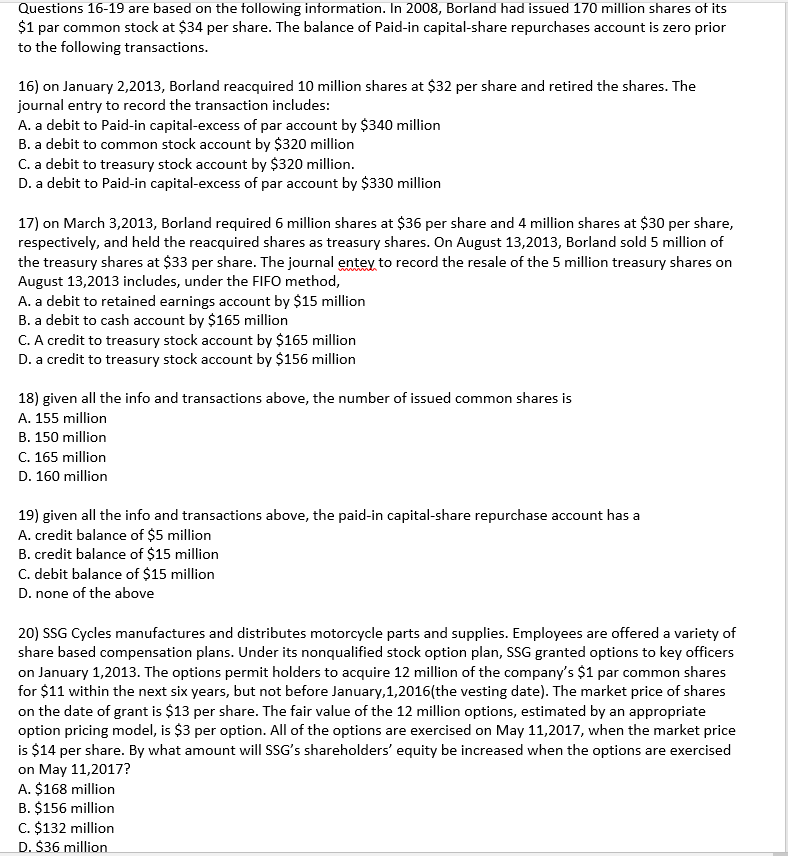

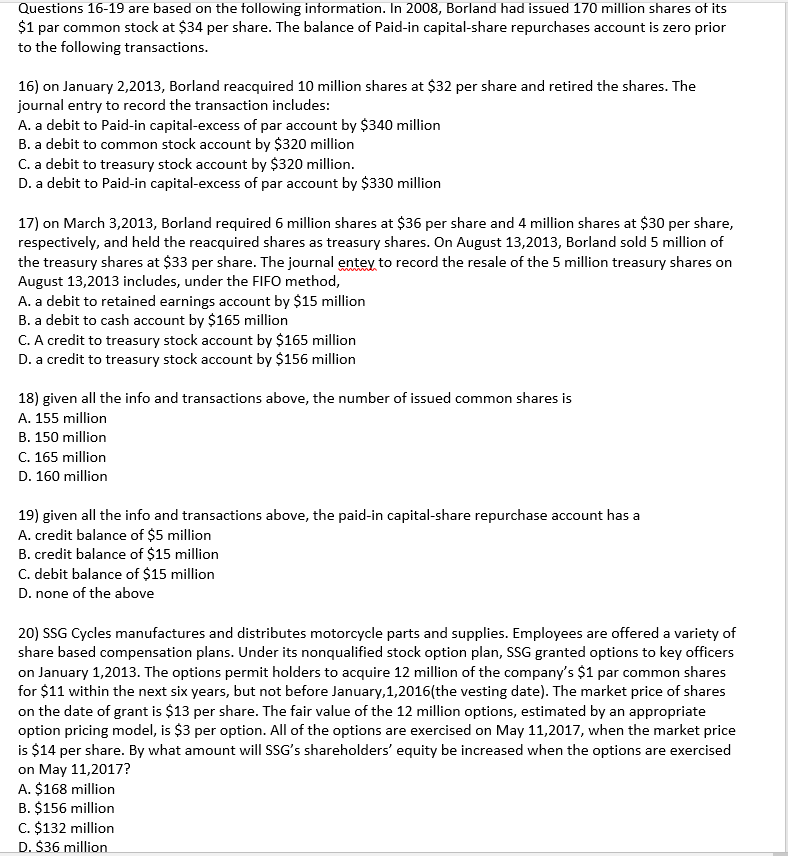

Are based on the following information. In 2008, Borland had issued 170 million shares of its $1 par common stock at $34 per share. The balance of Paid-in capital-share repurchases account is zero prior to the following transactions. on January 2,2013, Borland reacquired 10 million shares at $32 per share and retired the shares. The journal entry to record the transaction includes: A. a debit to Paid-in capital-excess of par account by $340 million B. a debit to common stock account by $320 million C. a debit to treasury stock account by $320 million. D. a debit to Paid-in capital-excess of par account by $330 million on March 3,2013, Borland required 6 million shares at $36 per share and 4 million shares at $30 per share, respectively, and held the reacquired shares as treasury shares. On August 13,2013, Borland sold 5 million of the treasury shares at $33 per share. The journal entey, to record the resale of the 5 million treasury shares on August 13,2013 includes, under the FIFO method, A. a debit to retained earnings account by $15 million B. a debit to cash account by $165 million C. A credit to treasury stock account by $165 million D. a credit to treasury stock account by $156 million given all the info and transactions above, the number of issued common shares is A. 155 million B. 150 million C. 165 million D. 160 million given all the info and transactions above, the paid-in capital-share repurchase account has a A. credit balance of $5 million B. credit balance of $15 million C. debit balance of $15 million D. none of the above SSG Cycles manufactures and distributes motorcycle parts and supplies. Employees are offered a variety of share based compensation plans. Under its nonqualified stock option plan, SSG granted options to key officers on January 1,2013. The options permit holders to acquire 12 million of the company's $1 par common shares for $11 within the next six years, but not before January, 1,2016(the vesting date). The market price of shares on the date of grant is $13 per share. The fair value of the 12 million options, estimated by an appropriate option pricing model, is $3 per option. All of the options are exercised on May 11,2017, when the market price is $14 per share. By what amount will SSG's shareholders' equity be increased when the options are exercised on May 11,2017? A. $168 million B. $156 million C. $132 million D. $36 million