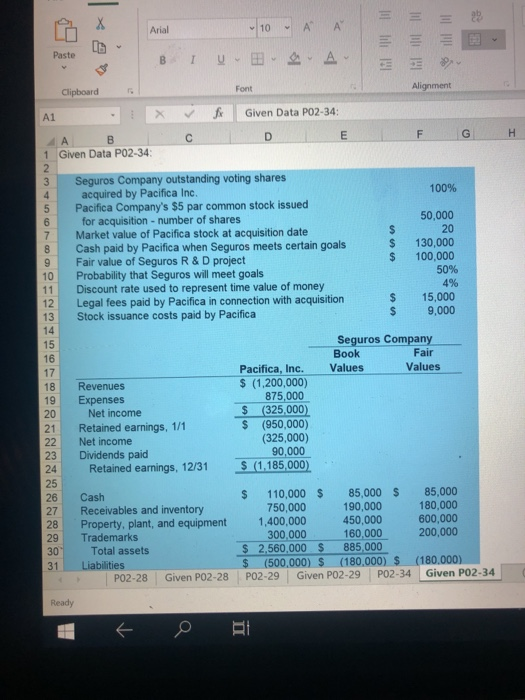

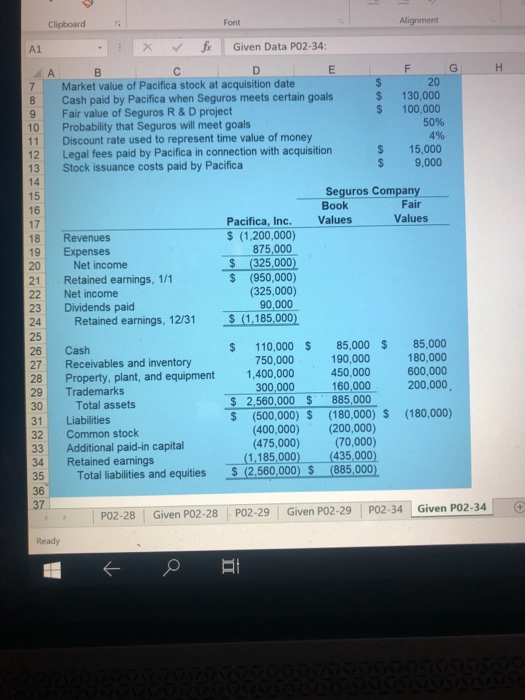

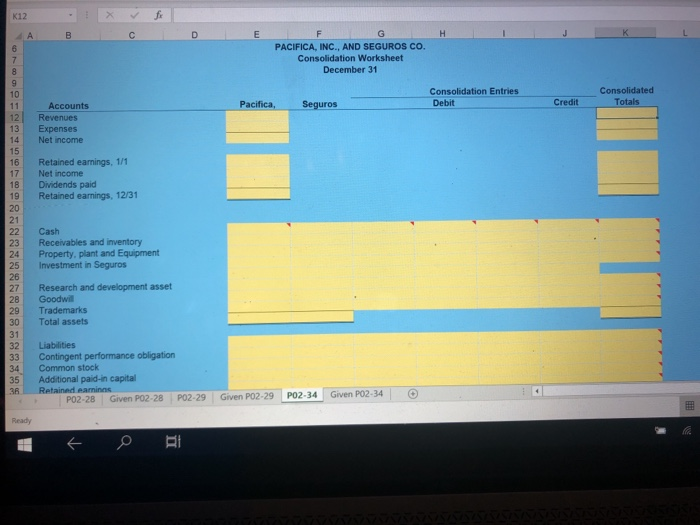

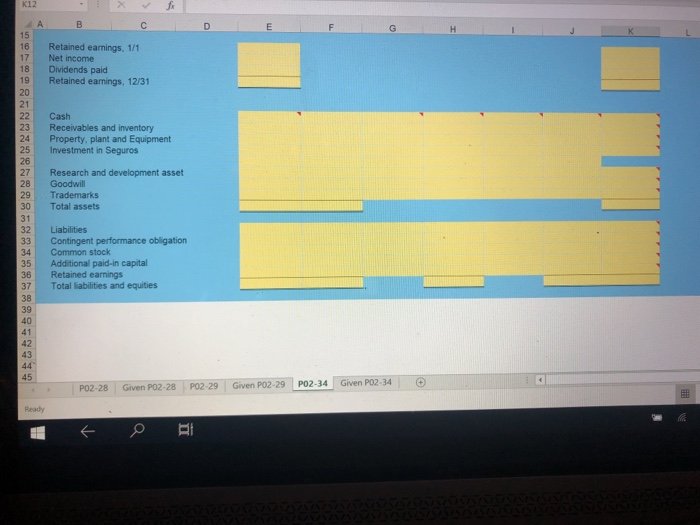

= = = Arial - 10 - A BIU. EA Paste Alignment Clipboard X f Given Data P02-34: F G H A B 1 Given Data P02-34 AN 100% 50,000 20 Seguros Company outstanding voting shares acquired by Pacifica Inc. Pacifica Company's $5 par common stock issued for acquisition - number of shares Market value of Pacifica stock at acquisition date Cash paid by Pacifica when Seguros meets certain goals Fair value of Seguros R & D project Probability that Seguros will meet goals Discount rate used to represent time value of money Legal fees paid by Pacifica in connection with acquisition Stock issuance costs paid by Pacifica 130,000 100,000 50% 4% 15,000 9,000 Seguros Company Book Fair Values Values Revenues Expenses Net income Retained earnings, 1/1 Net income Dividends paid Retained earnings, 12/31 Pacifica, Inc. $ (1,200,000) 875,000 $ (325,000) $ (950,000) (325,000) 90,000 $ (1,185,000) Cash Receivables and inventory Property, plant, and equipment Trademarks Total assets Liabilities PO2-28 Given P02-28 28 29 30 110,000 $ 85,000 $ 750,000 190,000 1,400,000 450,000 300,000 160,000 $ 2,560,000 $ 885,000 $ (500,000) $ (180,000) $ PO2-29 Given PO2-29 PO2-34 85,000 180,000 600,000 200,000 31 (180.000) Given PO2-34 Ready Clipboard Font Alignment fx Given Data PO2-34: G H $ $ $ Market value of Pacifica stock at acquisition date Cash paid by Pacifica when Seguros meets certain goals Fair value of Seguros R & D project Probability that Seguros will meet goals Discount rate used to represent time value of money Legal fees paid by Pacifica in connection with acquisition Stock issuance costs paid by Pacifica F 20 