Answered step by step

Verified Expert Solution

Question

1 Approved Answer

RIVER STYX Company is an experienced home appliance dealer. RIVER STYX Company also offers a number of services together with the home appliances that

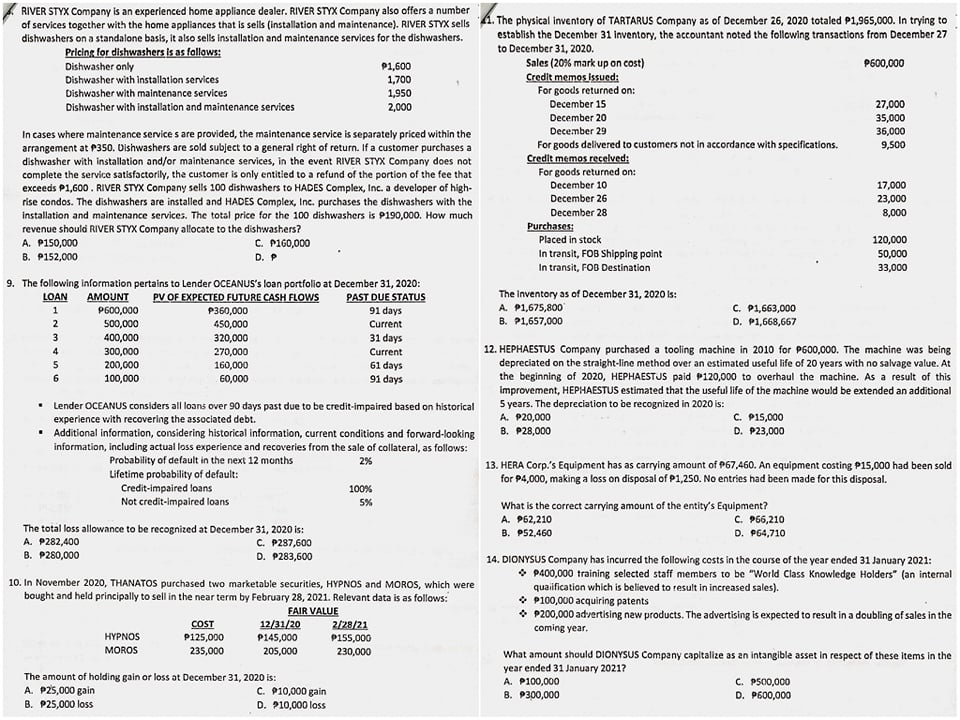

RIVER STYX Company is an experienced home appliance dealer. RIVER STYX Company also offers a number of services together with the home appliances that is sells (installation and maintenance). RIVER STYX sells dishwashers on a standalone basis, it also sells installation and maintenance services for the dishwashers. Pricing for dishwashers is as follows: Dishwasher only Dishwasher with installation services Dishwasher with maintenance services Dishwasher with installation and maintenance services P1,600 1,700 1,950 2,000 In cases where maintenance services are provided, the maintenance service is separately priced within the arrangement at P350. Dishwashers are sold subject to a general right of return. If a customer purchases a dishwasher with installation and/or maintenance services, in the event RIVER STYX Company does not complete the service satisfactorily, the customer is only entitled to a refund of the portion of the fee that exceeds P1,600. RIVER STYX Company sells 100 dishwashers to HADES Complex, Inc. a developer of high- rise condos. The dishwashers are installed and HADES Complex, Inc. purchases the dishwashers with the installation and maintenance services. The total price for the 100 dishwashers is P190,000. How much revenue should RIVER STYX Company allocate to the dishwashers? A. P150,000 B. P152,000 C. P160,000 D. P 9. The following information pertains to Lender OCEANUS's loan portfolio at December 31, 2020: LOAN AMOUNT PV OF EXPECTED FUTURE CASH FLOWS The physical inventory of TARTARUS Company as of December 26, 2020 totaled P1,965,000. In trying to establish the December 31 inventory, the accountant noted the following transactions from December 27 to December 31, 2020. Sales (20% mark up on cost) Credit memos issued: $600,000 For goods returned on: December 15 27,000 December 20 35,000 December 29 36,000 For goods delivered to customers not in accordance with specifications. 9,500 Credit memos received: For goods returned on: December 10 December 26 December 28 Purchases: Placed in stock In transit, FOB Shipping point In transit, FOB Destination The inventory as of December 31, 2020 Is: 17,000 23,000 8,000 120,000 50,000 33,000 1 P600,000 2 500,000 3 400,000 4 300,000 5 200,000 6 100,000 P360,000 450,000 320,000 270,000 160,000 60,000 PAST DUE STATUS 91 days Current 31 days Current 61 days 91 days A. P1,675,800 B. P1,657,000 Lender OCEANUS considers all loans over 90 days past due to be credit-impaired based on historical experience with recovering the associated debt. Additional information, considering historical information, current conditions and forward-looking information, including actual loss experience and recoveries from the sale of collateral, as follows: Probability of default in the next 12 months Lifetime probability of default: Credit-impaired loans Not credit-impaired loans The total loss allowance to be recognized at December 31, 2020 is: 2% 100% 5% C. P1,663,000 D. P1,668,667 12. HEPHAESTUS Company purchased a tooling machine in 2010 for P600,000. The machine was being depreciated on the straight-line method over an estimated useful life of 20 years with no salvage value. At the beginning of 2020, HEPHAESTUS paid $120,000 to overhaul the machine. As a result of this Improvement, HEPHAESTUS estimated that the useful life of the machine would be extended an additional 5 years. The depreciation to be recognized in 2020 is: A. P20,000 B. P28,000 C. P15,000 D. P23,000 13. HERA Corp.'s Equipment has as carrying amount of P67,460. An equipment costing P15,000 had been sold for $4,000, making a loss on disposal of P1,250. No entries had been made for this disposal. What is the correct carrying amount of the entity's Equipment? A. 62,210 B. P52,460 C. 66,210 D. 964,710 A. P282,400 B. P280,000 C. P287,600 D. P283,600 10. In November 2020, THANATOS purchased two marketable securities, HYPNOS and MOROS, which were bought and held principally to sell in the near term by February 28, 2021. Relevant data is as follows: HYPNOS MOROS COST P125,000 235,000 FAIR VALUE 12/31/20 P145,000 205,000 The amount of holding gain or loss at December 31, 2020 is: A. P25,000 gain B. P25,000 loss C. P10,000 gain D. 10,000 loss 2/28/21 P155,000 230,000 14. DIONYSUS Company has incurred the following costs in the course of the year ended 31 January 2021: + P400,000 training selected staff members to be "World Class Knowledge Holders" (an internal qualification which is believed to result in increased sales). P100,000 acquiring patents P200,000 advertising new products. The advertising is expected to result in a doubling of sales in the coming year. What amount should DIONYSUS Company capitalize as an intangible asset in respect of these items in the year ended 31 January 2021? A. P100,000 B. P300,000 C. P500,000 D. 9600,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started