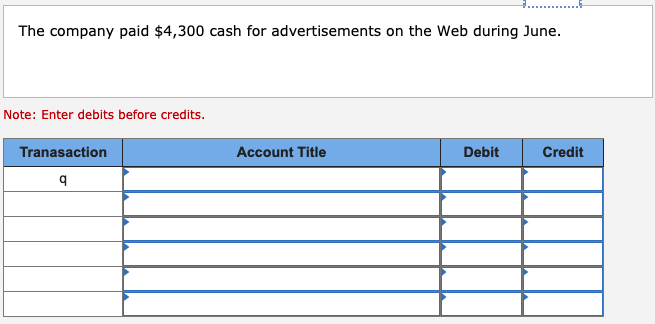

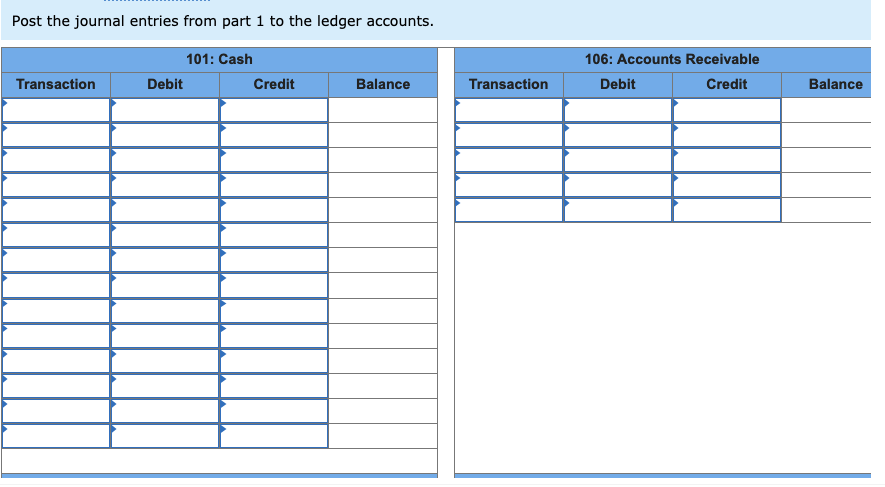

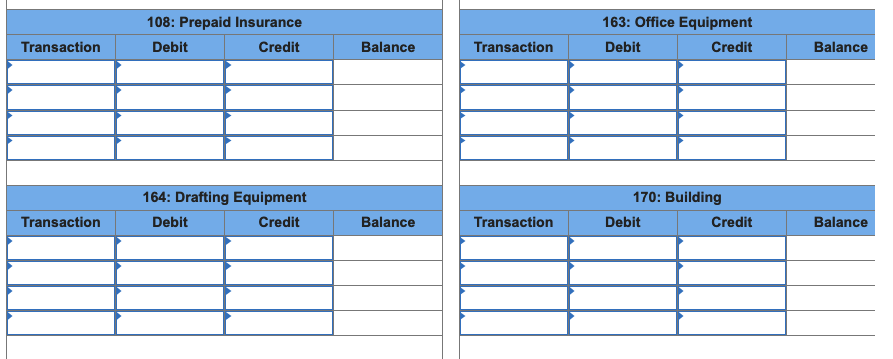

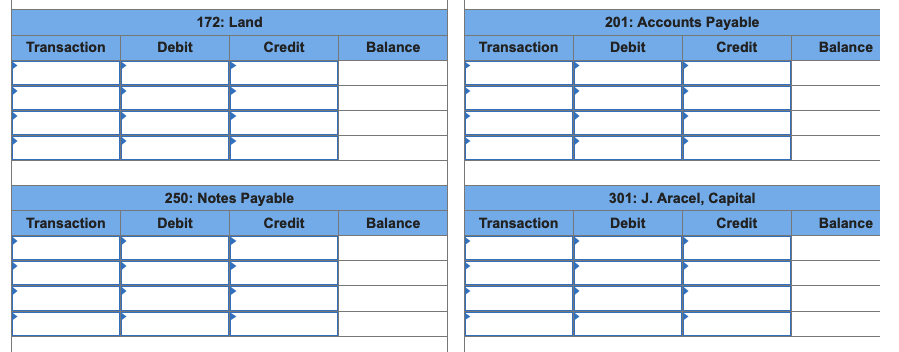

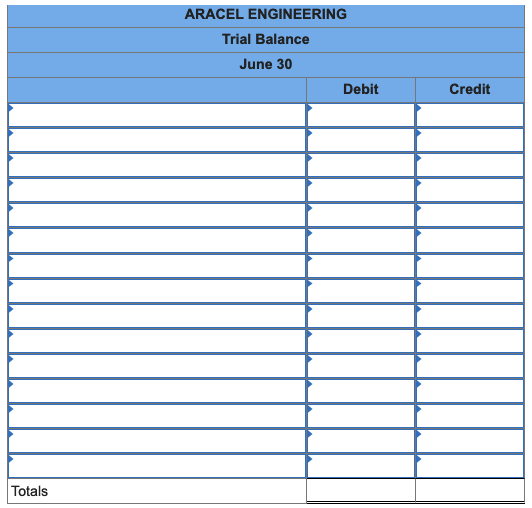

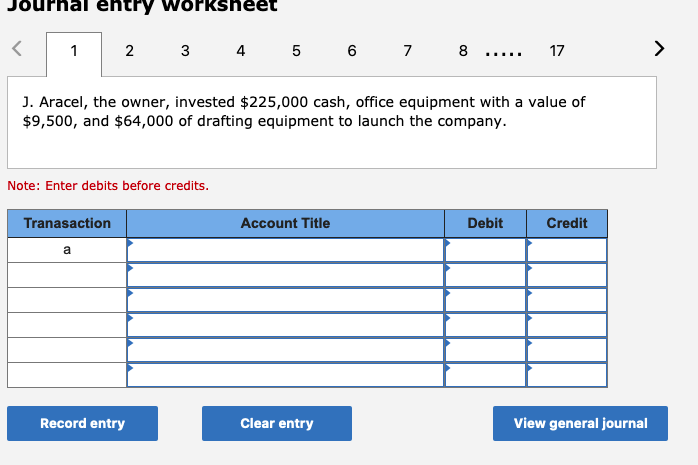

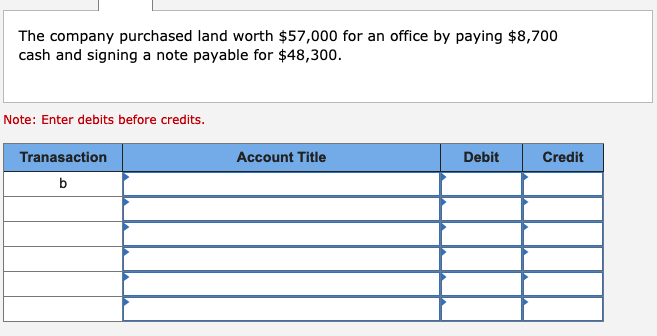

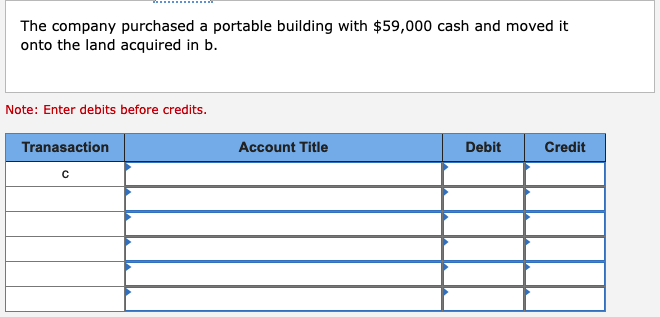

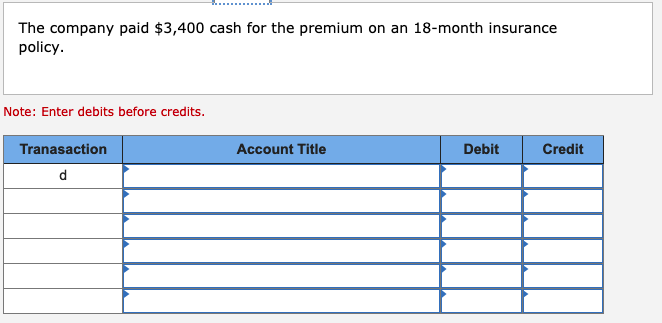

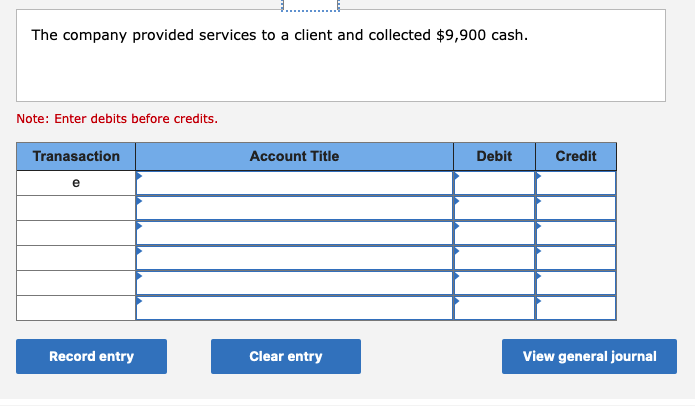

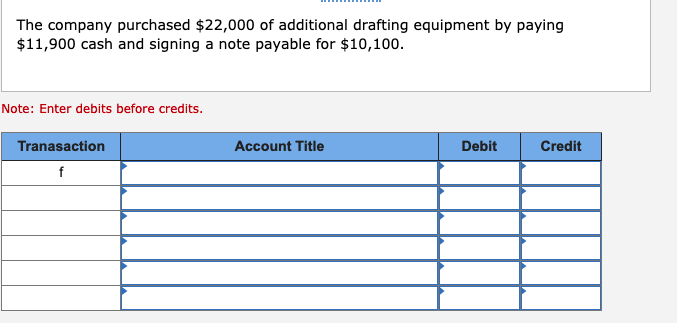

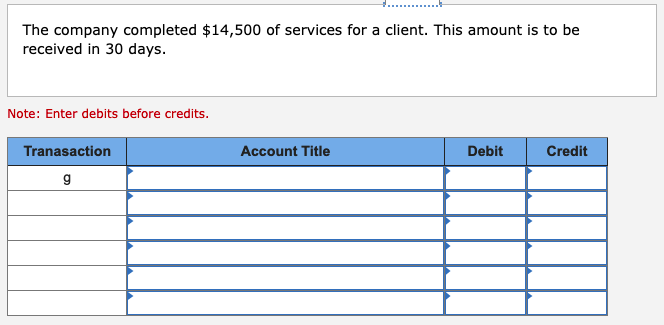

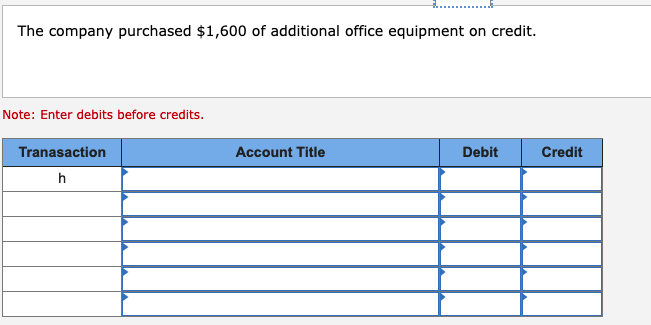

