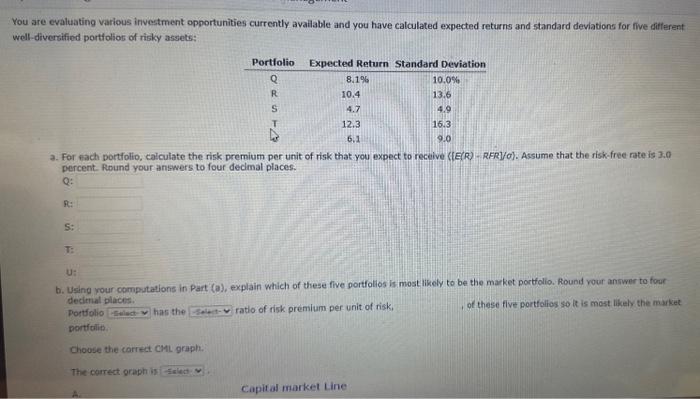

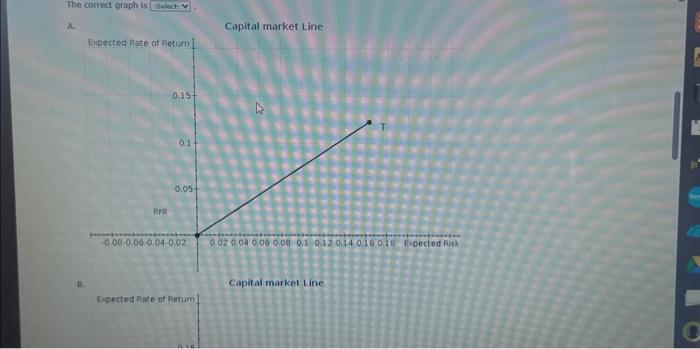

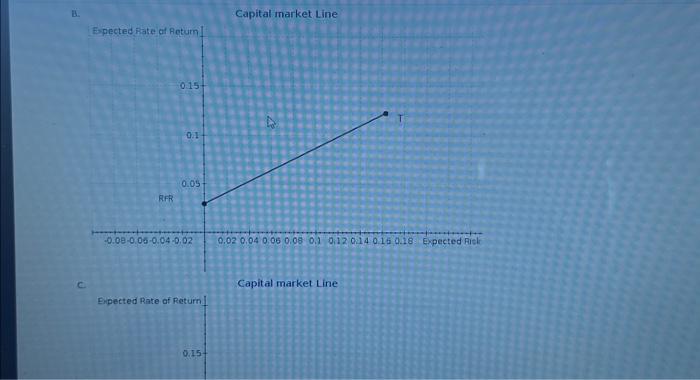

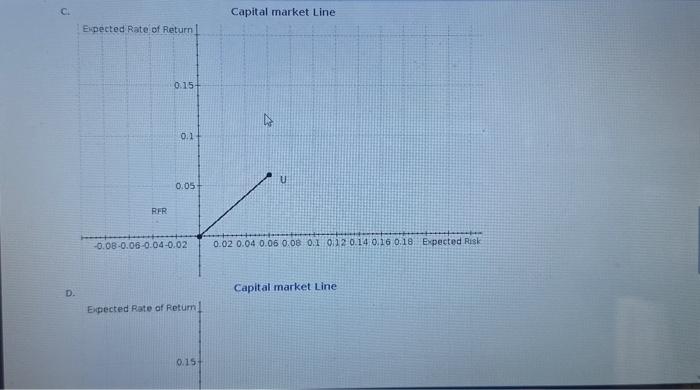

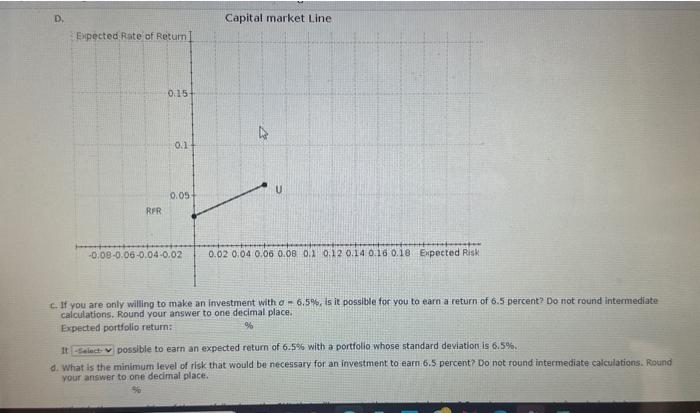

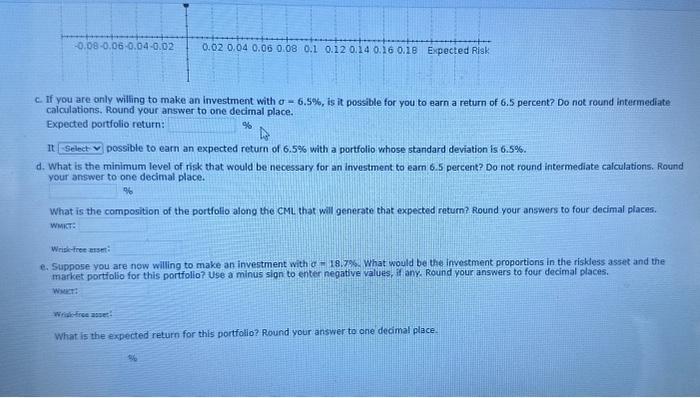

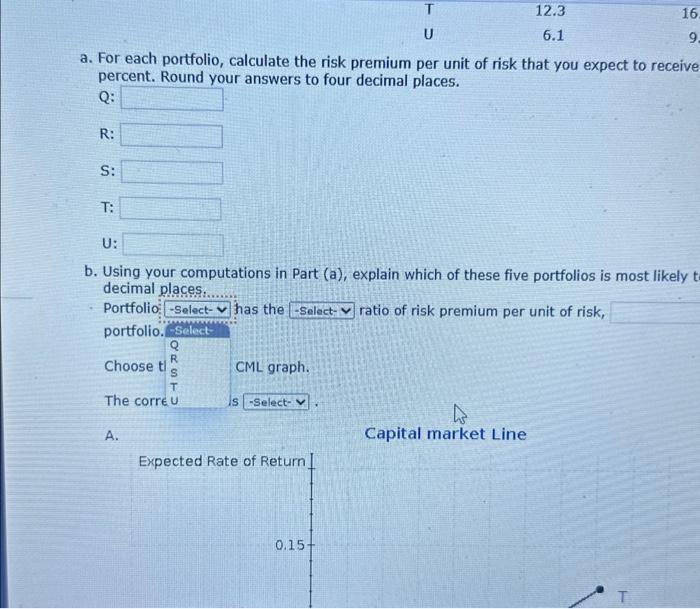

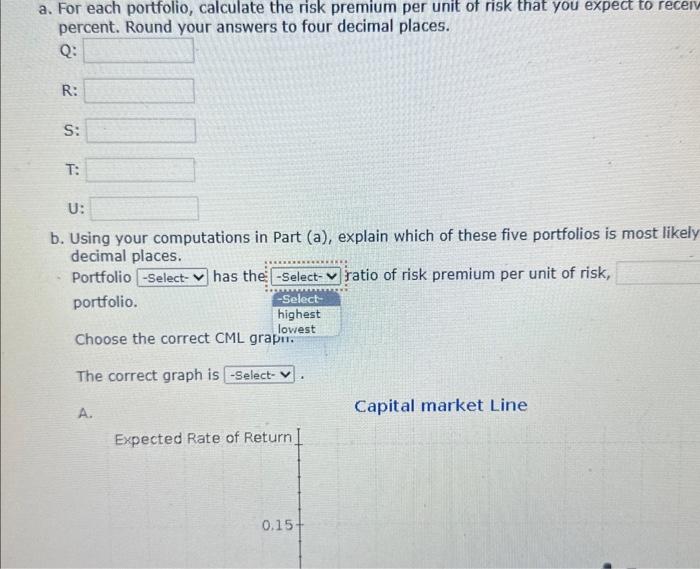

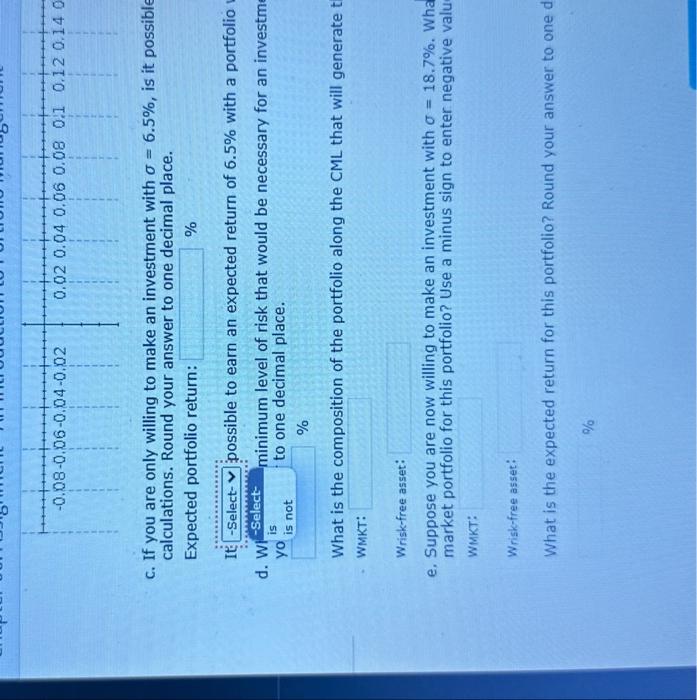

are evaluating various investment opportunities currently avallable and you have calculated expected returns and standard deviations for five different Al-diversified portfolior of risky assets: 3. For each portfolio, calculate the risk premium per unit of risk that you expect to receive {[E(R) - RFR]/O\}. Assume that the risk-free rate is 3.0 percent. Round your antwers to four decimal places. Q: : 5: T: U: b. Using vour computations in Part (a), explain which of these five portfolios is most likely to be the market portfolio. Round vour anmwer to four Portfolio pastios the rask premium per unit of risk. , of these five portfolios so it is most likely the market portfolip. Chouse the carrect CHL graph. The correct oraph is Capit al market Line The correct oraph is A. Capital market Line: 8.) Capital market line Epected Pate of setum B. Capital market Line c. Capital market Line Expected Rate of Return c. Capital market Line D. Capital market Line Expected Rate of Retum 0.15 c. If you are only willing to make an investment with =6.5%, is it