Answered step by step

Verified Expert Solution

Question

1 Approved Answer

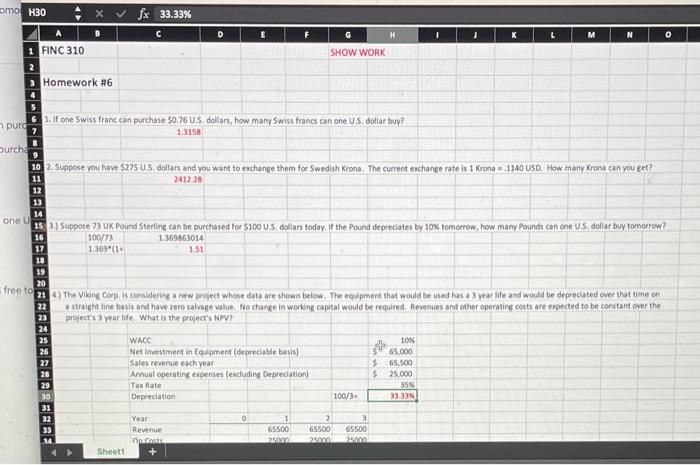

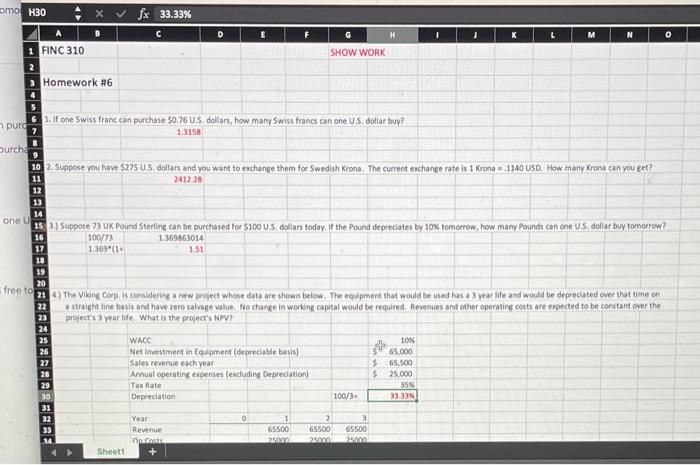

are these answers right? como H30 D H K M 0 X x 33.33% B 1 FINC 310 2 3 Homework #6 4 SHOW WORK

are these answers right?

como H30 D H K M 0 X x 33.33% B 1 FINC 310 2 3 Homework #6 4 SHOW WORK 1. If one Swiss franc can purchase $0.76 US dollars, how many Swiss francs can one U.S. dollar bu? 1.3158 purc 8 Surch 10 2. Suppose you have $275 US dollars and you want to exchange them for Swedish Krona. The current exchange rate is 1 Krona - 1140 USD. How many Krona can you get? 11 241228 12 13 14 one u 15 3.) Suppose 73 UK Pound Sterling can be purchased for $100 US dollars today. If the Pound depreciates by 10% tomorrow, how many Pounds can one U.S. dollar buy tomorrow 16 100/73 1.369863014 17 1.369 151 10 19 20 free to 214) The Viking Corp. is considering a ww project whose data are shown below. The equipment that would be used has a 3 year life and would be depreciated over that time on a straight line basis and have sero salvage value. No change in working capital would be required. Revenues and other operating costs are expected to be constant over the 23 project's year life. What is the project's NPV? 24 25 WACC 10% 26 Net Investment in Equipment (depreciable basis) 65,000 27 Sales revenue each year $ 65,500 28 Annual operating expenses (excluding Depreciation) 5 25,000 29 Tax Rate 35% Depreciation 100/3 333 % 6 7 30 31 0 Year Revenue Onian 1 65500 20.00 2 65500 250m 3 65500 35mm Sheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started