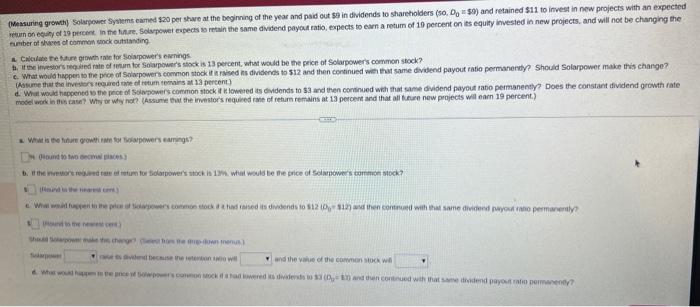

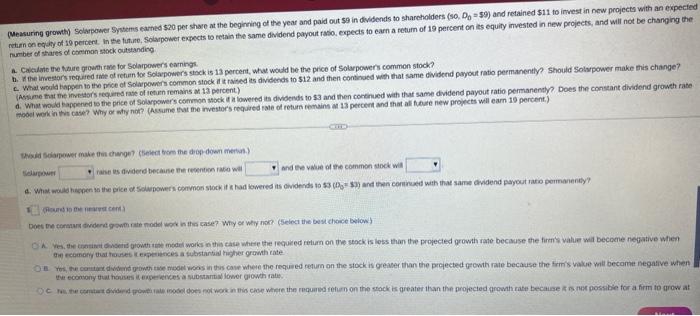

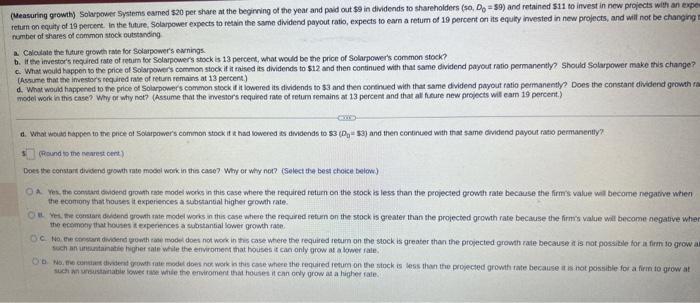

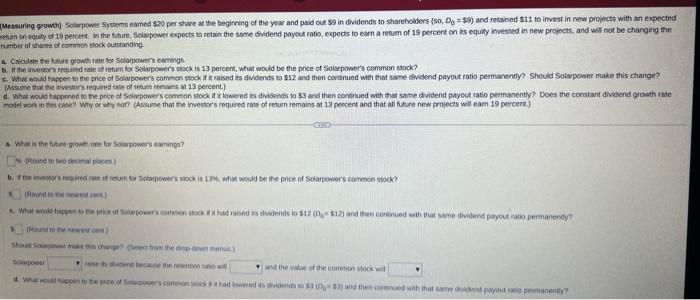

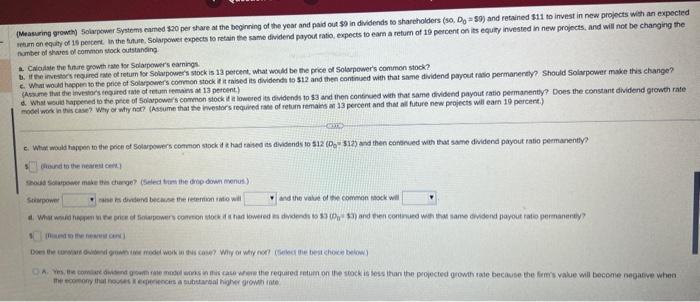

ariber of sheces ol conmen enck outitanding a. Cnculase te hatue groweh rave tor Solarpavers ekenings th. It the investors requied rate of tment to Solapower's sock is 13 percent, what would be the peice of Solarponer's common stock? c. What woild happen to the proe of Solapower common mock it a raised ns divdends to 512 and then continued wht that same dividend payout iatio permanendy? Should Solarpower make this change? 2. What is tof finur gowet rave for bolaponers earings? ws the value od the cowmon siock wi Measuring growtry Solarpover Systems eamed 520 per shwe at the begining of the year and paid out $9 in dividends to shareholders (so, D0=59 ) and retained $111 to imvest in new projecB witn ar netim on equby of to pertore. In the future, Solapower expects to retain the same dividend payout raso. exects to earn a feturn of 19 percert on its equily invested in new projects, and will not be changing the number of shares d coemon sack outsanding a. Cadalate the thire crountitac for Solapowers carning C. What woula tappen to the pice of Solapowers common stock it it raited is dividends to $12 and then conthoed with that same dividend payout ratio permanently? should Solvpower make this change? (Astime that the investars requared aste of icturn remains am 13 percent) Helagener: rase es avdeced bectane ter reerenton taco wall and te viaue of the common dock wit (Geasuring growth) Solarpower Systems eamed $20 per share at the begirning of the year and pudd out $9 in dividends to shareholders (\$o, D6=$9 ) and retained $11 to invest in new projects with an expe tetum on equity of 19 percect. In the future, solapower expects to retin the same dividend payout ratio, expects to ean a retum of 19 percent on its equity imvested in new projects, and wili not be changing number of shares of common stock outstanding a. Cadiale the fiture growth rane for Solarpower's ewnings. b. It teve investor's required rate of rerams for Solarpower's stock is 13 perceet, what would be the price of Solarpower's common stock? c. What would happen to the price of Solapowers common stock if it taiked it dwidends to $12 and then continued with that same dividend payout ratio permanently? Should Solapower make this