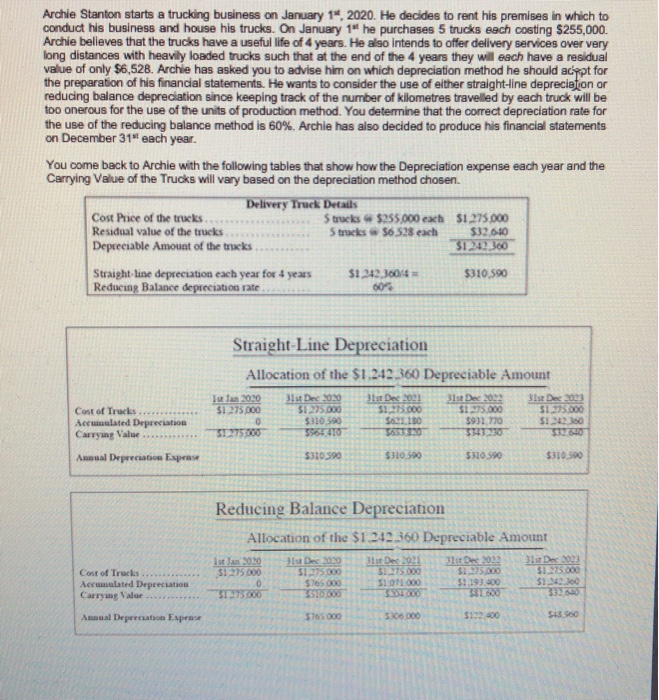

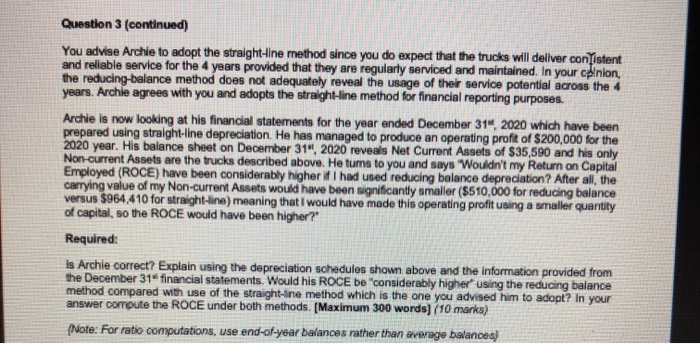

Archie Stanton starts a trucking business on January 14, 2020. He decides to rent his premises in which to conduct his business and house his trucks. On January 1" he purchases 5 trucks each costing $255,000. Archie believes that the trucks have a useful life of 4 years. He also intends to offer delivery services over very long distances with heavily loaded trucks such that at the end of the 4 years they will each have a residual value of only $6,528. Archie has asked you to advise him on which depreciation method he should acept for the preparation of his financial statements. He wants to consider the use of either straight-line depreciation or reducing balance depreciation since keeping track of the number of kilometres travelled by each truck will be too onerous for the use of the units of production method. You determine that the correct depreciation rate for the use of the reducing balance method is 60%. Archie has also decided to produce his financial statements on December 31" each year. You come back to Archie with the following tables that show how the Depreciation expense each year and the Carrying Value of the Trucks will vary based on the depreciation method chosen Delivery Truck Details Cost Price of the trucks Strucks $255.000 each $1.275.000 Residual value of the trucks Strucks 56 528 each $32,600 Depreciable Amount of the tracks $1,242300 Straight-line depreciation each year for 4 years 51 242.360/4 = $310.590 Reducing Balance depreciation rate 60% Straight-Line Depreciation Allocation of the $1,242.360 Depreciable Amount Ist an 2000 31 Dec 2011 31st Dec 2009 $1.275.000 51275.000 $! 25.000 S! 275.000 $175.000 $310 590 SARE 150 $931.770 $12360 51275.000 330640 Cost of Trucks Accumulated Depreciation Carrying Value Annual Depreciation Expense $310.590 $310.500 $310 590 $310.590 Reducing Balance Depreciation Allocation of the $1 242.360 Depreciable Amount Ista 2020 31st Dec 30 31st Dec 2011 31st Dec 23 51275.000 51275.000 51.275.000 $275.000 $125.000 0 $75 000 SIT1000 $1 193.600 $14.30 31.275.000 310.000 35 Cost of Trucks Accumulated Depreciation Carrying Valur Annual Depreciation Expense 5765 000 5306 000 $12.00 $43.00 Question 3 (continued) You advise Archie to adopt the straight-line method since you do expect that the trucks will deliver con ustent and reliable service for the 4 years provided that they are regularly serviced and maintained. In your cdnion, the reducing-balance method does not adequately reveal the usage of their service potential across the 4 years. Archie agrees with you and adopts the straight-line method for financial reporting purposes. Archie is now looking at his financial statements for the year ended December 31, 2020 which have been prepared using straight-line depreciation. He has managed to produce an operating profit of $200,000 for the 2020 year. His balance sheet on December 31" 2020 reveals Net Current Assets of $35,590 and his only Non-current Assets are the trucks described above. He turns to you and says "Wouldn't my Return on Capital Employed (ROCE) have been considerably higher if I had used reducing balance depreciation? After all, the carrying value of my Non-current Assets would have been significantly smaller ($S10,000 for reducing balance versus $964 410 for straight-line) meaning that I would have made this operating profit using a smaller quantity of capital, so the ROCE would have been higher?" Required: Is Archie correct? Explain using the depreciation schedules shown above and the information provided from the December 31" financial statements. Would his ROCE be "considerably higher using the reducing balance method compared with use of the straight-line method which is the one you advised him to adopt? In your answer compute the ROCE under both methods. [Maximum 300 words) (10 marks) {Note: For ratio computations, use end-of-year balances rather than average balances)