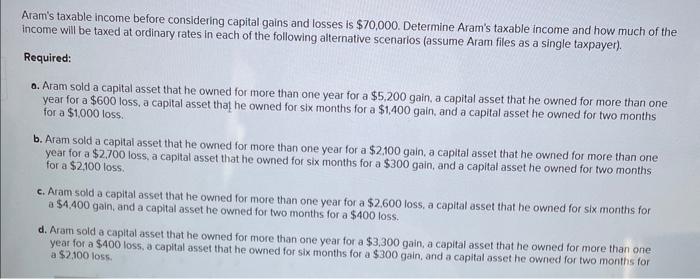

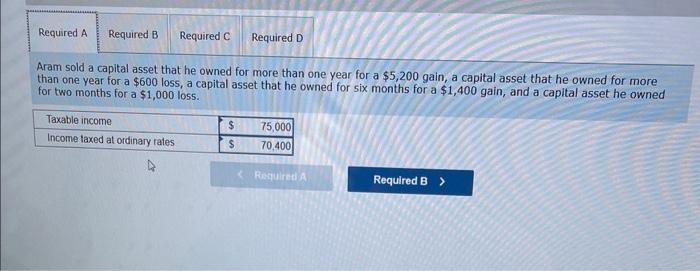

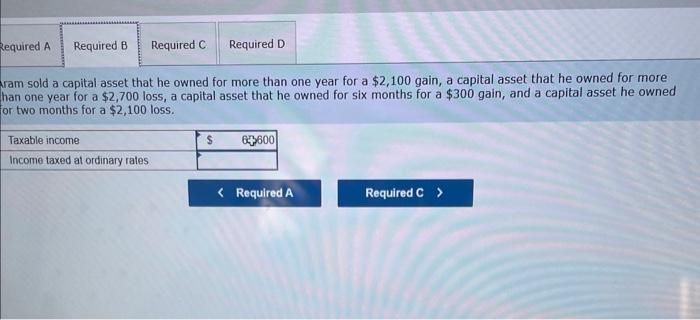

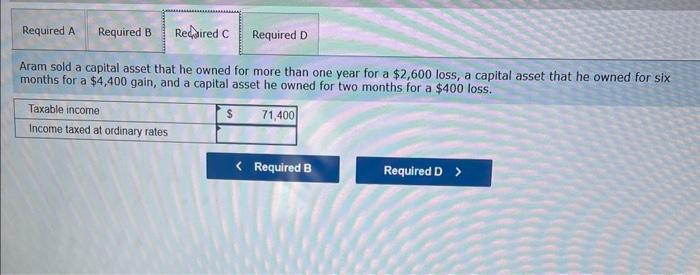

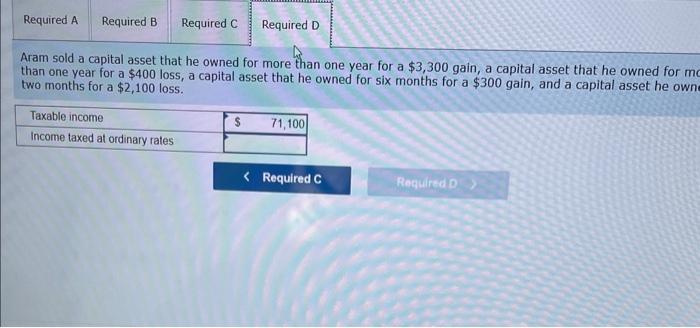

Aram's taxable income before considering capital gains and losses is $70,000. Determine Aram's taxable income and how much of the income will be taxed at ordinary rates in each of the following alternative scenarios (assume Aram files as a single taxpayer). Required: 0. Aram sold a capital asset that he owned for more than one year for a $5,200 gain, a capital asset that he owned for more than one year for a $600 loss, a capital asset that he owned for six months for a $1,400gain, and a capital asset he owned for two months for a $1.000 loss. b. Aram sold a capital asset that he owned for more than one year for a $2.100gain, a capital asset that he owned for more than one year for a $2.700 loss. a capital asset that he owned for six months for a $300gain, and a capital asset he owned for two months for a $2,100 loss. c. Aram sold a capital asset that he owned for more than one year for a $2.600 loss, a capital asset that he owned for six months for a $4,400 gain, and a capital asset he owned for two months for a $400 loss. d. Aram sold a capltal asset that he owned for more than one year for a $3,300 gain, a capital asset that he owned for more than one yeat for a \$400 loss, a capital asset that he owned for six months for a $300 gain, and a capital asset he owned for two months for Aram sold a capital asset that he owned for more than one year for a $5,200 gain, a capital asset that he owned for more than one year for a $600 loss, a capital asset that he owned for six months for a $1,400 gain, and a capital asset he owned for two months for a $1,000 loss. ram sold a capital asset that he owned for more than one year for a $2,100 gain, a capital asset that he owned for more han one year for a $2,700 loss, a capital asset that he owned for six months for a $300 gain, and a capital asset he owned or two months for a $2,100 loss. Aram sold a capital asset that he owned for more than one year for a $2,600 loss, a capital asset that he owned for six months for a $4,400 gain, and a capital asset he owned for two months for a $400 loss. Aram sold a capital asset that he owned for more than one year for a $3,300gain, a capital asset that he owned for me than one year for a $400 loss, a capital asset that he owned for six months for a $300 gain, and a capital asset he own two months for a $2,100 loss