change? (Rssume that the imestors tequired rase of petarn remairs at 13 percert) d. What would happoeed to the price of Solorpowers common steck if it lowered its dwidends to $3 and then coremued with that same dwidend payout ratio permanently? Does the constant dividend growth r (reound to the rearest otht the econbny that houses it experiences a subctantial higher growat rate. ii. Wei. the comsare deidend gromth rate model woris in this case whese the required recum on the stock is greater than the projected growth rate because the firms value wil become negative whe the ecemotr that houses texperiences a cubstantial sower gromeh rase. woch an intuntanatio higher tale while the enviroment that houses it can only grow at a koner rale. weth an urgustardabie lowe tase while the enstroment that houset it can orly orow at a higher fale. Measurieg growth) Solecpower Systems eamed $20 per share an the begiring of the yoar and paid out $9 in dividends to shareholders (so, D6=$9 ) and retsined $11 to invest in nerw proiects with an expected number of shares of common suck outstanding. C. Coutate the fiture growt rate tor Solarpowers earmings b. If the imedors reounded rate of retien for Solupower's stock is 13 percent, What would be the price of Solvpower's common siock? C. What woud thappen ts the price of Solapowers tommen sock it a raised is dividends to $12 and then corsnued with that same dividend payout ratio permanently? Should 50 alwpower make this change? model wok in tist chse? Why or Wfy not? (Assume that the imestors required rate of retum remains at 13 percert and that all hatire new pojects will eam 19 percent). a. What ine tie re qowh taie fat folispowers camings? sicoune in two scoca pach? and the vote of the comeron stock wil (Measuring growet) Solipower 5 ystemis numed 120 per thare at the begineing of the yoar and paid oud $9 in dividends 50 sharcholders (so, D0=5. ream on equity of 15 pectet. In the tinue, Solapponer experts to retain the same dividend payoun rato exects to eam a retum of to percent on is Aimber of shwos do common stock outstanding 2. Culoille the finte growth ras for Solarpowers eavings. 2. Cdoalio the fintegowtitame tor Sciapowers eaning. mosel wosk this case? Why or whty not? (Astume that the inestors requived tase of retum remaied an 13 perceen and that al future new projects will earn 19 percert.) faisid to the nearest eekl) Strimpowe and the vale of the common rook will