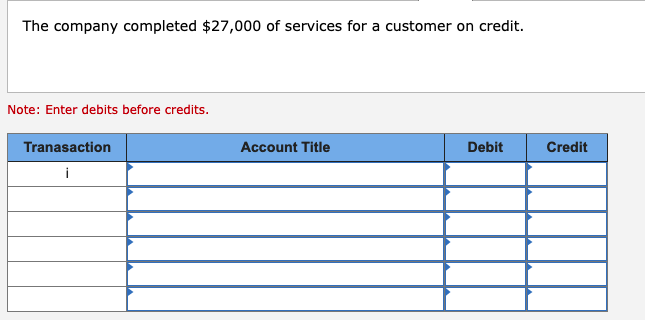

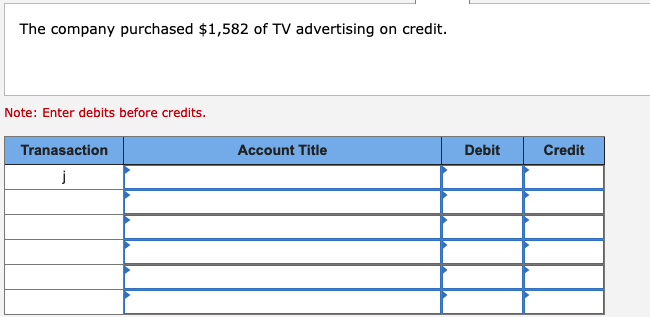

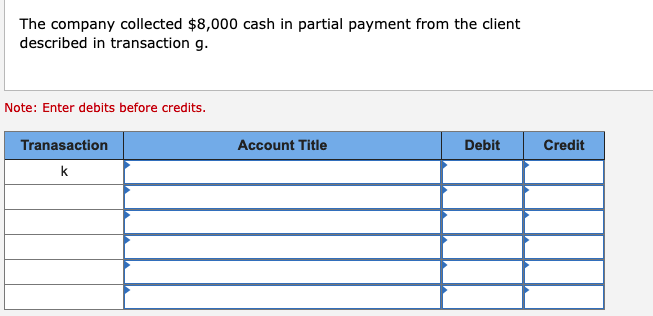

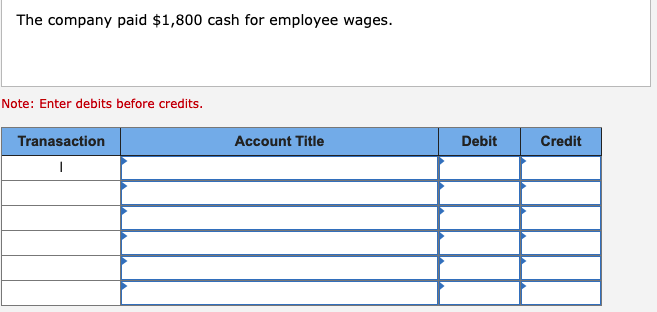

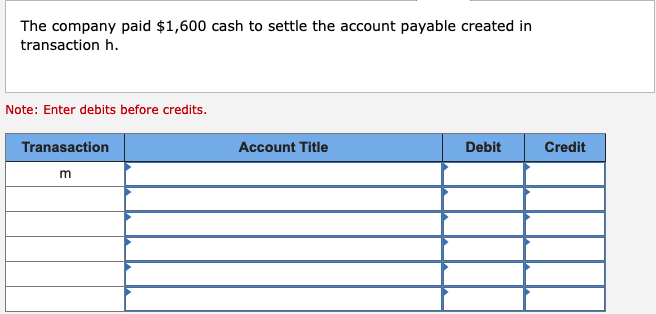

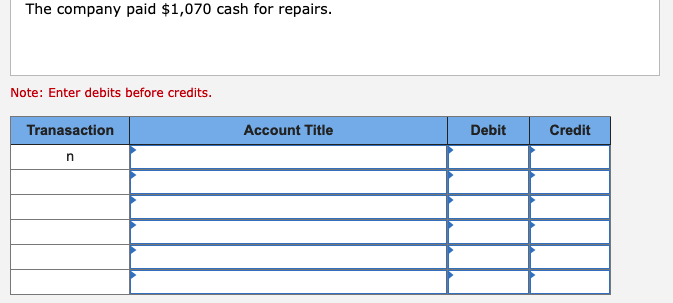

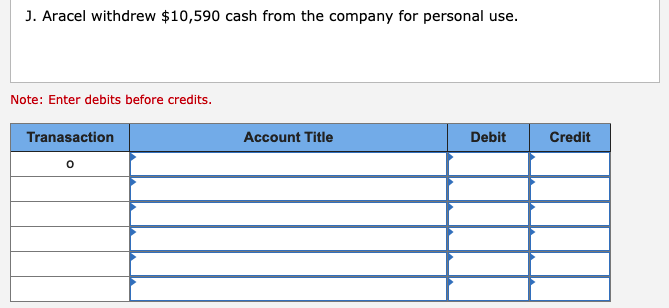

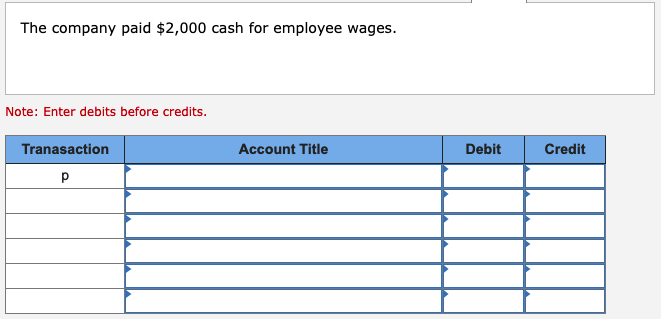

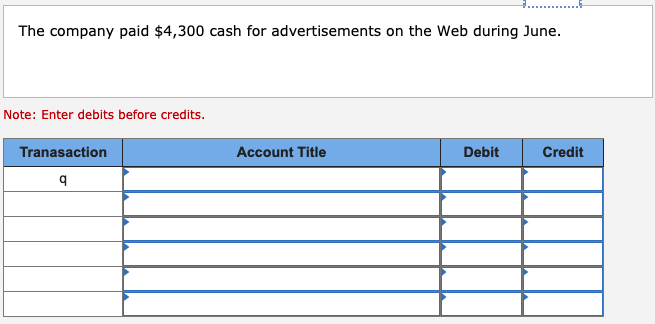

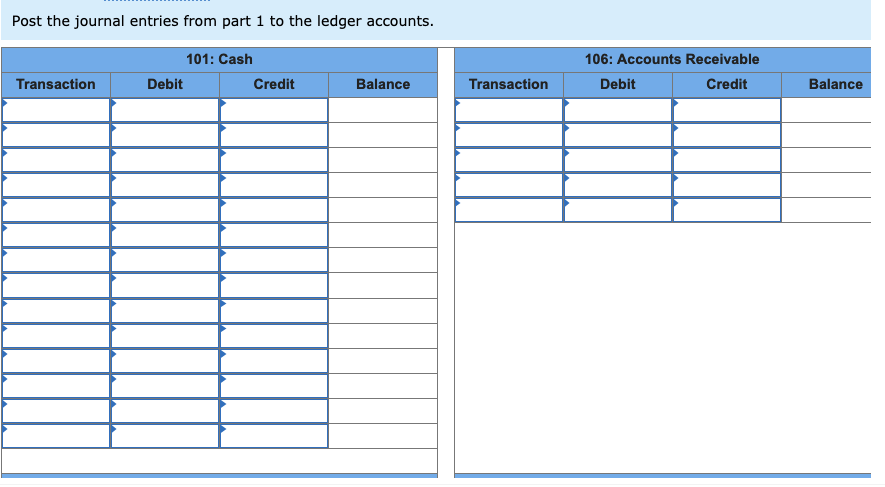

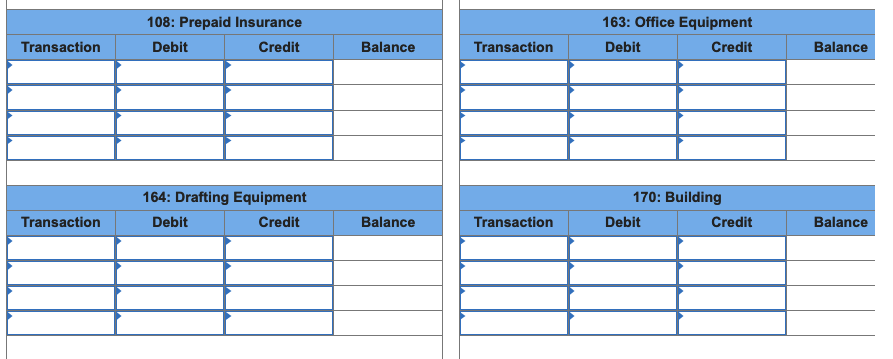

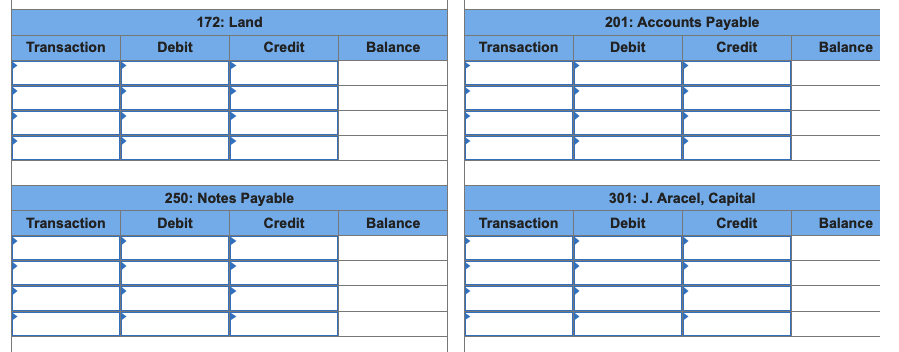

