Answered step by step

Verified Expert Solution

Question

1 Approved Answer

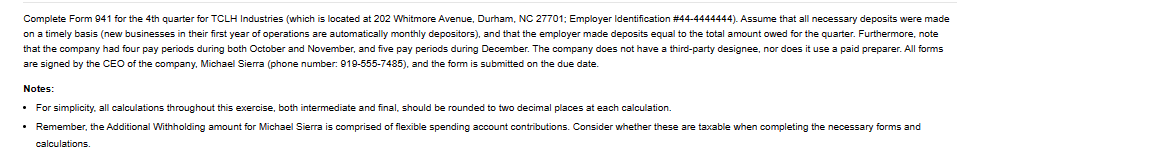

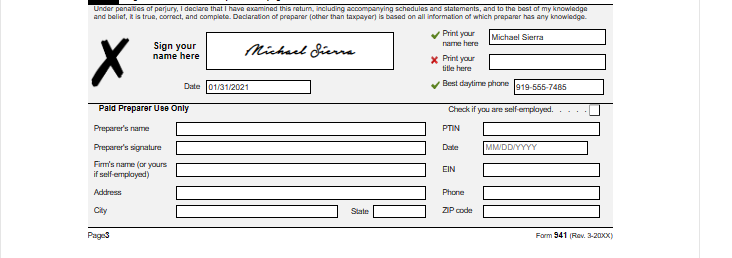

are signed by the CEO of the company, Michael Sierra (phone number: 919-555-7485), and the form is submitted on the due date. Notes: - For

