Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Are all the forms listed required for the given information and Form 8826 (disabled access credit). Show detail of the child tax credit computation (with

Are all the forms listed required for the given information

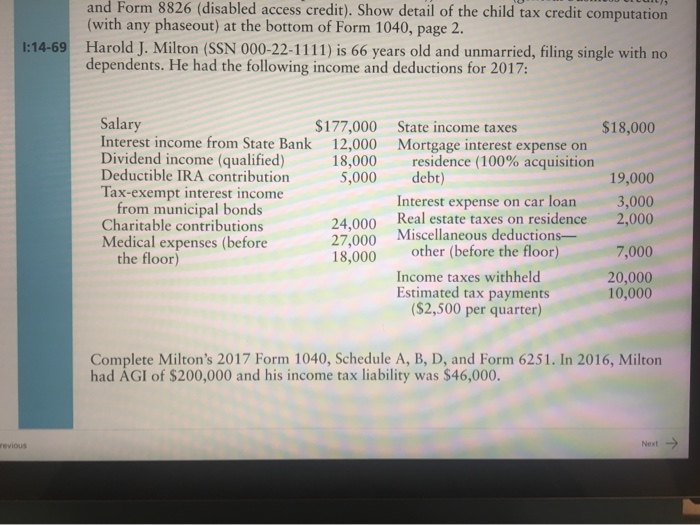

and Form 8826 (disabled access credit). Show detail of the child tax credit computation (with any phaseout) at the bottom of Form 1040, page 2 Harold J. Milton (SSN 000-22-1111) is 66 years old and unmarried, filing single with no dependents. He had the following income and deductions for 2017: I:14-69 Salary Interest income from State Bank Dividend income (qualified) Deductible IRA contribution Tax-exempt interest income from municipal bonds Charitable contributions Medical expenses (before the floor) $177,000 12,000 18,000 5,000 State income taxes Mortgage interest expense on residence (100% acquisition debt) $18,000 19,000 Interest expense on car loan 3,000 2,000 Real estate taxes on residence Miscellaneous deductions other (before the floor) 24,000 27,000 7,000 18,000 Income taxes withheld Estimated tax payments ($2,500 per quarter) 20,000 10,000 Complete Milton's 2017 Form 1040, Schedule A, B, D, and Form 6251. In 2016, Milton had AGI of $200,000 and his income tax liability was $46,000. revious Next and Form 8826 (disabled access credit). Show detail of the child tax credit computation (with any phaseout) at the bottom of Form 1040, page 2 Harold J. Milton (SSN 000-22-1111) is 66 years old and unmarried, filing single with no dependents. He had the following income and deductions for 2017: I:14-69 Salary Interest income from State Bank Dividend income (qualified) Deductible IRA contribution Tax-exempt interest income from municipal bonds Charitable contributions Medical expenses (before the floor) $177,000 12,000 18,000 5,000 State income taxes Mortgage interest expense on residence (100% acquisition debt) $18,000 19,000 Interest expense on car loan 3,000 2,000 Real estate taxes on residence Miscellaneous deductions other (before the floor) 24,000 27,000 7,000 18,000 Income taxes withheld Estimated tax payments ($2,500 per quarter) 20,000 10,000 Complete Milton's 2017 Form 1040, Schedule A, B, D, and Form 6251. In 2016, Milton had AGI of $200,000 and his income tax liability was $46,000. revious Next Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started