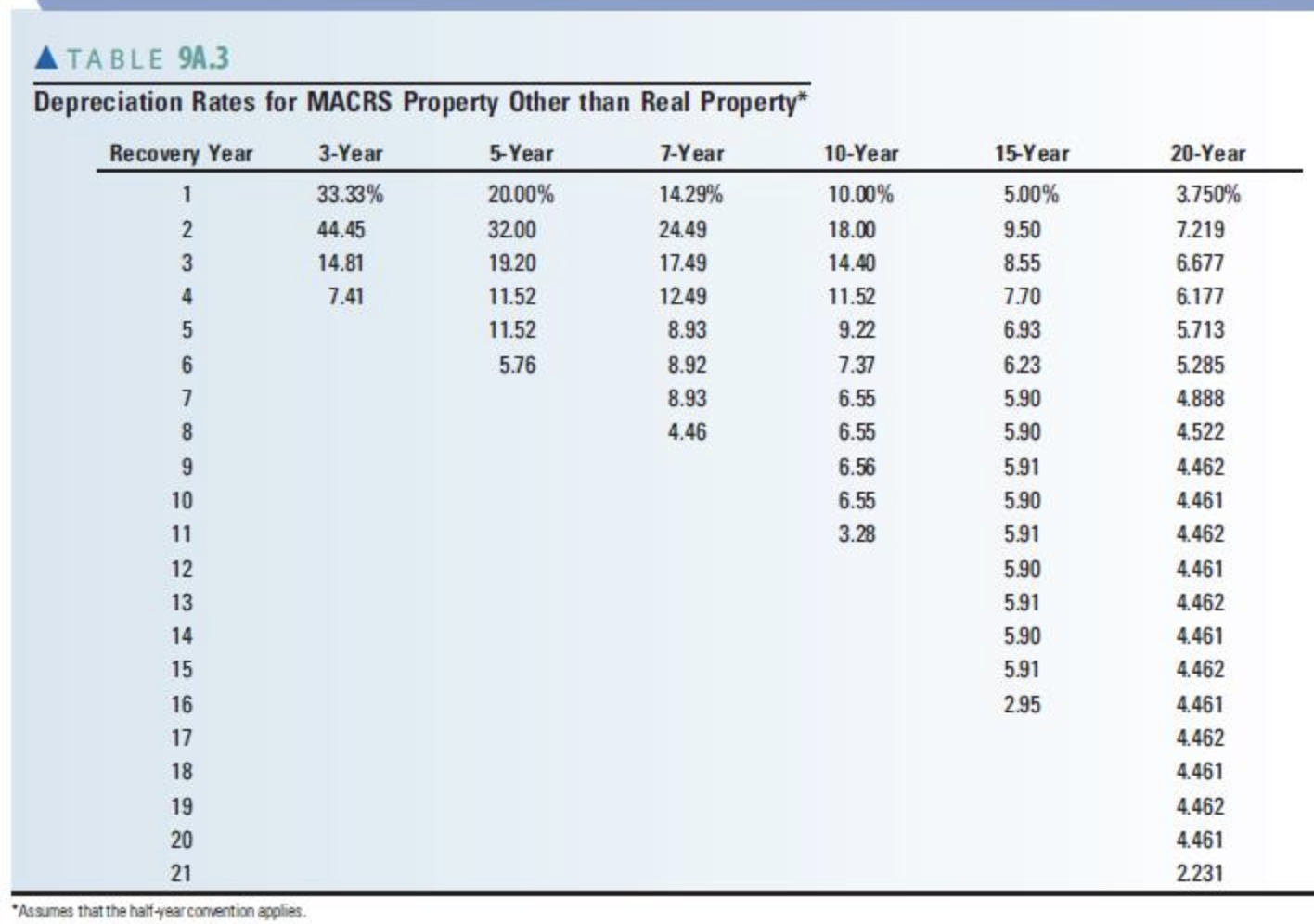

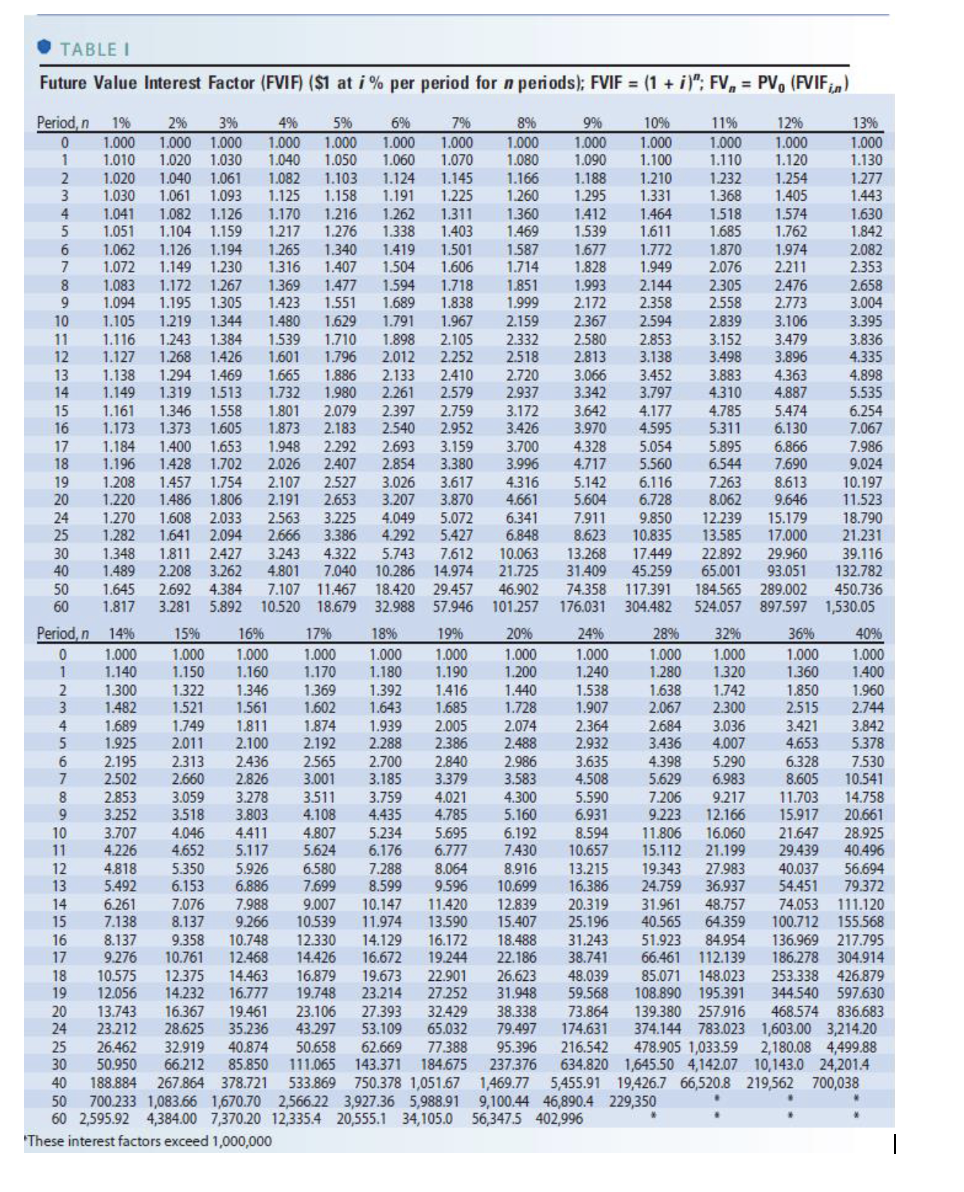

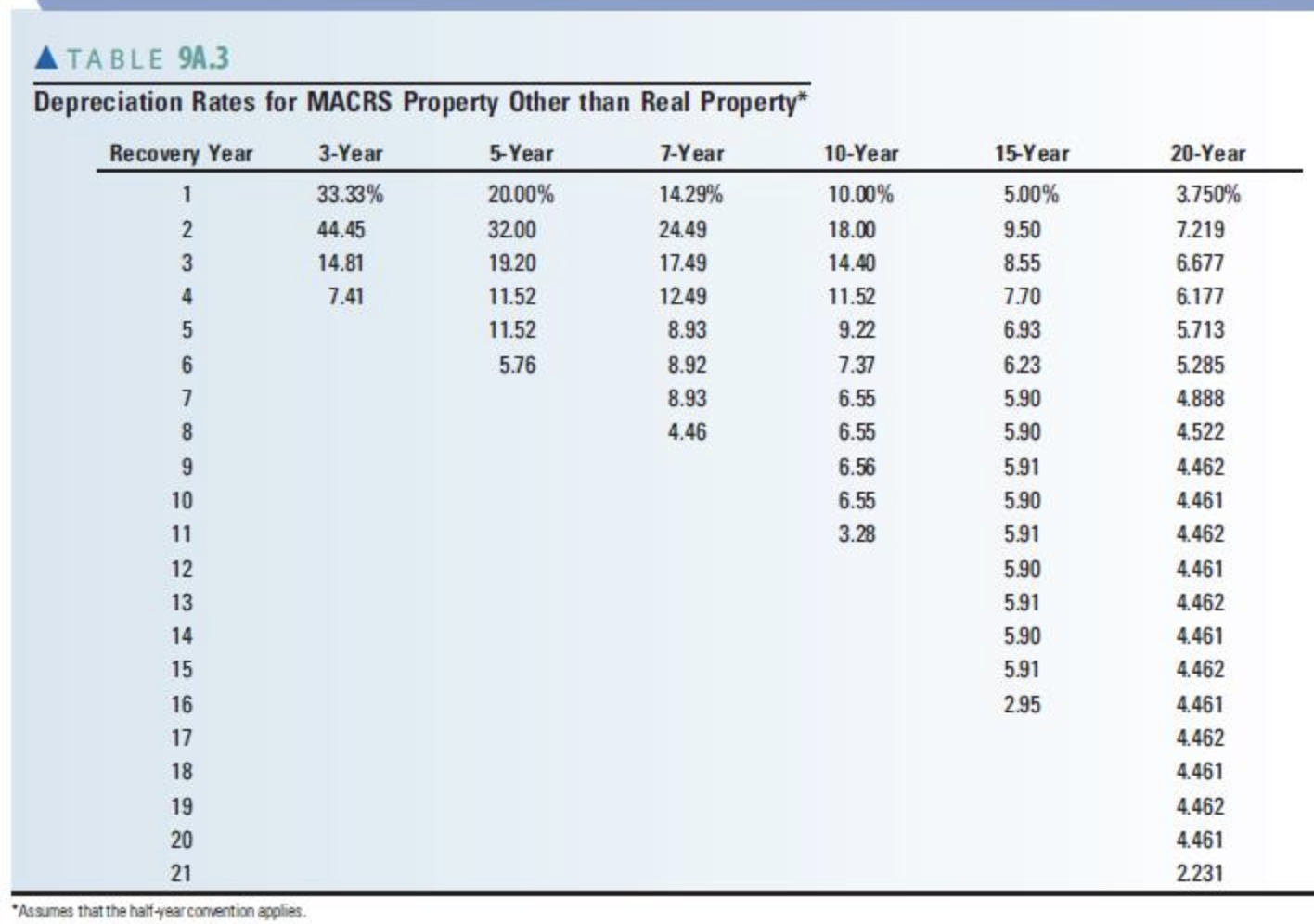

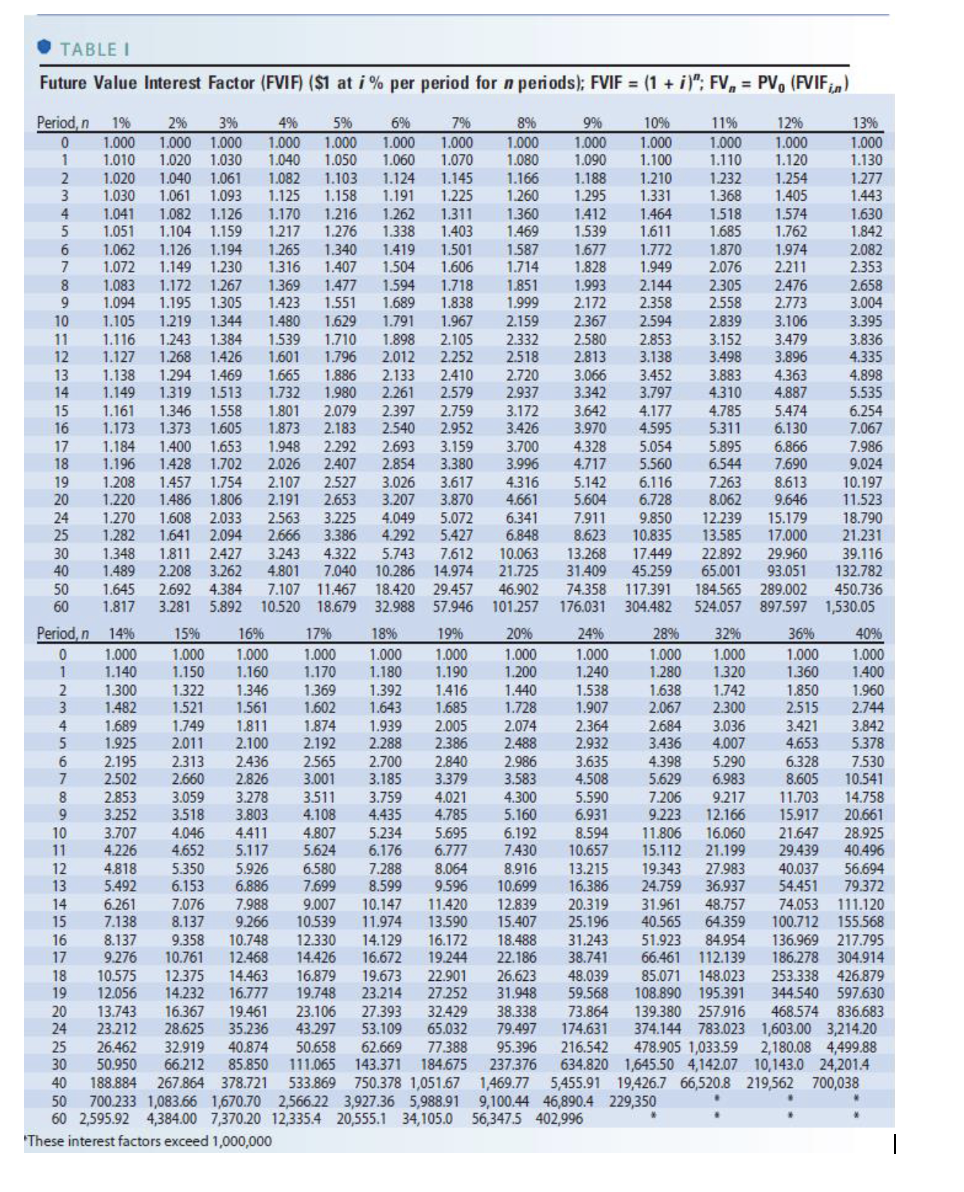

Argyl Manufacturing is evaluating the possibility of expanding its operations. This expansion will require the purchase of land at a cost of $130,000. A new building will cost $100,000 and will be depreciated on a straight-line basis over 25 years to a salvage value of $0. Actual land salvage at the end of 25 years is expected to be $210,000. Actual building salvage at the end of 25 years is expected to be $130,000. Equipment for the facility is expected to cost $210,000. Installation costs will be an additional $50,000 and shipping costs will be $9,000. This equipment will be depreciated as a 7-year MACRS asset. Actual estimated salvage at the end of 25 years is $0. The project will require net working capital of $55,000 initially (year 0), an additional $30,000 at the end of year 1, and an additional $30,000 at the end of year 2. The project is expected to generate increased EBIT (operating income) for the firm of $90,000 during year 1. Annual EBIT is expected to grow at a rate of 8 percent per year until the project terminates at the end of year 25. The marginal tax rate is 40 percent. Use Table 9A-3 and Table I to answer the questions below. Round your answers to the nearest dollar.