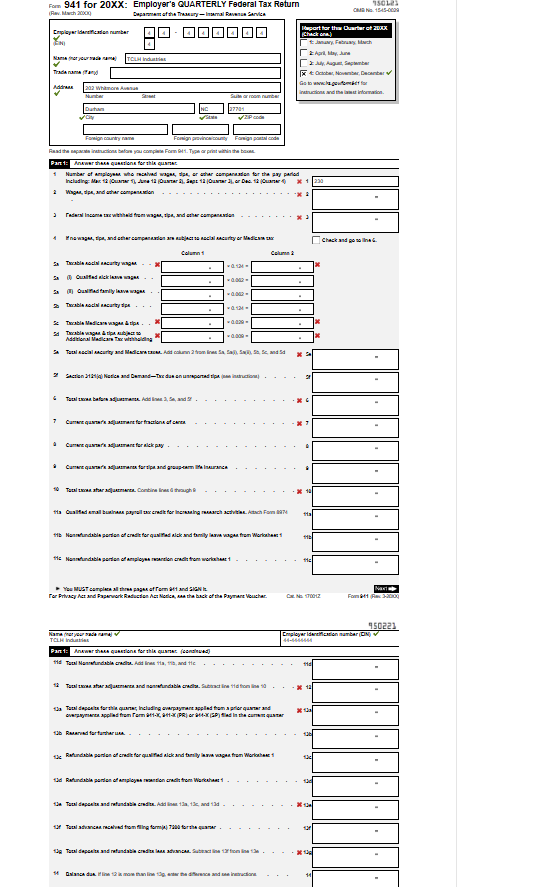

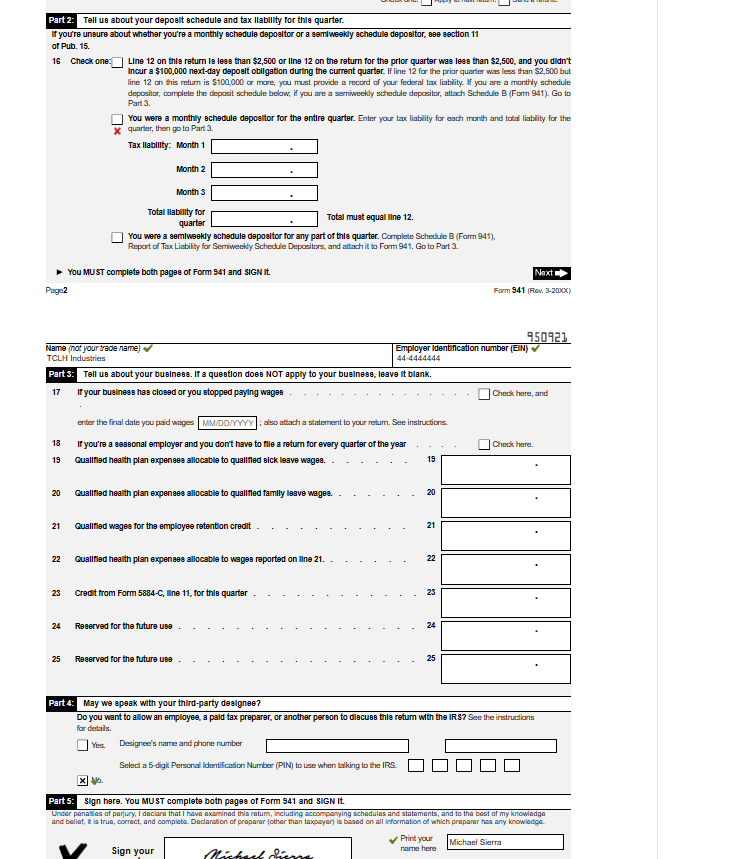

are signed by the CEO of the company, Michael Sierra (phone number: 919-555-7485), and the form is submitted on the due date. Notes: - For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation. calculations. Fom 941 for 20XX: Employer'B QUARTERLY Federal Tax Return Ifen Mash 3000 on 2 Whoe, dpe, and ather eomperevion [ chack and po so lhe 6. Column 1 Celume : 5. Trable sodel acarty wager - - X 5. 0 Gulfed alckiews magex 5. (i) Oavinad fanlly lewa wagex 2 Twable nodil acarty dipe... x+ a Camkequarsits acluernant for alekpy 0 4 Qb Rearnedfarfartharue . . . . . . . . . . . . . . . . . . . . . . . . . 6 If yore unsure about whether you're a monthly schedule depositor or a aemiweekly achedule depositor, eee aection 11 of Pub. 15. 16 Check one: LIne 12 on thle return le lees than $2,500 or line 12 on the return for the prior quarter was lees than $2,500, and you dlan't Incur a $100,000 next-day depoalt obilgation during the current quarter. If line 12 for the priar quarter was less than $2,500 but line 12 on this return is $100,000 or mare, you must provide a record of your federal taxe liablity. If you are a monthly schedule deposilor, corrplete the deposit schedule belaw, if you are a serniveekly schedule depositer, attach Schedule B (Form 941). Go to Part 3. You were a monthly achedule depoeltor for the entire quarter. Enter your tax liability for each menth and tolal liablity for the x quarter, then go to Part 3. Tax llability: Month 1 Month 2 Month 3 Total llabillty for quarter Total muat equal lline 12. You were a aemlweekdy achedule depositor for any part of thla quarter. Camplete Schedule B (Farm 941), Report of Tax Liabilty for Serriweekly Schedule Deposilors, and attach it to Farm 941. Go to Part 3. You MUST complete both pages of Form 941 and sIGN It. Page2 Naxt Form 941 (Fiov. 3-20xx) Name (inot your trade name) 5092 TCLH Industries Employer Identification number (EN) 44-4444444 Part 4: May we apeak with your third-party dealgnee? Do you want to allow an employee, a pald tax preparer, or another person to dlecuse thle return wth the IRS? See the irstructions for detals. Yes. Designee's narne and phone number Selact a 5 -digit Perscral Identification Nurrber (PIN) to use when talking to the IRS. Sign your name here Date narne here Print your tite here Best daytirne phone Form 941 (Fov. 3-2axx) are signed by the CEO of the company, Michael Sierra (phone number: 919-555-7485), and the form is submitted on the due date. Notes: - For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation. calculations. Fom 941 for 20XX: Employer'B QUARTERLY Federal Tax Return Ifen Mash 3000 on 2 Whoe, dpe, and ather eomperevion [ chack and po so lhe 6. Column 1 Celume : 5. Trable sodel acarty wager - - X 5. 0 Gulfed alckiews magex 5. (i) Oavinad fanlly lewa wagex 2 Twable nodil acarty dipe... x+ a Camkequarsits acluernant for alekpy 0 4 Qb Rearnedfarfartharue . . . . . . . . . . . . . . . . . . . . . . . . . 6 If yore unsure about whether you're a monthly schedule depositor or a aemiweekly achedule depositor, eee aection 11 of Pub. 15. 16 Check one: LIne 12 on thle return le lees than $2,500 or line 12 on the return for the prior quarter was lees than $2,500, and you dlan't Incur a $100,000 next-day depoalt obilgation during the current quarter. If line 12 for the priar quarter was less than $2,500 but line 12 on this return is $100,000 or mare, you must provide a record of your federal taxe liablity. If you are a monthly schedule deposilor, corrplete the deposit schedule belaw, if you are a serniveekly schedule depositer, attach Schedule B (Form 941). Go to Part 3. You were a monthly achedule depoeltor for the entire quarter. Enter your tax liability for each menth and tolal liablity for the x quarter, then go to Part 3. Tax llability: Month 1 Month 2 Month 3 Total llabillty for quarter Total muat equal lline 12. You were a aemlweekdy achedule depositor for any part of thla quarter. Camplete Schedule B (Farm 941), Report of Tax Liabilty for Serriweekly Schedule Deposilors, and attach it to Farm 941. Go to Part 3. You MUST complete both pages of Form 941 and sIGN It. Page2 Naxt Form 941 (Fiov. 3-20xx) Name (inot your trade name) 5092 TCLH Industries Employer Identification number (EN) 44-4444444 Part 4: May we apeak with your third-party dealgnee? Do you want to allow an employee, a pald tax preparer, or another person to dlecuse thle return wth the IRS? See the irstructions for detals. Yes. Designee's narne and phone number Selact a 5 -digit Perscral Identification Nurrber (PIN) to use when talking to the IRS. Sign your name here Date narne here Print your tite here Best daytirne phone Form 941 (Fov. 3-2axx)