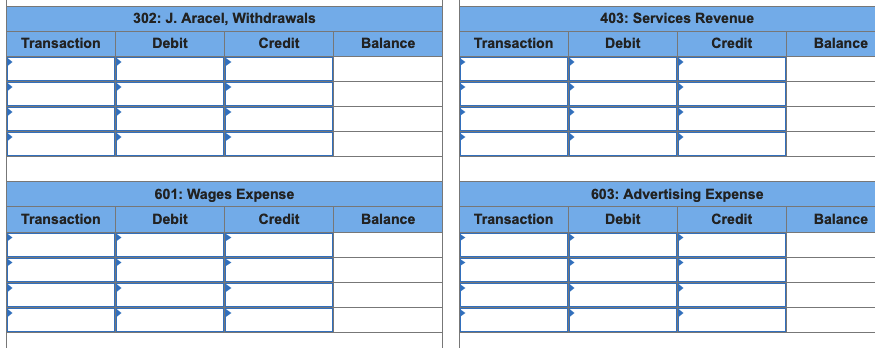

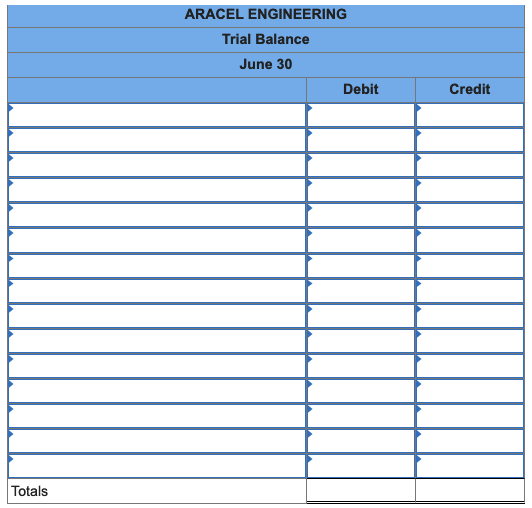

Aracel Engineering completed the following transactions in the month of June. J. Aracel, the owner, invested $225,000 cash, office equipment with a value of $9,500, and $64,000 of drafting equipment to launch the company. The company purchased land worth $57,000 for an office by paying $8,700 cash and signing a note payable for $48,300. The company purchased a portable building with $59,000 cash and moved it onto the land acquired in b. The