Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Arbitrage Free Valuation or the Law of One Price: On February 1 5 , 2 0 0 8 , traders could buy and sell two

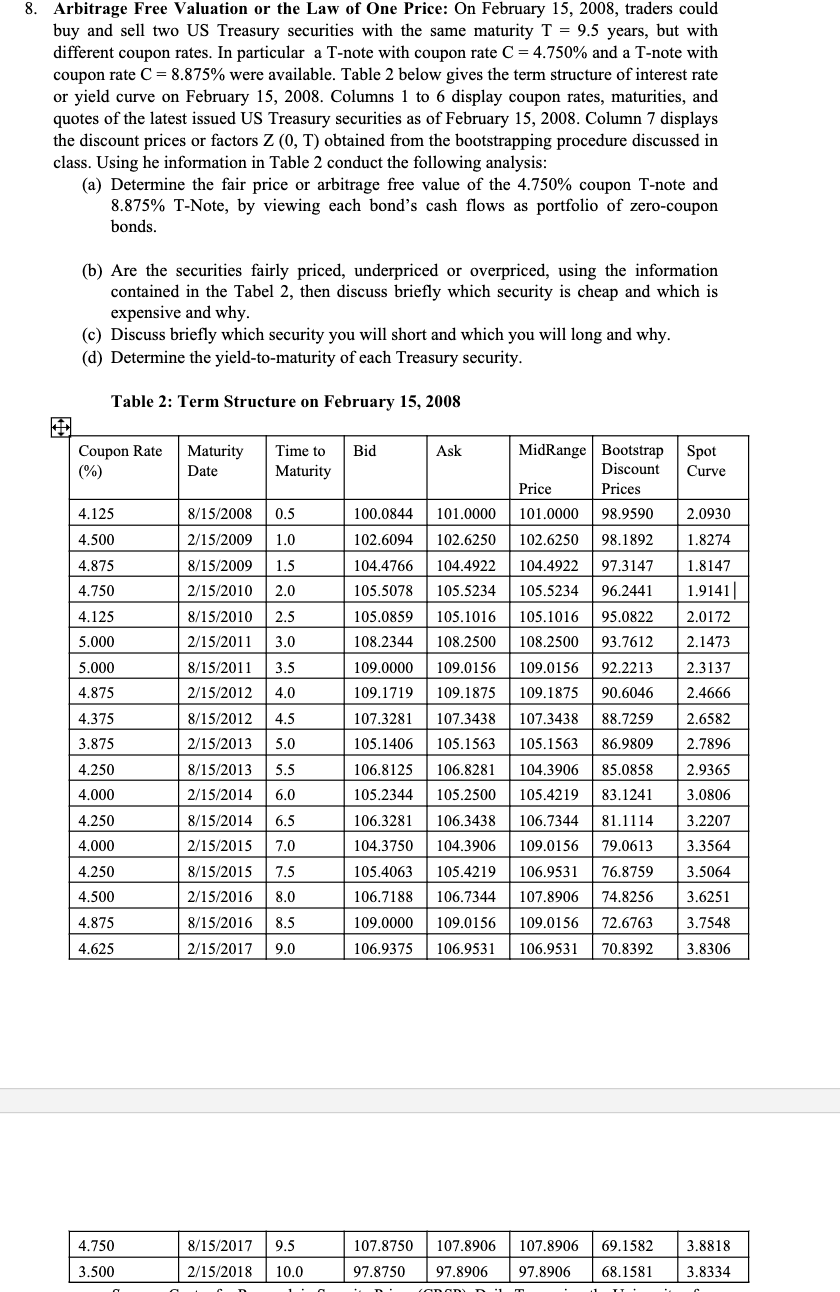

Arbitrage Free Valuation or the Law of One Price: On February traders could buy and sell two US Treasury securities with the same maturity years, but with different coupon rates. In particular a Tnote with coupon rate and a Tnote with coupon rate were available. Table below gives the term structure of interest rate or yield curve on February Columns to display coupon rates, maturities, and quotes of the latest issued US Treasury securities as of February Column displays the discount prices or factors obtained from the bootstrapping procedure discussed in class. Using he information in Table conduct the following analysis:

a Determine the fair price or arbitrage free value of the coupon note and Note, by viewing each bond's cash flows as portfolio of zerocoupon bonds.

b Are the securities fairly priced, underpriced or overpriced, using the information contained in the Tabel then discuss briefly which security is cheap and which is expensive and why.

c Discuss briefly which security you will short and which you will long and why.

d Determine the yieldtomaturity of each Treasury security.

Table : Term Structure on February

tabletableCoupon Rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started