are signed by the CEO of the company, Michael Sierra (phone number: 919-555-7485), and the form is submitted on the due date. Notes: - For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation. calculations. Fom 941 for 20XX: Employer'B QUARTERLY Federal Tax Return Ifen Mash 3000 on 2 Whoe, dpe, and ather eomperevion [ chack and po so lhe 6. Column 1 Celume : 5. Trable sodel acarty wager - - X 5. 0 Gulfed alckiews magex 5. (i) Oavinad fanlly lewa wagex 2 Twable nodil acarty dipe... x+ a Camkequarsits acluernant for alekpy 0 4 Qb Rearnedfarfartharue . . . . . . . . . . . . . . . . . . . . . . . . . 6 If yore unsure about whether you're a monthly schedule depositor or a aemiweekly achedule depositor, eee aection 11 of Pub. 15. 16 Check one: LIne 12 on thle return le lees than $2,500 or line 12 on the return for the prior quarter was lees than $2,500, and you dlan't Incur a $100,000 next-day depoalt obilgation during the current quarter. If line 12 for the priar quarter was less than $2,500 but line 12 on this return is $100,000 or mare, you must provide a record of your federal taxe liablity. If you are a monthly schedule deposilor, corrplete the deposit schedule belaw, if you are a serniveekly schedule depositer, attach Schedule B (Form 941). Go to Part 3. You were a monthly achedule depoeltor for the entire quarter. Enter your tax liability for each menth and tolal liablity for the x quarter, then go to Part 3. Tax llability: Month 1 Month 2 Month 3 Total llabillty for quarter Total muat equal lline 12. You were a aemlweekdy achedule depositor for any part of thla quarter. Camplete Schedule B (Farm 941), Report of Tax Liabilty for Serriweekly Schedule Deposilors, and attach it to Farm 941. Go to Part 3. You MUST complete both pages of Form 941 and sIGN It. Page2 Naxt Form 941 (Fiov. 3-20xx) Name (inot your trade name) 5092 TCLH Industries Employer Identification number (EN) 44-4444444 Part 4: May we apeak with your third-party dealgnee? Do you want to allow an employee, a pald tax preparer, or another person to dlecuse thle return wth the IRS? See the irstructions for detals. Yes. Designee's narne and phone number Selact a 5 -digit Perscral Identification Nurrber (PIN) to use when talking to the IRS. Sign your name here Date narne here Print your tite here Best daytirne phone Form 941 (Fov. 3-2axx) are signed by the CEO of the company, Michael Sierra (phone number: 919-555-7485), and the form is submitted on the due date. Notes: - For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation. calculations. Fom 941 for 20XX: Employer'B QUARTERLY Federal Tax Return Ifen Mash 3000 on 2 Whoe, dpe, and ather eomperevion [ chack and po so lhe 6. Column 1 Celume : 5. Trable sodel acarty wager - - X 5. 0 Gulfed alckiews magex 5. (i) Oavinad fanlly lewa wagex 2 Twable nodil acarty dipe... x+ a Camkequarsits acluernant for alekpy 0 4 Qb Rearnedfarfartharue . . . . . . . . . . . . . . . . . . . . . . . . . 6 If yore unsure about whether you're a monthly schedule depositor or a aemiweekly achedule depositor, eee aection 11 of Pub. 15. 16 Check one: LIne 12 on thle return le lees than $2,500 or line 12 on the return for the prior quarter was lees than $2,500, and you dlan't Incur a $100,000 next-day depoalt obilgation during the current quarter. If line 12 for the priar quarter was less than $2,500 but line 12 on this return is $100,000 or mare, you must provide a record of your federal taxe liablity. If you are a monthly schedule deposilor, corrplete the deposit schedule belaw, if you are a serniveekly schedule depositer, attach Schedule B (Form 941). Go to Part 3. You were a monthly achedule depoeltor for the entire quarter. Enter your tax liability for each menth and tolal liablity for the x quarter, then go to Part 3. Tax llability: Month 1 Month 2 Month 3 Total llabillty for quarter Total muat equal lline 12. You were a aemlweekdy achedule depositor for any part of thla quarter. Camplete Schedule B (Farm 941), Report of Tax Liabilty for Serriweekly Schedule Deposilors, and attach it to Farm 941. Go to Part 3. You MUST complete both pages of Form 941 and sIGN It. Page2 Naxt Form 941 (Fiov. 3-20xx) Name (inot your trade name) 5092 TCLH Industries Employer Identification number (EN) 44-4444444 Part 4: May we apeak with your third-party dealgnee? Do you want to allow an employee, a pald tax preparer, or another person to dlecuse thle return wth the IRS? See the irstructions for detals. Yes. Designee's narne and phone number Selact a 5 -digit Perscral Identification Nurrber (PIN) to use when talking to the IRS. Sign your name here Date narne here Print your tite here Best daytirne phone Form 941 (Fov. 3-2axx) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started