130,000 100,000 50% 4% 15,000 9,000 $ $ Seguros Company Book Fair Values Values Revenues Expenses Net income Retained earnings, 1/1 Net income Dividends paid Retained earnings, 12/31 Pacifica, Inc. $ (1,200,000) 875,000 $ (325,000) $ (950,000) (325,000) 90,000 $ (1,185,000) 85,000 180,000 600,000 200,000 Cash Receivables and inventory Property, plant, and equipment Trademarks Total assets Liabilities Common stock Additional paid-in capital Retained earnings Total liabilities and equities $ 110,000 $ 750,000 1,400,000 300,000 $ 2,560,000 $ $ (500,000) $ (400,000) (475,000) (1,185,000) $ (2,560,000) $ 85,000 $ 190,000 450,000 160,000 885,000 (180,000) $ (200,000) (70,000) (435,000) (885,000) (180,000) 37 PO2-28 Given P02-28 PO2-29 Given P02-29 PO2-34 Given P02-34 Ready G PACIFICA, INC., AND SEGUROS CO. Consolidation Worksheet December 31 Consolidation Entries Debit Consolidated Totals Pacifica Seguros Credit Accounts Revenues Expenses Net income Retained earnings, 1/1 Net income Dividends paid Retained earnings, 12/31 Cash Receivables and inventory Property, plant and Equipment Investment in Seguros Research and development asset Goodwill Trademarks Total assets 35 3 Liabilities Contingent performance obligation Common stock Additional paid-in capital Retained earnings PO2-28 Given PO2-28 PO2-29 Given PO2-29 PO2-34 Given PO2-34 Ready Retained earnings, 1/1 Net income Dividends paid Retained earnings, 12/31 Cash Receivables and inventory Property, plant and Equipment Investment in Seguros Research and development asset Goodwill Trademarks Total assets Liabilities Contingent performance obligation Common stock Additional paid-in capital Retained earnings Total liabilities and equities PO2-28 Given P02-28 PO2-29 Given P02-29 PO2-34 Given PO2-34 Ready