Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Argentine Float. The Argentine peso was fixed through a currency board at Ps 1.00=$1.00 throughout the 1990 s. In January 2002, the Argentine peso was

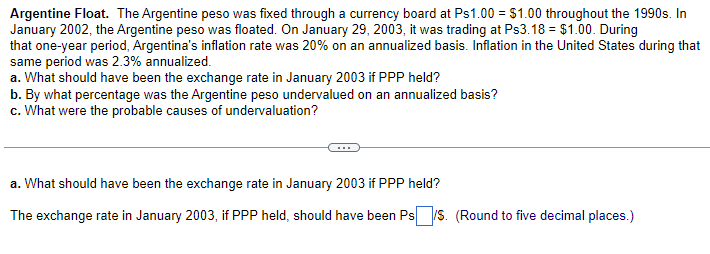

Argentine Float. The Argentine peso was fixed through a currency board at Ps 1.00=$1.00 throughout the 1990 s. In January 2002, the Argentine peso was floated. On January 29,2003 , it was trading at Ps 3.18=$1.00. During that one-year period, Argentina's inflation rate was 20% on an annualized basis. Inflation in the United States during that same period was 2.3% annualized. a. What should have been the exchange rate in January 2003 if PPP held? b. By what percentage was the Argentine peso undervalued on an annualized basis? c. What were the probable causes of undervaluation? a. What should have been the exchange rate in January 2003 if PPP held? The exchange rate in January 2003, if PPP held, should have been Ps 1\$. (Round to five decimal places.)

Argentine Float. The Argentine peso was fixed through a currency board at Ps 1.00=$1.00 throughout the 1990 s. In January 2002, the Argentine peso was floated. On January 29,2003 , it was trading at Ps 3.18=$1.00. During that one-year period, Argentina's inflation rate was 20% on an annualized basis. Inflation in the United States during that same period was 2.3% annualized. a. What should have been the exchange rate in January 2003 if PPP held? b. By what percentage was the Argentine peso undervalued on an annualized basis? c. What were the probable causes of undervaluation? a. What should have been the exchange rate in January 2003 if PPP held? The exchange rate in January 2003, if PPP held, should have been Ps 1\$. (Round to five decimal places.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started