company paid $3,400 cash for the premium on an 18-month insurance policy. The company provided services to a client and collected $9,900 cash. The company purchased $22,000 of additional drafting equipment by paying $11,900 cash and signing a note payable for $10,100. The company completed $14,500 of services for a client. This amount is to be received in 30 days. The company purchased $1,600 of additional office equipment on credit. The company completed $27,000 of services for a customer on credit. The company purchased $1,582 of TV advertising on credit. The company collected $8,000 cash in partial payment from the client described in transaction g. The company paid $1,800 cash for employee wages. The company paid $1,600 cash to settle the account payable created in transaction h. The company paid $1,070 cash for repairs. J. Aracel withdrew $10,590 cash from the company for personal use. The company paid $2,000 cash for employee wages. The company paid $4,300 cash for advertisements on the Web during June. Required: 1. Prepare general journal entries to record these transactions using the following titles: Cash (101); Accounts Receivable (106); Prepaid Insurance (108); Office Equipment (163); Drafting Equipment (164); Building (170); Land (172); Accounts Payable (201); Notes Payable (250); J. Aracel, Capital (301); J. Aracel, Withdrawals (302); Services Revenue (403); Wages Expense (601); Advertising Expense (603); and Repairs Expense (604). 2. Post the journal entries from part 1 to the ledger accounts. 3. Prepare a trial balance as of the end of June.

