Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are the junior analyst of a firm which wants to invest in a company that in addition to high financial performance is also

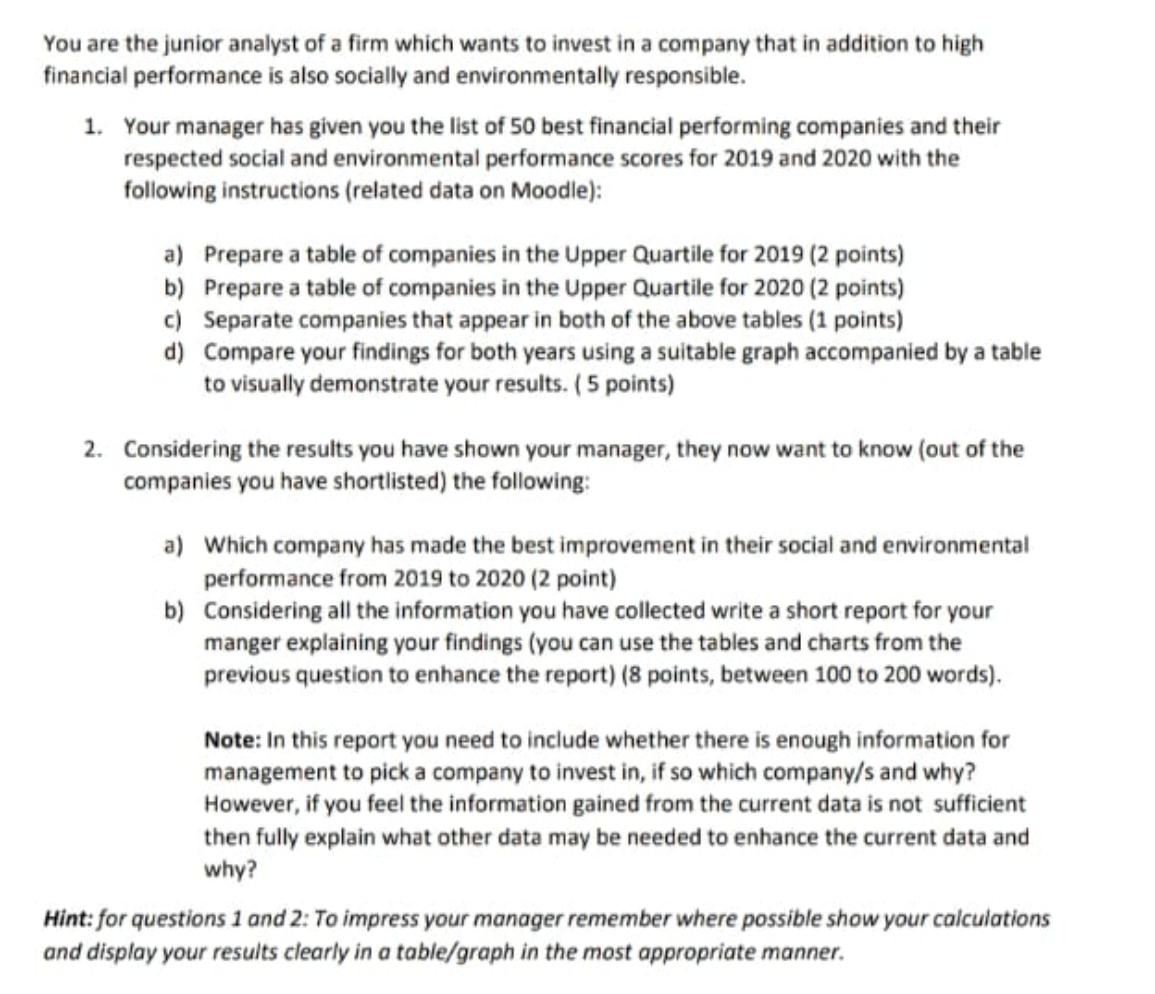

You are the junior analyst of a firm which wants to invest in a company that in addition to high financial performance is also socially and environmentally responsible. 1. Your manager has given you the list of 50 best financial performing companies and their respected social and environmental performance scores for 2019 and 2020 with the following instructions (related data on Moodle): a) Prepare a table of companies in the Upper Quartile for 2019 (2 points) b) Prepare a table of companies in the Upper Quartile for 2020 (2 points) c) Separate companies that appear in both of the above tables (1 points) d) Compare your findings for both years using a suitable graph accompanied by a table to visually demonstrate your results. (5 points) 2. Considering the results you have shown your manager, they now want to know (out of the companies you have shortlisted) the following: a) Which company has made the best improvement in their social and environmental performance from 2019 to 2020 (2 point) b) Considering all the information you have collected write a short report for your manger explaining your findings (you can use the tables and charts from the previous question to enhance the report) (8 points, between 100 to 200 words). Note: In this report you need to include whether there is enough information for management to pick a company to invest in, if so which company/s and why? However, if you feel the information gained from the current data is not sufficient then fully explain what other data may be needed to enhance the current data and why? Hint: for questions 1 and 2: To impress your manager remember where possible show your calculations and display your results clearly in a table/graph in the most appropriate manner.

Step by Step Solution

★★★★★

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started