Answered step by step

Verified Expert Solution

Question

1 Approved Answer

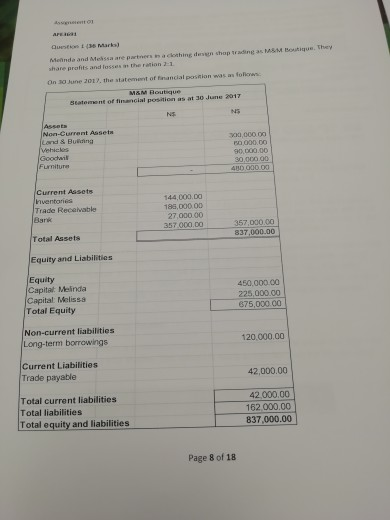

areas Mennda and Messsa are partners n acknhing dengn shoptradene 31 M&M Boutique. They hare profits and losses On 30 June 2012. the statement of

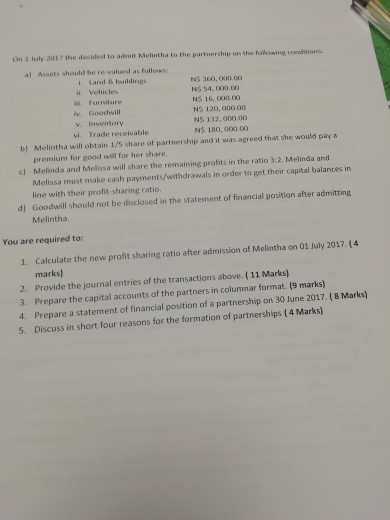

areas Mennda and Messsa are partners n acknhing dengn shoptradene 31 M&M Boutique. They hare profits and losses On 30 June 2012. the statement of financial postion was as foFlow Statement of financial position as at 30 June 2017 3000,000.00 e0 000.00 144,000.00 188,000 00 27,000.00 357 000.00 Trade Recelwable Bark 357,000.00 837,000.00 Total Assets Equity and Liabilities Equity Capital Melinda 450,000.00 225,000.00 875,000.00 Capital: Melissa Total Equity Non-current liabilities Long-term borrowings 120,000.00 Current Liabilities Trade payable 42,000.00 Total current liabilities Total liabilities Total equity and liabilities 42000.00 162,000.00 837,000.00 Page 8 of 118 On 1 luly 20187 the decided to adenit Mclintha to the partnership on the folowing condtions. a) Assets should be re-valued as follows i Land &buildings NS 360,000.00 NS 54, 00.00 NS 16, 000.00 NS 120, 000.00 N$ 132,000.00 NS 180, 000.00 Vehicles i Goodwill v. Inventory vi Trade receivable b) Melintha will obtain 1/5 share of partnership and it was agreed that she would pay a premium for good will for her share. cl Melinda and Melissa will share the remaining profits in the ratio 3:2. Melinda and Melissa must make cash payments/withdrawals in order to get their capital balances in line with their profit-sharing ratio. Goodwill should not be disclosed in the statement of financial position after admitting dl Melintha. You are required to Calculate the new profit sharing ratio after admission of Melintha on 01 July 2017.(4 marks) Provide the journal entries of the transactions above. ( 11 Marks) Prepare the capital accounts of the partners in columnar format. (9 marks) Prepare a statement of financial position of a partnership on 30 lune 2017.(8 Marks) Discuss in short four reasons for the formation of partnerships (4 Marks) 1. 2. 3. 4. 5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started