Question

Arbor City Community Foundation (A): The Foundation The Arbor City Community Foundation (ACCF) was a medium-sized endowment established in Illinois in the late 1970s through

Arbor City Community Foundation (A): The Foundation

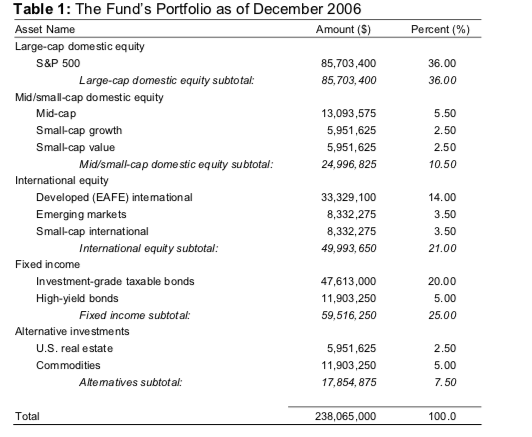

The Arbor City Community Foundation (ACCF) was a medium-sized endowment established in Illinois in the late 1970s through the hard work of several local families. The vision of the founders was to create a comprehensive center for philanthropy in the greater Arbor City region. Its mission was to improve the quality of life for area residents by supporting high academic achievement, developing resources for economic security, and promoting environmental awareness. As of December 31, 2006, ACCF had a fund balance (known collectively as the fund) of just under $240 million.

Investment Management

Given that most public foundations were established as perpetual entities, proper management of plan assets was crucial to ensure that current and future beneficiaries received equal consideration. In order to meet this duty of impartiality, foundations historically relied solely upon the interest and dividends received from investments for making annual distributions. Their primary investment objective was the preservation of capital and maximization of income necessary to support the yearly budget. A secondary goal was capital appreciation to mitigate the effects of inflation on the long-term purchasing power of plan assets. However, as interest rates fell throughout the 1990s and early 2000s, foundations had more difficulty meeting their annual distribution requirements using this approach. This development, along with a more widespread acceptance of modern portfolio theory, brought with it implementation of total return investing at many charitable institutions. With total return investing, funds were invested to achieve the best level of return compatible with the fiduciary responsibility to maintain safe investments. This allowed trustees to invest plan assets in a way they believed would produce the best long-term returns for the charity, regardless of whether those returns came in the form of income or capital appreciation. ACCF employed a total return approach in the investment of its plan assets.

The ACCF board of trustees had appointed a committee to oversee investment decisions relating to the foundation assets. Given the relatively small size of the fund, the committee relied primarily on passive index vehicles and external investment advisors for the daily portfolio management of its accounts. Passive equity investing attempted to mimic the return on the market instead of selecting securities that would perform better than the average. Passive investing (or indexing) involved purchasing diversified portfolios of all the securities in an asset class. The benefits of passive investing included reduced costs, tax efficiency, and the fact that passive funds historically outperformed a majority of active funds. The asset allocation was set by the committee and was based on input from outside firms as well as internal opinions on the potential economic and market conditions in the coming twelve to twenty-four months. The allocation as of December 31, 2006, is listed in Table 1.

Brokerage firms had developed funds that served as surrogates for purchasing a specific mixture of assets. For instance, an investor would typically select an exchange-traded fund (ETF) that had a mixture of assets reflective of a desired market index. The Standard and Poors 500 Index (S&P 500) is often indexed through the ETF, listed on NYSE as SPY.

The investment committee, under the guidance of the board, also pursued an active risk management policy for the fund. The plan administrators were primarily concerned with the volatility and distribution of portfolio returns. Historically, the board had considered 90% of the S&P 500 volatility level to be an appropriate guideline. The investment committee was also concerned with the amount of the fund that could be lost in a specific period of time. The committee recognized that short-term losses were also a possible issue, and it looked to gauge short-term volatility with a measure that incorporated likelihood and loss. The value-at-risk (VaR) approach was commonly used in asset management for this purpose. The investment committee targeted a daily VaR of less than 1% of the fund value with 95% confidence and less than 1.5% of the fund value with 99% confidence. The committee could deviate slightly from these targets if it felt strongly about a particular investment, but it had rarely done so in the past. VaR calculations were used to provide guidance on the amount of the portfolio that was at risk, given market volatility; it was not necessarily predictive of risk going forward.

Questions

Assess the risk posed by the S&P 500.

The investment committee would like to understand the level of volatility inherent in the S&P 500. Value-at-risk (VaR) is useful in measuring the risk of losses on a daily (short-term) and monthly (mid-term) level.

1. Calculate the VaR for the S&P 500 as exhibited through the SPY ETF. Specifically:

A .Calculate the daily (same as one-day) VaR with 95% confidence and 99% confidence.

B. Calculate the monthly VaR with 99% confidence.

*Options: Consider the historical and parametric approaches. For the parametric approach, consider a log-normal distribution as needed.*

2. Comment on the appropriateness of the SPY ETF as a single investment instrument for the ACCF.

3. Explain to the funds directors what the VaR of the SPY means, what it measures, and how the investment committee might use it to measure the risk of the S&P 500.

Assess the current diversification of the ACCF portfolio and the level of risk it poses.

The investment committee needs to determine the risk posed by the current fund holdings. This is known as the portfolio VaR. The committee is concerned about both short-term and mid- term risk. Generally, management of short-term risk is believed to manage long-term risk.

4. Calculate the portfolio VaR for the ACCF portfolio.

A. Calculate the daily VaR with 95% confidence and 99% confidence.

B. Calculate the monthly VaR with 99% confidence.

*Options: Consider the historical and parametric approaches, as noted in Question 1.*

5. Comment on the role of diversification in managing risk relative to holding only the SPY.

Transcribed image textStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started