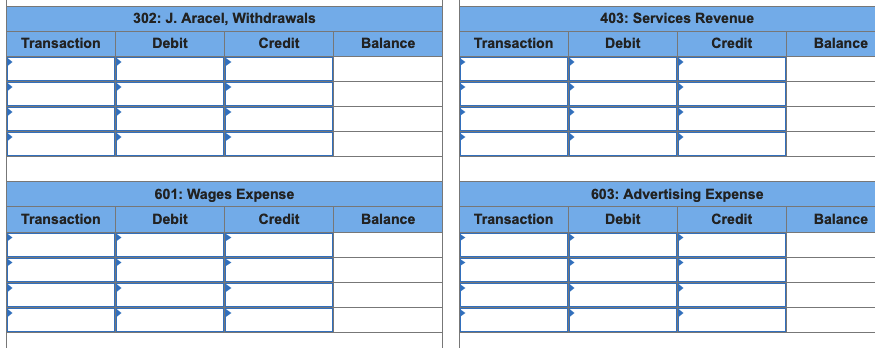

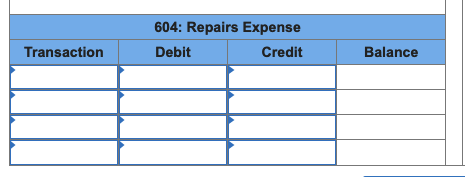

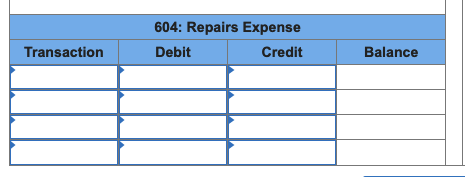

J. Aracel, the owner, invested $225,000 cash, office equipment with a value of $9,500, and $64,000 of drafting equipment to launch the company. Note: Enter debits before credits. The company purchased land worth $57,000 for an office by paying $8,700 cash and signing a note payable for $48,300. Note: Enter debits before credits. The company purchased a portable building with $59,000 cash and moved it onto the land acquired in b. Note: Enter debits before credits. The company paid $3,400 cash for the premium on an 18 -month insurance policy. Note: Enter debits before credits. The company provided services to a client and collected $9,900 cash. Note: Enter debits before credits. The company purchased $22,000 of additional drafting equipment by paying $11,900 cash and signing a note payable for $10,100. Note: Enter debits before credits. The company completed $14,500 of services for a client. This amount is to be received in 30 days. Note: Enter debits before credits. The company purchased $1,600 of additional office equipment on credit. Note: Enter debits before credits. The company completed $27,000 of services for a customer on credit. Note: Enter debits before credits. The company purchased $1,582 of TV advertising on credit. Note: Enter debits before credits. The company collected $8,000 cash in partial payment from the client described in transaction g. Note: Enter debits before credits. The company paid $1,800 cash for employee wages. Note: Enter debits before credits. The company paid $1,600 cash to settle the account payable created in transaction h. Note: Enter debits before credits. The company paid $1,070 cash for repairs. Note: Enter debits before credits. J. Aracel withdrew $10,590 cash from the company for personal use. Note: Enter debits before credits. The company paid $2,000 cash for employee wages. Note: Enter debits before credits. The company paid $4,300 cash for advertisements on the Web during June. Note: Enter debits before credits. Post the journal entries from part 1 to the ledger accounts. \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ 108: Prepaid Insurance } \\ \hline Transaction & Debit & Credit & Balance \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l} \hline \multicolumn{3}{c|}{ 163: Office Equipment } \\ \hline Transaction & Debit & \multicolumn{1}{c}{ Credit } & Balance \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline Transaction & Debit & Credit & Balance \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline \multicolumn{3}{|c|}{ 172: Land } \\ \hline Transaction & Debit & Credit & Balance \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c} \hline \multicolumn{4}{c|}{ 201: Accounts Payable } \\ \hline Transaction & Debit & Credit & Balance \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ 604: Repairs Expense } \\ \hline Transaction & Debit & \multicolumn{1}{c|}{ Credit } & Balance \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular}