Answered step by step

Verified Expert Solution

Question

1 Approved Answer

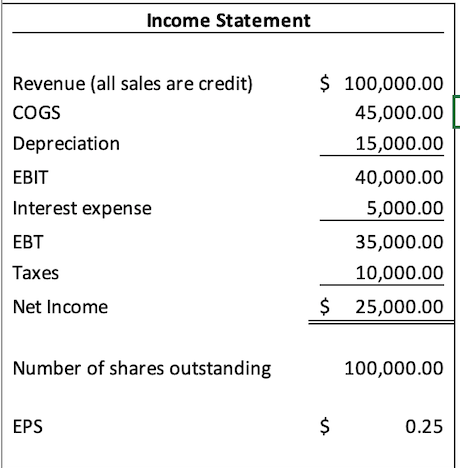

Are the calculation of these ratios correct? Income Statement Revenue (all sales are credit) COGS Depreciation EBIT $ 100,000.00 45,000.00 15,000.00 40,000.00 5,000.00 Interest expense

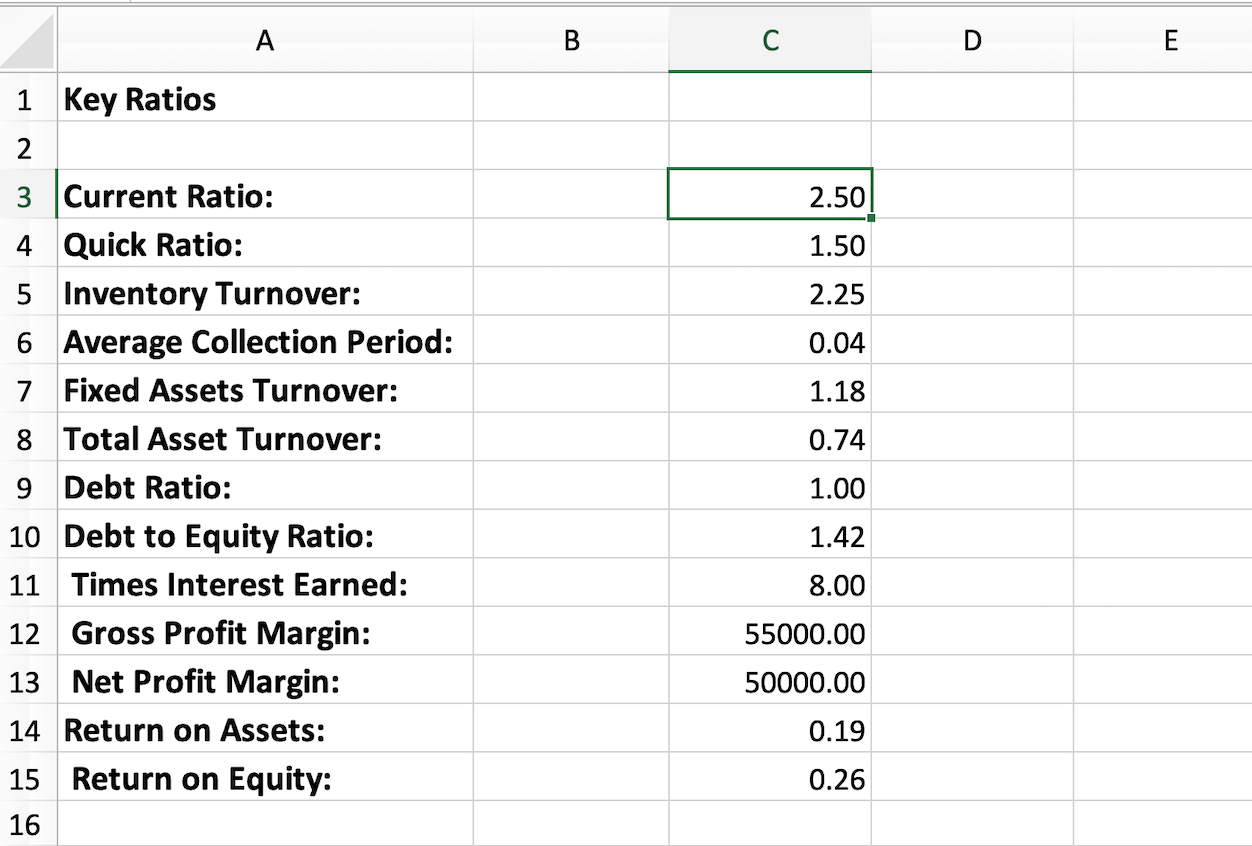

Are the calculation of these ratios correct?