A. Compute the initial net investment.

$_______

B. Compute the annual net cash flow from the project in year 25.

$ _______

TABLE 9A.3 Depreciation Rates for MACRS Property Other than Real Property* Recovery Year 3-Year 5-Year 7-Year 1 33.33% 20.00% 14.29% 2 44.45 3200 24.49 3 14.81 19.20 17.49 4 7.41 11.52 1249 5 11.52 8.93 6 5.76 8.92 7 8.93 8 4.46 9 10 11 12 13 14 15 16 17 18 19 20 21 10-Year 10.00% 18.00 14.40 11.52 9.22 7.37 6.55 6.55 6.56 6.55 3.28 15-Year 5.00% 9.50 8.55 7.70 6.93 6.23 5.90 5.90 5.91 5.90 5.91 5.90 5.91 5.90 5.91 2.95 20-Year 3.750% 7.219 6.677 6.177 5713 5.285 4.888 4.522 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 2.231 *Assumes that the half-year convention applies TABLET Future Value Interest Factor (FVIF) ($1 at i % per period for n periods); FVIF = (1 + i)"; FV, = PV, (FVIFin) 1.677 2.367 3.106 11.467 Period, 19 2% 39 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 0 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1 1.010 1.020 1.030 1.040 1.050 1.060 1.070 1.080 1.090 1.100 1.110 1.120 1.130 2 1.020 1.040 1.061 1.082 1.103 1.124 1.145 1.166 1.188 1.210 1.232 1.254 1.277 3 1.030 1.061 1.093 1.125 1.158 1.191 1.225 1.260 1.295 1.331 1.368 1.405 1.443 4 1.041 1.082 1.126 1.170 1.216 1.262 1.311 1.360 1.412 1.464 1.518 1.574 1.630 5 1.051 1.104 1.159 1.217 1.276 1.338 1.403 1.469 1.539 1.611 1.685 1.762 1.842 6 1.062 1.126 1.194 1.265 1.340 1.419 1.501 1.587 1.772 1.870 1.974 2.082 7 1.072 1.149 1.230 1.316 1.407 1,504 1.606 1.714 1.828 1.949 2.076 2.211 2.353 8 1.083 1.172 1.267 1.369 1.477 1.594 1.718 1.851 1.993 2.144 2.305 2.476 2.658 9 1.094 1.195 1.305 1.423 1.551 1.689 1.838 1.999 2.172 2.358 2.558 2.773 3.004 10 1.105 1.219 1.344 1.480 1.629 1.791 1.967 2.159 2.594 2.839 3.395 11 1.116 1.243 1.384 1.539 1.710 1.898 2.105 2.332 2.580 2.853 3.152 3.479 3.836 12 1.127 1.268 1.426 1.601 1.796 2.012 2.252 2.518 2.813 3.138 3.498 3.896 4.335 13 1.138 1.294 1.469 1.665 1.886 2.133 2.410 2.720 3.066 3.452 3.883 4.363 4.898 14 1.149 1.319 1.513 1.732 1.980 2.261 2.579 2.937 3.342 3.797 4.310 4.887 5.535 15 1.161 1.346 1.558 1.801 2.079 2.397 2.759 3.172 3.642 4.177 4.785 5.474 6.254 16 1.173 1.373 1.605 1.873 2.183 2.540 2.952 3.426 3.970 4.595 5.311 6.130 7.067 17 1.184 1.400 1.653 1.948 2.292 2.693 3.159 3.700 4.328 5.054 5.895 6.866 7.986 18 1.196 1.428 1.702 2.026 2.407 2.854 3.380 3.996 4.717 5.560 6.544 7.690 9.024 19 1.208 1.457 1.754 2.107 2.527 3.026 3.617 4.316 5.142 6.116 7.263 8.613 10.197 20 1.220 1.486 1.806 2.191 2.653 3.207 3.870 4.661 5.604 6.728 8.062 9.646 11.523 24 1.270 1.608 2.033 2.563 3.225 4.049 5.072 6.341 7.911 9.850 12.239 15.179 18.790 25 1.282 1.641 2.094 2.666 3.386 4.292 5.427 