possible for you to earn a return of 6.5 percent? Do not round intermediate calculations. Round your answer to one decimal place. Expected portfolio return: 11 possible to earn an expected return of 6.5%6 with a portiotio whose standard deviation is 6.5%. d. What is the minimum level of risk that would be necessary for an investment to earn 6.5 percent? Do not round intermediate calculations. Round vour answer to one decimal place. c. If you are only willing to make an investment with 0=6.5%, is it possible for you to earn a return of 6.5 percent? Do not round intermediate. calculations, Round your answer to one decimal place. Expected portfolio return: II possible to earn an expected return of 6.5% with a portfolio whose standard deviation is 6.5%. d. What is the minimum level of risk that would be necessary for an investment to earn 6.5 percent? Do not round intermediate calculations. Round your answer to one decimal place. What is the composition of the portfolio along the CML that will generate that expected return? Round your answers to four decimal places. WMic: Wriskitete ersm: e. Suppose you are now willing to make an investment with c18.7%. What would be the invostment proportions in the riskless asset and the Suppose you are now willing to make an investent with market portiolio for this portfollo? Use a minus sion to enter negative values, if anv. Round your answers to four decimal places. Whace: : Wrikifice asse: What is the expected return for this portfolio? Round your answer to one decimal place. a. For each portfolio, calculate the risk premium per unit of risk that you expect to receive percent. Round your answers to four decimal places. Q: R: S: T : U: b. Using your computations in Part (a), explain which of these five portfolios is most likely decimal places. Portfolio has the ratio of risk premium per unit of risk, portfolio. Choose CML graph. The corri s A. Capital market Line Expected Rate of Return 0.15 percent. Round your answers to four decimal places. Q: R: S: T: U: b. Using your computations in Part (a), explain which of these five portfolios is most likely decimal places. Portfolio has the ratio of risk premium per unit of risk, portfolio. Choose the correct CML grapr.. The correct graph is A. Capital market Line Expected Rate of Return 0.15 c. If you are only willing to make an investment with =6.5%, is it possible calculations. Round your answer to one decimal place. Expected portfolio return: % It to onsible to earn an expected return of 6.5% with a portfolio yo What is the composition of the portfolio along the CML that will generate WMKT: Wrisk-free asset: e. Suppose you are now willing to make an investment with =18.7%. Wha market portfolio for this portfolio? Use a minus sign to enter negative valu WMKT: Wrisk-free asset: What is the expected return for this portfolio? Round your answer to one