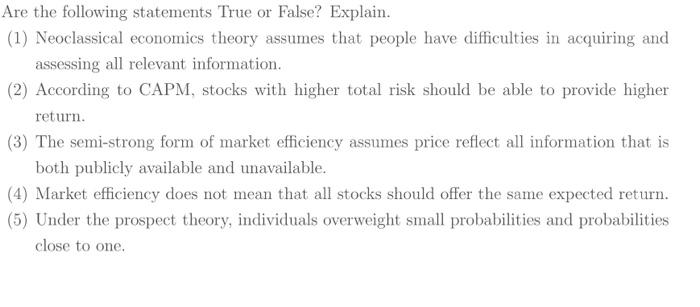

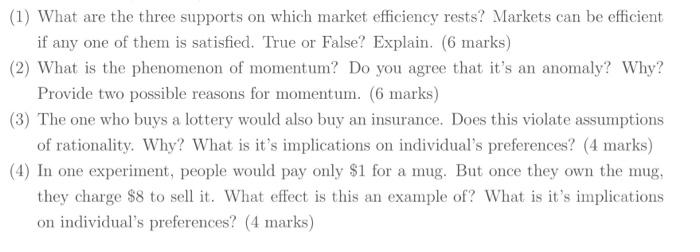

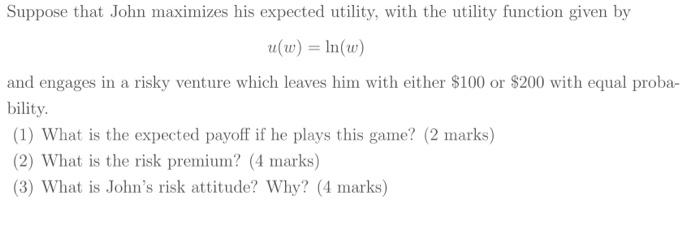

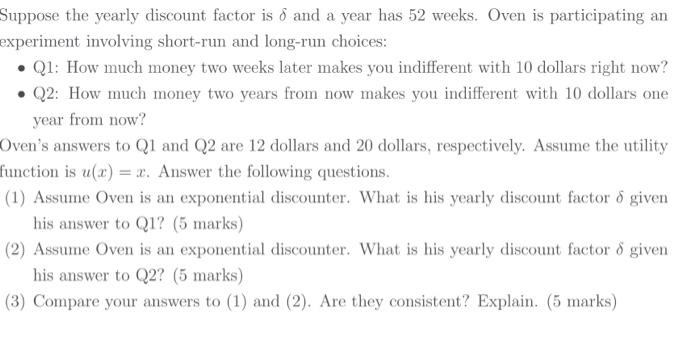

Are the following statements True or False? Explain. (1) Neoclassical economics theory assumes that people have difficulties in acquiring and assessing all relevant information. (2) According to CAPM, stocks with higher total risk should be able to provide higher return. (3) The semi-strong form of market efficiency assumes price reflect all information that is both publicly available and unavailable. (4) Market efficiency does not mean that all stocks should offer the same expected return. (5) Under the prospect theory, individuals overweight small probabilities and probabilities close to one. (1) What are the three supports on which market efficiency rests? Markets can be efficient if any one of them is satisfied. True or False? Explain. (6 marks) (2) What is the phenomenon of momentum? Do you agree that it's an anomaly? Why? Provide two possible reasons for momentum. (6 marks) (3) The one who buys a lottery would also buy an insurance. Does this violate assumptions of rationality. Why? What is it's implications on individual's preferences? (4 marks) (4) In one experiment, people would pay only $1 for a mug. But once they own the mug, they charge $8 to sell it. What effect is this an example of? What is it's implications on individual's preferences? (4 marks) u(w)=ln(w) and engages in a risky venture which leaves him with either $100 or $200 with equal probability. (1) What is the expected payoff if he plays this game? (2 marks) (2) What is the risk premium? (4 marks) (3) What is John's risk attitude? Why? (4 marks) Suppose the yearly discount factor is and a year has 52 weeks. Oven is participating an experiment involving short-run and long-run choices: - Q1: How much money two weeks later makes you indifferent with 10 dollars right now? - Q2: How much money two years from now makes you indifferent with 10 dollars one year from now? Oven's answers to Q1 and Q2 are 12 dollars and 20 dollars, respectively. Assume the utility function is u(x)=x. Answer the following questions. (1) Assume Oven is an exponential discounter. What is his yearly discount factor given his answer to Q1? (5 marks) (2) Assume Oven is an exponential discounter. What is his yearly discount factor given his answer to Q2? (5 marks) (3) Compare your answers to (1) and (2). Are they consistent? Explain