Answered step by step

Verified Expert Solution

Question

1 Approved Answer

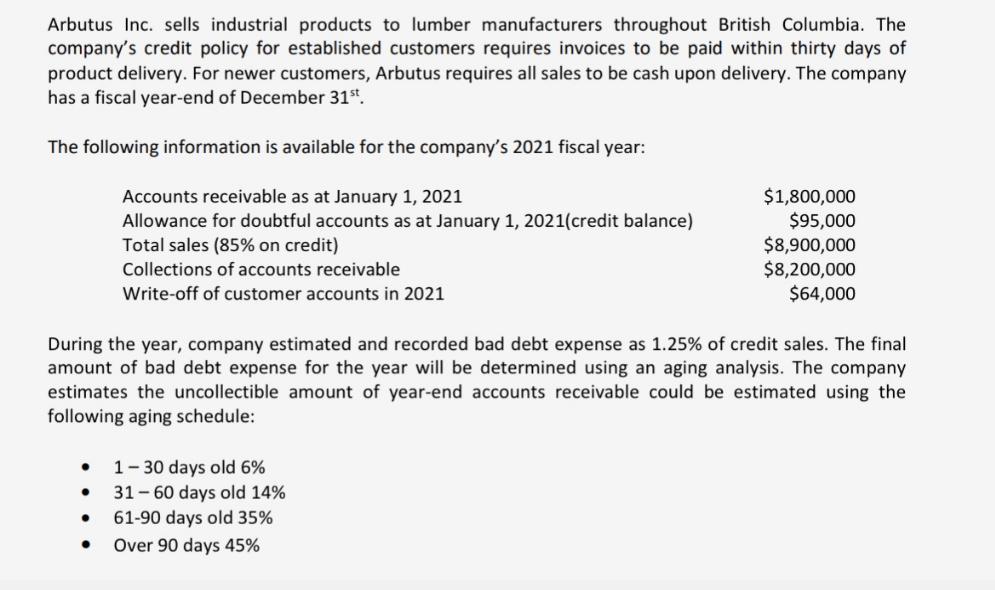

Arbutus Inc. sells industrial products to lumber manufacturers throughout British Columbia. The company's credit policy for established customers requires invoices to be paid within

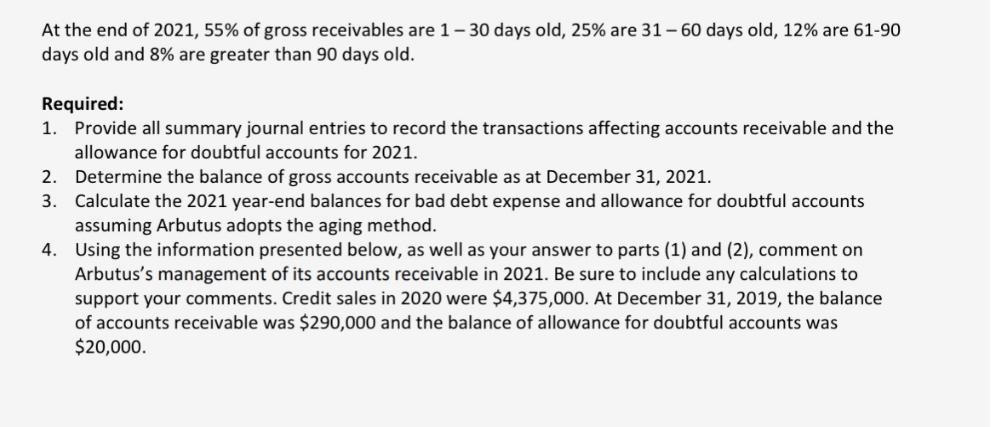

Arbutus Inc. sells industrial products to lumber manufacturers throughout British Columbia. The company's credit policy for established customers requires invoices to be paid within thirty days of product delivery. For newer customers, Arbutus requires all sales to be cash upon delivery. The company has a fiscal year-end of December 31st. The following information is available for the company's 2021 fiscal year: Accounts receivable as at January 1, 2021 Allowance for doubtful accounts as at January 1, 2021(credit balance) Total sales (85% on credit) Collections of accounts receivable Write-off of customer accounts in 2021 During the year, company estimated and recorded bad debt expense as 1.25% of credit sales. The final amount of bad debt expense for the year will be determined using an aging analysis. The company estimates the uncollectible amount of year-end accounts receivable could be estimated using the following aging schedule: $1,800,000 $95,000 $8,900,000 $8,200,000 $64,000 1-30 days old 6% 31-60 days old 14% 61-90 days old 35% Over 90 days 45% At the end of 2021, 55% of gross receivables are 1-30 days old, 25% are 31-60 days old, 12% are 61-90 days old and 8% are greater than 90 days old. Required: 1. Provide all summary journal entries to record the transactions affecting accounts receivable and the allowance for doubtful accounts for 2021. 2. Determine the balance of gross accounts receivable as at December 31, 2021. 3. Calculate the 2021 year-end balances for bad debt expense and allowance for doubtful accounts assuming Arbutus adopts the aging method. 4. Using the information presented below, as well as your answer to parts (1) and (2), comment on Arbutus's management of its accounts receivable in 2021. Be sure to include any calculations to support your comments. Credit sales in 2020 were $4,375,000. At December 31, 2019, the balance of accounts receivable was $290,000 and the balance of allowance for doubtful accounts was $20,000.

Step by Step Solution

★★★★★

3.55 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

1 Provide all summary journal entries to record the transactions affecting accounts receivable and the allowance for doubtful accounts for 2021 Januar...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started