Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Are Marthas unreimbursed medical expenses deductible on the Neals tax return? Why or why not? Is Martha required to file a tax return? Why or

- Are Marthas unreimbursed medical expenses deductible on the Neals tax return? Why or why not?

- Is Martha required to file a tax return? Why or why not?

- What tax advantage(s), attributable to Hollys education expenses, can the Neals include on their return?

- How much of the total medical expenses will the Neals be able to deduct on their taxes?

- Can the Neals IRA contributions be deducted on their tax return? If so, to what extent?

- Would the Neals benefit from itemizing their deductions? Why?

- Calculate the Neals total 2017 tax liability using the method most advantageous to them.

- Should Zachary have his employer adjust his federal tax withholding amount? Why or why not?

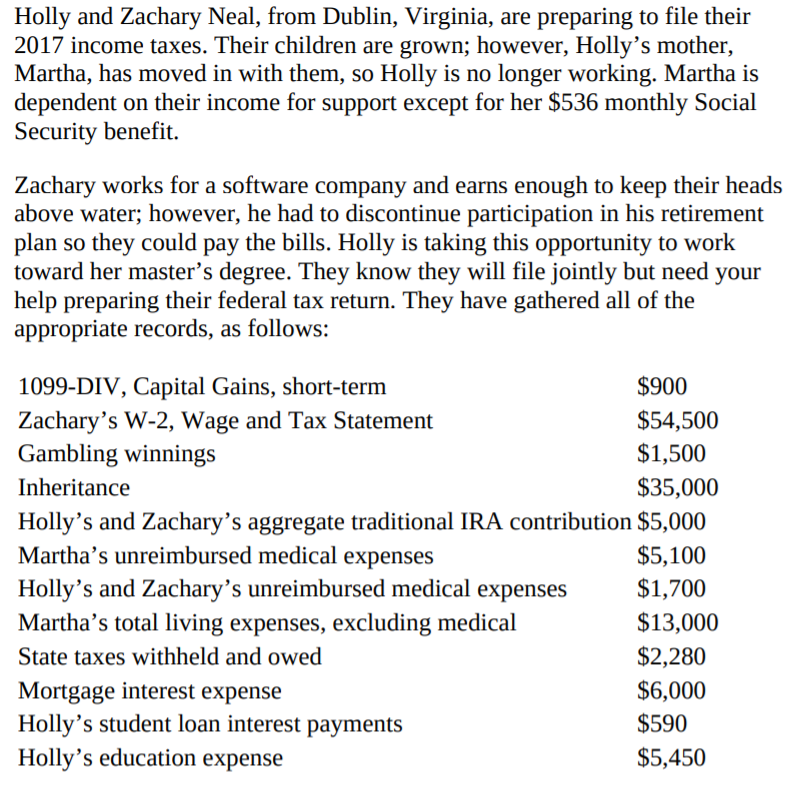

Holly and Zachary Neal, from Dublin, Virginia, are preparing to file their 2017 income taxes. Their children are grown; however, Holly's mother, Martha, has moved in with them, so Holly is no longer working. Martha is dependent on their income for support except for her $536 monthly Social Security benefit. Zachary works for a software company and earns enough to keep their heads above water; however, he had to discontinue participation in his retirement plan so they could pay the bills. Holly is taking this opportunity to work toward her master's degree. They know they will file jointly but need your help preparing their federal tax return. They have gathered all of the appropriate records, as follows: 1099-DIV, Capital Gains, short-term $900 Zachary's W-2, Wage and Tax Statement $54,500 Gambling winnings $1,500 Inheritance $35,000 Holly's and Zachary's aggregate traditional IRA contribution $5,000 Martha's unreimbursed medical expenses $5,100 Holly's and Zachary's unreimbursed medical expenses $1,700 Martha's total living expenses, excluding medical $13,000 State taxes withheld and owed $2,280 Mortgage interest expense $6,000 Holly's student loan interest payments $590 Holly's education expense $5,450

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started