Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Are the following statements true or false? Given your reasons. a ) In a portfolio of two assets, diversification will not work if the two

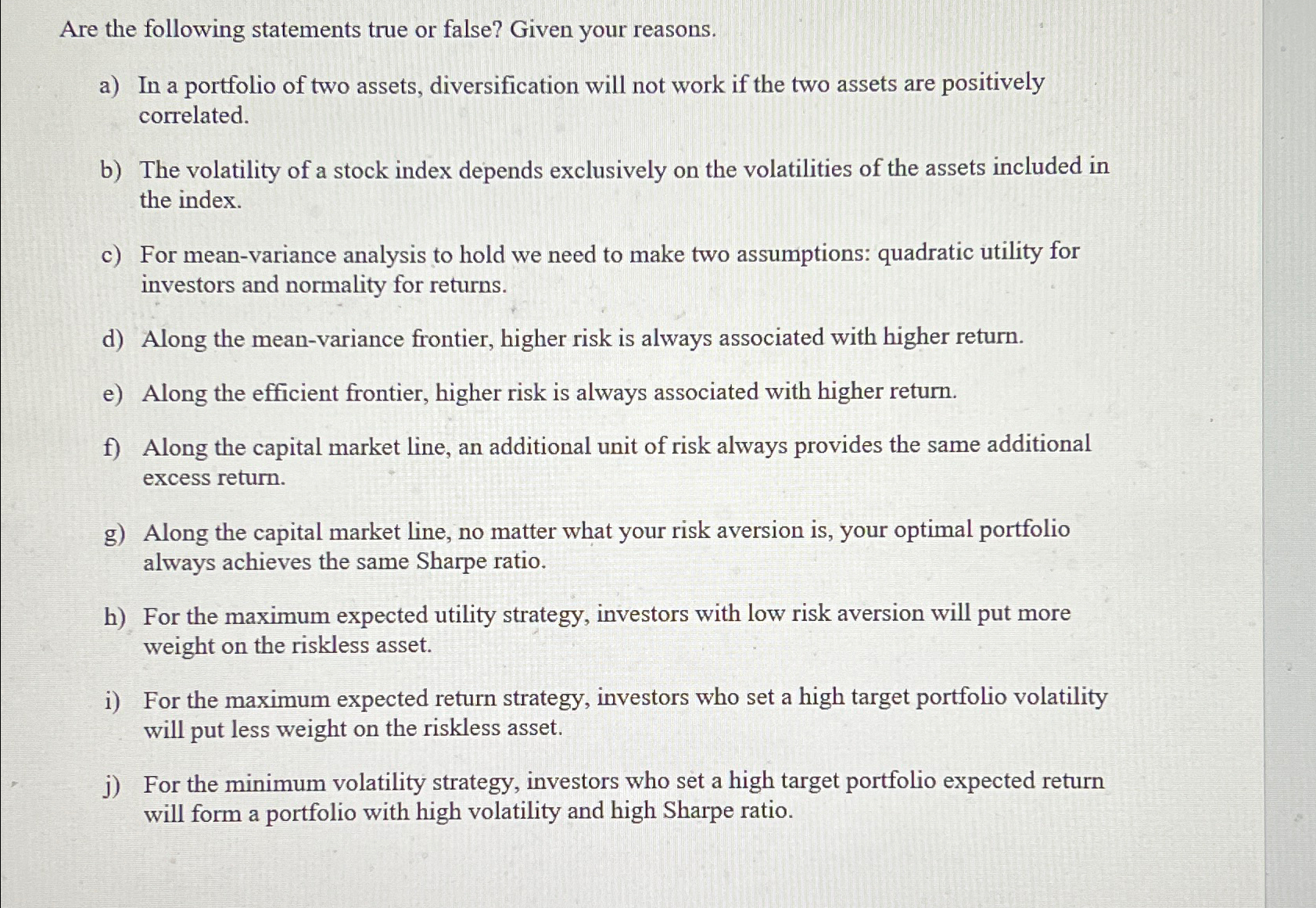

Are the following statements true or false? Given your reasons.

a In a portfolio of two assets, diversification will not work if the two assets are positively correlated.

b The volatility of a stock index depends exclusively on the volatilities of the assets included in the index.

c For meanvariance analysis to hold we need to make two assumptions: quadratic utility for investors and normality for returns.

d Along the meanvariance frontier, higher risk is always associated with higher return.

e Along the efficient frontier, higher risk is always associated with higher return.

f Along the capital market line, an additional unit of risk always provides the same additional excess return.

g Along the capital market line, no matter what your risk aversion is your optimal portfolio always achieves the same Sharpe ratio.

h For the maximum expected utility strategy, investors with low risk aversion will put more weight on the riskless asset.

i For the maximum expected return strategy, investors who set a high target portfolio volatility will put less weight on the riskless asset.

j For the minimum volatility strategy, investors who set a high target portfolio expected return will form a portfolio with high volatility and high Sharpe ratio.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started