Arch Airway expects to purchase 5.6 million gallons of jet fuel in three months and decides to use heating oil futures to hedge the

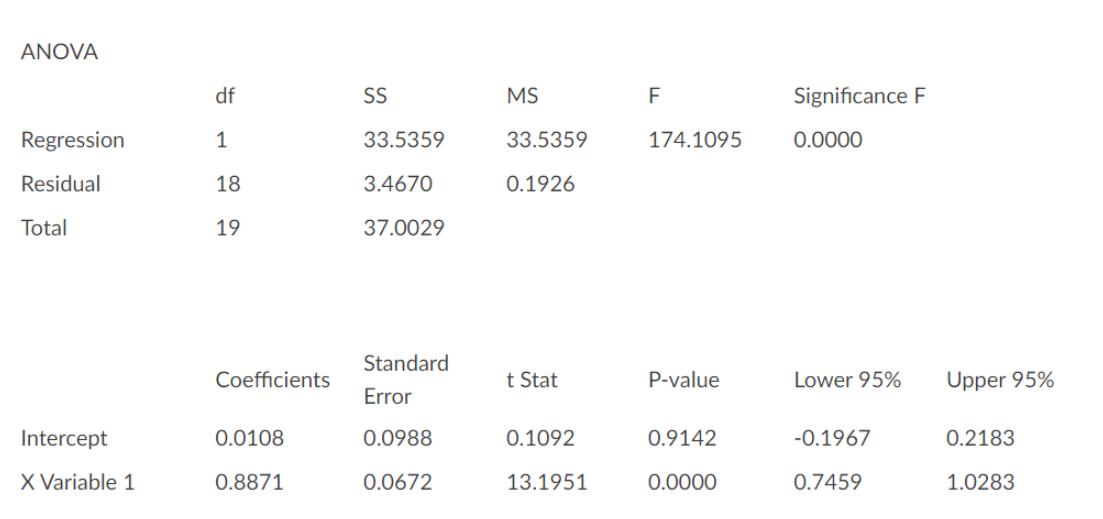

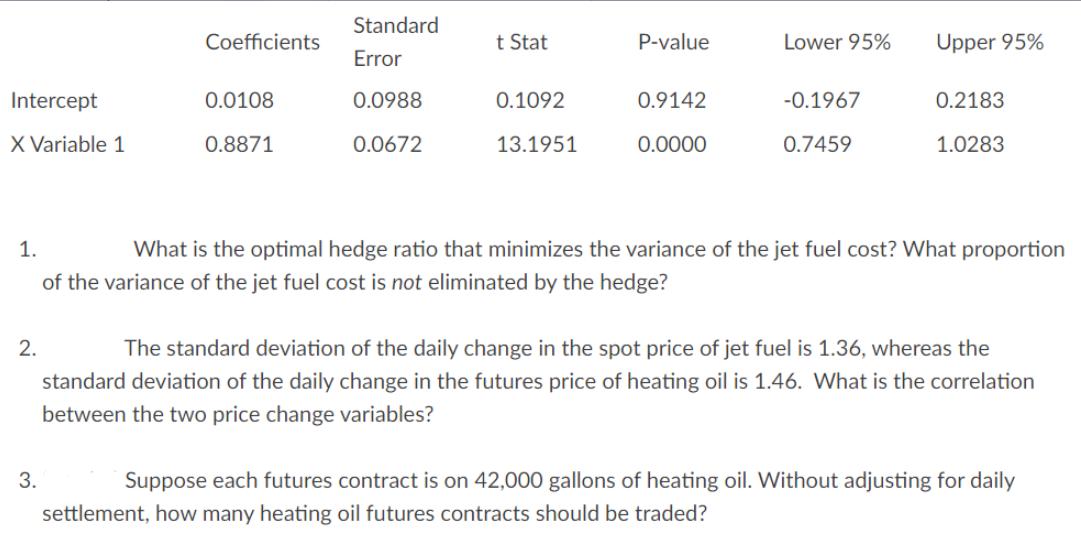

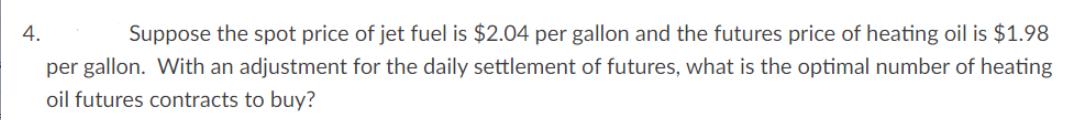

Arch Airway expects to purchase 5.6 million gallons of jet fuel in three months and decides to use heating oil futures to hedge the fuel price risk. A regression has been performed: The dependent variable is the daily change in the spot price of jet fuel, whereas the independent variable is the daily change in the futures price of heating oil. The regression output is as follows: Regression Statistics Multiple R R Square 0.9520 0.9063 Adjusted R Square 0.9011 Standard Error 0.4389 Observations 20 ANOVA df SS MS Regression 1 33.5359 33.5359 Residual 18 3.4670 0.1926 Total 19 37.0029 F Significance F 174.1095 0.0000 Standard Coefficients t Stat P-value Lower 95% Upper 95% Error Intercept 0.0108 0.0988 0.1092 0.9142 -0.1967 0.2183 X Variable 1 0.8871 0.0672 13.1951 0.0000 0.7459 1.0283 Standard Coefficients t Stat P-value Lower 95% Upper 95% Error Intercept 0.0108 0.0988 0.1092 0.9142 -0.1967 0.2183 X Variable 1 0.8871 0.0672 13.1951 0.0000 0.7459 1.0283 1. 2. 3. What is the optimal hedge ratio that minimizes the variance of the jet fuel cost? What proportion of the variance of the jet fuel cost is not eliminated by the hedge? The standard deviation of the daily change in the spot price of jet fuel is 1.36, whereas the standard deviation of the daily change in the futures price of heating oil is 1.46. What is the correlation between the two price change variables? Suppose each futures contract is on 42,000 gallons of heating oil. Without adjusting for daily settlement, how many heating oil futures contracts should be traded? 4. Suppose the spot price of jet fuel is $2.04 per gallon and the futures price of heating oil is $1.98 per gallon. With an adjustment for the daily settlement of futures, what is the optimal number of heating oil futures contracts to buy?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

ANSWER 1 The optimal hedge ratio can be calculated using the coefficient of the independent variable X Variable 1 from the regression output In this c...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started