Answered step by step

Verified Expert Solution

Question

1 Approved Answer

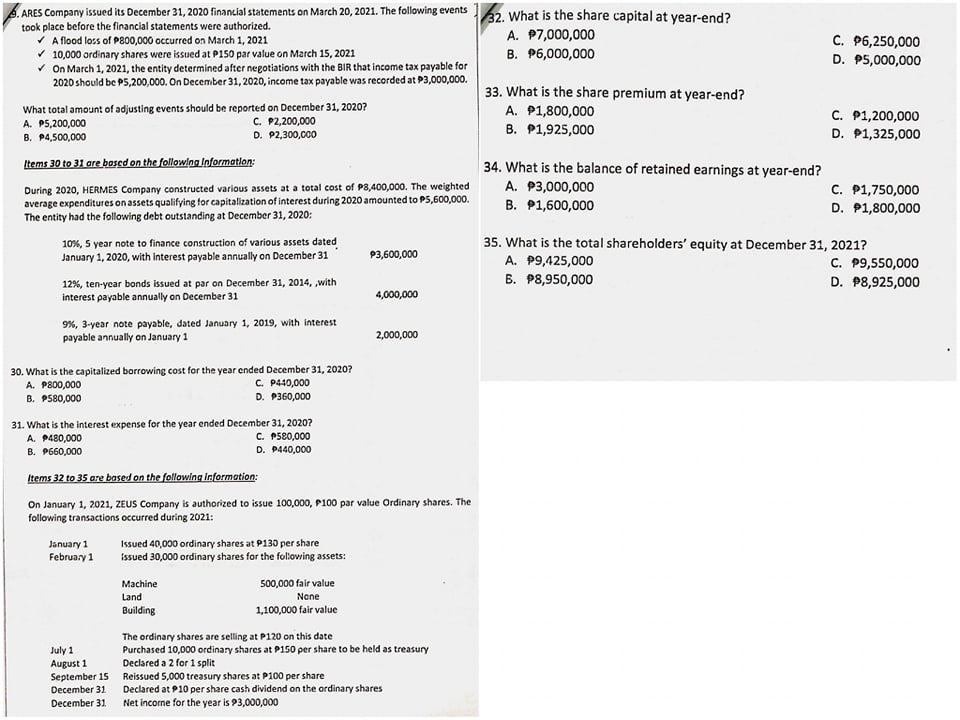

ARES Company issued its December 31, 2020 financial statements on March 20, 2021. The following events took place before the financial statements were authorized.

ARES Company issued its December 31, 2020 financial statements on March 20, 2021. The following events took place before the financial statements were authorized. A flood loss of P800,000 occurred on March 1, 2021 10,000 ordinary shares were issued at P150 par value on March 15, 2021 On March 1, 2021, the entity determined after negotiations with the BIR that income tax payable for 2020 should be P5,200,000. On December 31, 2020, income tax payable was recorded at P3,000,000. What total amount of adjusting events should be reported on December 31, 2020? 32. What is the share capital at year-end? A. $7,000,000 B. P6,000,000 A. P5,200,000 B. $4,500,000 Items 30 to 31 are based on the following Information: C. $2,200,000 D. 92,300,000 During 2020, HERMES Company constructed various assets at a total cost of P8,400,000. The weighted average expenditures on assets qualifying for capitalization of interest during 2020 amounted to P5,600,000. The entity had the following debt outstanding at December 31, 2020: 10%, 5 year note to finance construction of various assets dated January 1, 2020, with interest payable annually on December 31 P3,600,000 C. P6,250,000 D. P5,000,000 33. What is the share premium at year-end? A. P1,800,000 B. P1,925,000 C. P1,200,000 D. P1,325,000 34. What is the balance of retained earnings at year-end? A. P3,000,000 C. P1,750,000 B. $1,600,000 D. $1,800,000 35. What is the total shareholders' equity at December 31, 2021? A. P9,425,000 12%, ten-year bonds issued at par on December 31, 2014,,with interest payable annually on December 31 B. P8,950,000 4,000,000 9%, 3-year note payable, dated January 1, 2019, with interest payable annually on January 1 2,000,000 30. What is the capitalized borrowing cost for the year ended December 31, 2020? A. P800,000 B. 580,000 C. P440,000 D. $360,000 31. What is the interest expense for the year ended December 31, 2020? A. $480,000 B. 9660,000 Items 32 to 35 are based on the following information: C. P580,000 D. P440,000 On January 1, 2021, ZEUS Company is authorized to issue 100,000, P100 par value Ordinary shares. The following transactions occurred during 2021: January 1 February 1 Issued 40,000 ordinary shares at P130 per share issued 30,000 ordinary shares for the following assets: July 1 August 1 Machine Land Building 500,000 fair value None 1,100,000 fair value The ordinary shares are selling at P120 on this date Purchased 10,000 ordinary shares at P150 per share to be held as treasury Declared a 2 for 1 split September 15 Reissued 5,000 treasury shares at P100 per share Declared at P10 per share cash dividend on the ordinary shares December 31 December 31. Net income for the year is 93,000,000 C. P9,550,000 D. P8,925,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started