Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ariel Company for the manufacture of cotton clothes in Turkey sells 40% of its production in Turkey and sells 10% of its production in Arab

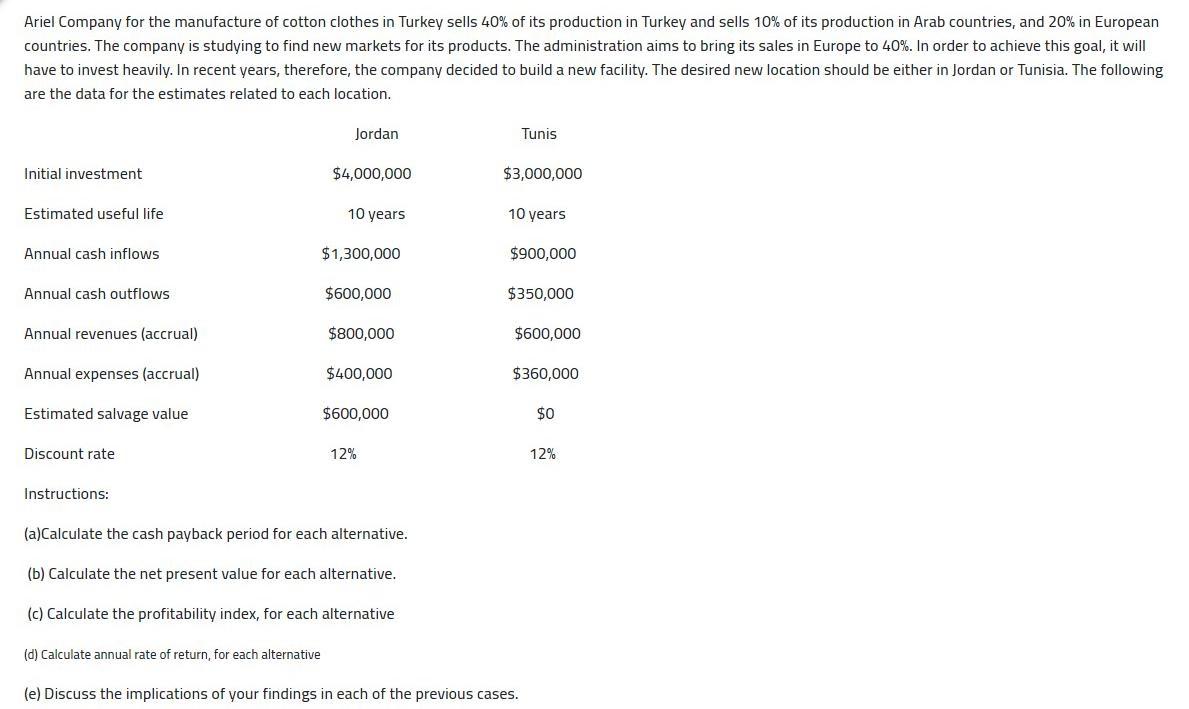

Ariel Company for the manufacture of cotton clothes in Turkey sells 40% of its production in Turkey and sells 10% of its production in Arab countries, and 20% in European countries. The company is studying to find new markets for its products. The administration aims to bring its sales in Europe to 40%. In order to achieve this goal, it will have to invest heavily. In recent years, therefore, the company decided to build a new facility. The desired new location should be either in Jordan or Tunisia. The following are the data for the estimates related to each location. Jordan Tunis Initial investment $4,000,000 $3,000,000 Estimated useful life 10 years 10 years Annual cash inflows $1,300,000 $900,000 Annual cash outflows $600,000 $350,000 Annual revenues (accrual) $800,000 $600,000 Annual expenses (accrual) $400,000 $360,000 Estimated salvage value $600,000 $0 Discount rate 12% 12% Instructions: (a)Calculate the cash payback period for each alternative. (b) Calculate the net present value for each alternative. (c) Calculate the profitability index, for each alternative (d) Calculate annual rate of return, for each alternative (e) Discuss the implications of your findings in each of the previous cases. Ariel Company for the manufacture of cotton clothes in Turkey sells 40% of its production in Turkey and sells 10% of its production in Arab countries, and 20% in European countries. The company is studying to find new markets for its products. The administration aims to bring its sales in Europe to 40%. In order to achieve this goal, it will have to invest heavily. In recent years, therefore, the company decided to build a new facility. The desired new location should be either in Jordan or Tunisia. The following are the data for the estimates related to each location. Jordan Tunis Initial investment $4,000,000 $3,000,000 Estimated useful life 10 years 10 years Annual cash inflows $1,300,000 $900,000 Annual cash outflows $600,000 $350,000 Annual revenues (accrual) $800,000 $600,000 Annual expenses (accrual) $400,000 $360,000 Estimated salvage value $600,000 $0 Discount rate 12% 12% Instructions: (a)Calculate the cash payback period for each alternative. (b) Calculate the net present value for each alternative. (c) Calculate the profitability index, for each alternative (d) Calculate annual rate of return, for each alternative (e) Discuss the implications of your findings in each of the previous cases

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started