6.848 8.623 10.835 13.585 17.000 21.231 30 1.348 1.811 2.427 3.243 4.322 5.743 7.612 10.063 13.268 17.449 22.892 29.960 39.116 40 1.489 2.208 3.262 4.801 7.040 10.286 14.974 21.725 31.409 45.259 65.001 93.051 132.782 50 1.645 2.692 4.384 7.107 18.420 29.457 46.902 74.358 117.391 184.565 289.002 450.736 60 1.817 3.281 5.892 10.520 18.679 32.988 57.946 101.257 176.031 304.482 524.057 897.597 1,530.05 Period, n 14% 15% 16% 17% 18% 19% 20% 24% 28% 32% 36% 40% 0 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1 1.140 1.150 1.160 1.170 1.180 1.190 1.200 1.240 1.280 1.320 1.360 1.400 2 1.300 1.322 1.346 1.369 1.392 1.416 1.440 1.538 1.638 1.742 1.850 1.960 3 1.482 1.521 1.561 1.602 1.643 1.685 1.728 1.907 2.067 2.300 2.515 2.744 4 1.689 1.749 1.811 1.874 1.939 2.005 2.074 2.364 2.684 3.036 3.421 3.842 5 1.925 2.011 2.100 2.192 2.288 2.386 2.488 2.932 3.436 4.007 4.653 5.378 6 2.195 2.313 2.436 2.565 2.700 2.840 2.986 3.635 4.398 5.290 6.328 7.530 7 2.502 2.660 2.826 3.001 3.185 3.379 3.583 4.508 5.629 6.983 8.605 10.541 8 2.853 3.059 3.278 3.511 3.759 4.021 4.300 5.590 7.206 9.217 11.703 14.758 9 3.252 3.518 3.803 4.108 4.435 4.785 5.160 6.931 9.223 12.166 15.917 20.661 10 3.707 4.046 4.411 4.807 5.234 5.695 6.192 8.594 11.806 16.060 21.647 28.925 11 4.226 4.652 5.117 5.624 6.176 6.777 7.430 10.657 15.112 21.199 29.439 40.496 12 4.818 5.350 5.926 6.580 7.288 8.064 8.916 13.215 19.343 27.983 40.037 56.694 13 5.492 6.153 6.886 7.699 8.599 9.596 10.699 16.386 24.759 36.937 54.451 79.372 14 6.261 7.076 7.988 9.007 10.147 11.420 12.839 20.319 31.961 48.757 74.053 15 7.138 111.120 8.137 9.266 10.539 11.974 13.590 15.407 25.196 40.565 64.359 100.712 155.568 16 8.137 9.358 10.748 12.330 14.129 16.172 18.488 31.243 51.923 84.954 136.969 217.795 17 9.276 10.761 12.468 14.426 16.672 19.244 22.186 38.741 66.461 112.139 186.278 304.914 18 10.575 12.375 14.463 16.879 19.673 22.901 26.623 48.039 85.071 148.023 253.338 12.056 426.879 19 14.232 16.777 19.748 23.214 27.252 31.948 59.568 108.890 195.391 344.540 597.630 20 13.743 16.367 19.461 23.106 27.393 32.429 38.338 73.864 139.380 257.916 468.574 836,683 24 23.212 28.625 35.236 43.297 53.109 65.032 79.497 174.631 374.144 783.023 1,603.00 3,214.20 25 26.462 32.919 40.874 50.658 62.669 77.388 95.396 216.542 478.905 1,033.59 2,180.08 4,499.88 30 50.950 66.212 85.850 111.065 143.371 184.675 237.376 634.820 1,645.50 4,142.07 10.143.0 24,201.4 40 188.884 267.864 378.721 533.869 750.378 1,051.67 1,469.77 5,455.91 19,426.7 66,520.8 219,562 700,038 50 700.233 1,083.66 1,670.70 2,566.223,927.36 5,988.91 9,100.44 46,890.4 229,350 60 2,595.92 4,384.00 7,370.20 12,335.4 20,555.1 34,105.0 56,347.5 402,996 These interest factors exceed 1,000,000