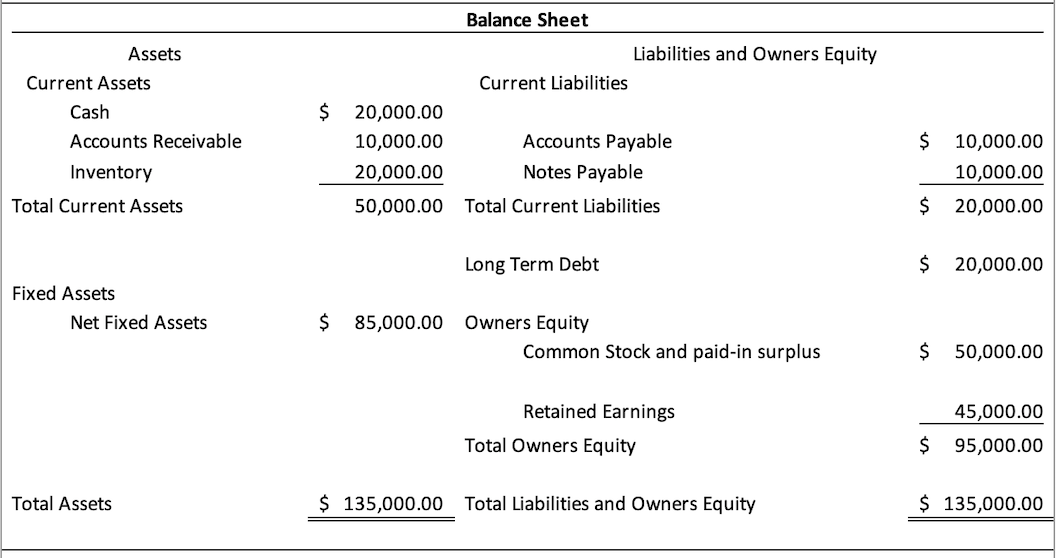

Income Statement Revenue (all sales are credit) COGS Depreciation EBIT $ 100,000.00 45,000.00 15,000.00 40,000.00 5,000.00 Interest expense EBT Taxes 35,000.00 10,000.00 25,000.00 Net Income $ Number of shares outstanding 100,000.00 EPS $ 0.25 Balance Sheet Liabilities and Owners Equity Current Liabilities $ Assets Current Assets Cash Accounts Receivable Inventory Total Current Assets $ 20,000.00 10,000.00 20,000.00 50,000.00 Accounts Payable Notes Payable Total Current Liabilities 10,000.00 10,000.00 20,000.00 $ Long Term Debt $ 20,000.00 Fixed Assets Net Fixed Assets $ 85,000.00 Owners Equity Common Stock and paid-in surplus $ 50,000.00 Retained Earnings Total Owners Equity 45,000.00 95,000.00 $ Total Assets $ 135,000.00 Total Liabilities and Owners Equity $ 135,000.00 1 Key Ratios wn 2.500 1.50 2.25 0.04 1.18 0.74 000 1.00 3 Current Ratio: 4 Quick Ratio: 5 Inventory Turnover: 6 Average Collection Period: 7 Fixed Assets Turnover: 8 Total Asset Turnover: 9 Debt Ratio: Debt to Equity Ratio: 11 Times Interest Earned: 12 Gross Profit Margin: 13 Net Profit Margin: 14 Return on Assets: 15 Return on Equity: 16 1.42 8.00 55000.00 50000.00 0.19 0.26Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started